Wolseley springs £1.3bn leak

29th September 2015 13:45

by Lee Wild from interactive investor

It's been a knock-out year for US plumbing and heating business, but with competition in the UK hotting up, North American industrial markets weakening and construction coming off the boil, management warn that revenue growth will slow in the first half of 2016. That's caused a round of profit downgrades in the City and £1.3 billion has been wiped off the high-flying building materials supplier's market value.

Last year, revenue rose 7% on a like-for-like basis to £13.3 billion, with a 10 basis-point margin improvement taking trading profit to £857 million, up 11%. A £242 million impairment charge – mostly at the struggling operations in Denmark, Finland, and Sweden – caused a slump in pre-tax profit from £676 million to £508 million in the year ended 31 July 2015. Earnings per share before these one-offs rose 18% to 230p.

Chief executive Ian Meakins still expects to generate like-for-like revenue growth of about 4% in the first half, with most of US unit Ferguson tipped to do well. "However, industrial markets in North America [mainly oil and gas], which account for about 15% of revenue in the region, were challenging in the fourth quarter and we expect this to continue," warns Meakins. "We expect a continued steady recovery in Nordic markets, although the heating market in the UK is expected to remain very competitive with little growth. Overall, we expect to make continued progress in 2016."

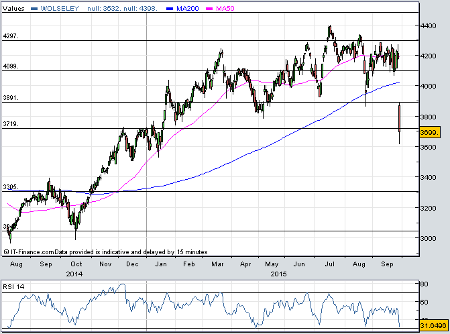

(Click to enlarge)

In response, Barclays has reduced its trading profit and EPS estimates – already below consensus - by 1% for 2016 to £934 million and 256.4p respectively. However, it remains optimistic about prospects and pencils in compound annual growth rate (CAGR) of 10% for 2015-2018.

"We continue to like the shares as we expect growth to improve again in the second half, as the comparatives ease, and believe efforts to improve the business model will drive market share gains for several years," said Barclays analyst Paul Checketts.

The distributor of plumbing parts share price had surged 47% this year to a 12-month high of 4,398p in July, but after slumping by 12% Tuesday trade near levels last seen in January. That puts the shares on a modest 14.4 times forward earnings.

Last year, Wolseley's American plumbing and heating business Ferguson stole the show, with record sales growth of 9.6% and a trading margin of 8.2%. In the US, 13 acquisitions were completed, including Chicago-based HVAC company eComfort and Salt Lake City waterworks business W R White, generating combined revenue of £131 million. The US business contributes over three-quarters of group trading profit, while the UK generates 10%, Nordics 8%, Canada 4% and Central Europe 2%.

As well as North American industrial markets, issues were also found in European and Canadian operations, especially the UK's repairs, maintenance and improvement division.

Opting for a £300 million share buyback programme instead of a special dividend wasn't enough to ease investor's nerves, either, even if the ordinary dividend does rise by 10%.

"In an environment where equity markets are tough and interest rates exceptionally low, income is more important than ever and a 'pledge to return any excess cash after meeting investment needs' is clearly seeing C-suite performance metrics (EPS, acquisition) being favoured," said Mike van Dulken, head of research at Accendo Markets. "Having undone most of 2015's share price progress, shareholders are clearly re-evaluating their holdings as the shares 'sink' back to 'tap' fresh nine-month lows."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.