Why you should back Warren Buffett (and his successor)

We may learn more about the Sage of Omaha’s heir on Saturday, but the 90-year-old remains one to follow.

29th April 2020 11:27

by Rodney Hobson from interactive investor

We may learn more about the Sage of Omaha’s heir on Saturday, but the 90-year-old remains one to follow.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Spreading risk is a sensible investment strategy at the best of times; in the current circumstances it is especially important. It is obvious that a wide range of companies will come out of the coronavirus comparatively unscathed, while others will suffer disproportionately, and that is already partly reflected in share prices.

There is no shame in taking advantage of experts in uncertain times and there is surely none greater than Warren Buffett, the Sage of Omaha.

The company he founded, Berkshire Hathaway (NYSE:BRK.B), is a cross between a conglomerate and an investment trust. It operates as a holding company for a wide range of subsidiaries that generate cash to be used to buy even more companies.

Activities include financial services, reinsurance, transport, utilities, energy and manufacturing. It also takes stakes in other companies, usually those with solid trading performances or that have great potential.

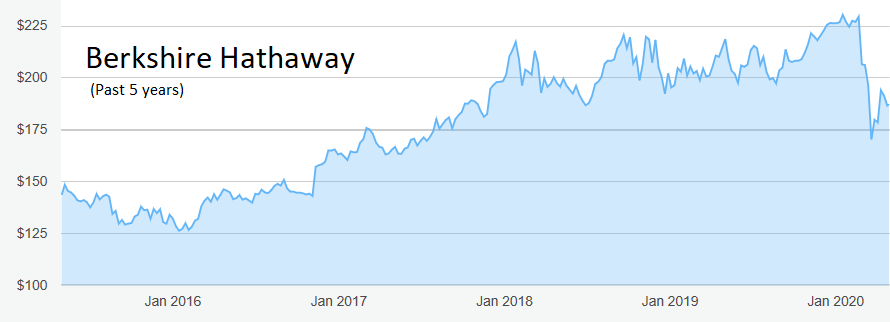

Berkshire did pretty well in the 2019 calendar year, producing record earnings of $81 billion. That more than made up for a dip in 2018.

A slight concern was the poor final quarter, when operating profits dipped 23%, but, with such a spread of investments, the figures can bounce up and down a bit.

The overall trend is upwards – or at least it was until the coronavirus pandemic altered the whole business landscape.

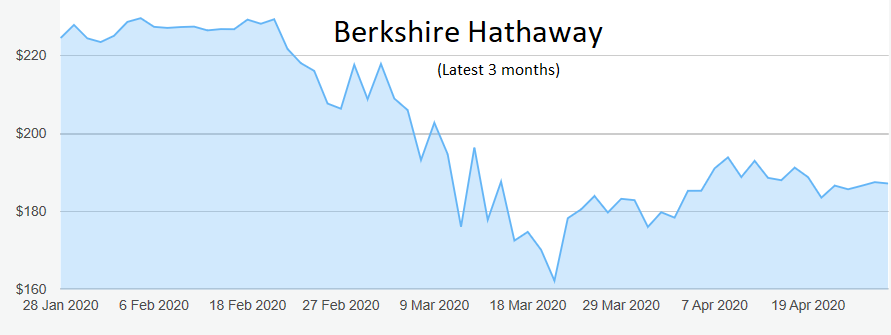

Source: interactive investor Past performance is not a guide to future performance

The company had cash at year end of $128 billion, a record level. Some commentators thought that Buffett had run out of ideas on how to invest the money, having not made a major acquisition for four years. It is sensible not to make acquisitions just for the sake of it and that reluctance now looks pretty shrewd.

It is likely, though, that he will be making some timely investments as the year progresses, just as he did in the wake of the last market crash in 2008 when the buying spree including General Electric (NYSE:GE), Harley-Davidson (NYSE:HOG) and Tiffany (NYSE:TIF).

Buffett has a happy knack of waiting for companies to come to him rather than chasing acquisitions and having to overpay.

The greatest worry is over Buffett himself. He has been the driving force behind Berkshire Hathaway and is still chairman, with 37% of the voting rights.

Many investors think of the company as his personal fiefdom, which they don’t mind as long as he keeps delivering. However, Buffett is nearly 90 years old and there seems to be no succession plan.

His long-term business partner, Charlie Munger, is six years older.

It looks as if Buffett will keep going for as long as he can, but we may learn more at the annual general meeting on Saturday, 2nd May. Greg Abel, a vice-president, is touted as the most likely successor, and he will be the only person other than Buffett at the coronavirus-restricted meeting.

When even Buffett proves to be mortal, it is always possible that a new broom will reverse the policy of buying back shares and will pay a dividend instead. A newcomer could seek to enhance value by selling parts of the massive empire, as happened with the Hanson conglomerate in the UK.

While it will undoubtedly be a big wrench when he finally steps aside, it is worth remembering that the subsidiaries are generally autonomous and they continue to deliver good results.

I wrote about Berkshire Hathaway in March last year when the shares looked good value at around $200, and I said they would not fall below $190 “unless the whole market crashes”.

Source: interactive investor Past performance is not a guide to future performance

Alas, that is precisely what happened, but the shares held up better than most, falling only as far as $170. They have nearly recovered to the $190 level which I thought would be the floor.

Hobson’s choice: Buy while the stock is still below $200. I expect that level to be achieved well before the year is out and the 2019 peak of $230 is achievable in due course.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.