Workplace pension pots for pre-retirement workers slump

Many run the risk of entering retirement without an adequate amount of money to support themselves.

2nd January 2020 09:54

by Tom Bailey from interactive investor

Many run the risk of entering retirement without an adequate amount of money to support themselves.

Workplace pension savings have fallen by a third over the past two years for those approaching retirement, new data for pension administrator Equiniti shows.

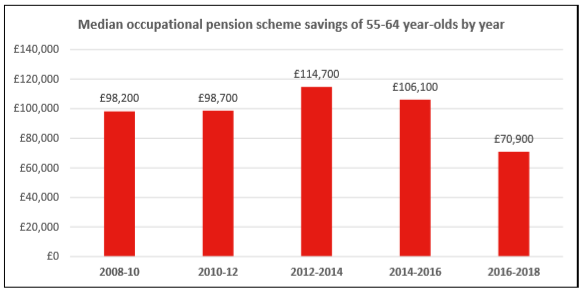

Between 2008 and 2012, the median workplace pension savings pot for those aged between 55 and 64 years old was relatively constant, sitting at between £98,000 and £99,000.

That figure then rose to £115,000 between 2012 and 2014, before starting to fall. The median savings rate for workplace pensions now sits at just £70,900. The new figures represent a fall of 38%, or £44,000, from the 2012/14 peak.

Younger age groups have also seen declines in their median pension savings, but much less dramatic or worrying.

Among those approaching retirement with the least saved, the savings rate has fallen even faster. Equiniti’s figures show that the bottom 25% have seen their savings rate go from £20,700 in 2014/16 to just £8,500 today, representing a decline of more than half.

According to Equiniti, the declining workplace savings pots raise the risk for many of entering retirement without an adequate amount of money to support themselves. As a result, many face the prospect of relying heavily upon the state pension to cope financially.

Duncan Watson, chief executive of Equiniti’s pension business, comments: “It is alarming to see so many people within 10 years of reaching the state pension age are looking likely to enter retirement with so little reserved in their occupational pension savings.

“Innovation through auto-enrolment and pensions dashboards will transform the pension industry in this country, but this will be of little comfort for those who will largely be unable to benefit from the reforms.”

Watson argues that the latest figures should act as a warning light to those in lower age brackets to start contributing more.

“Starting to contribute to a pension is the hardest part in having to sacrifice a chunk of the monthly pay-cheque, but it will become second nature and will make a huge difference to the quality of life people can afford 40 years down the line. Your future self will thank you,” he says.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.