The world's 10 biggest dividend stocks revealed

23rd November 2018 09:43

by Tom Bailey from interactive investor

Global dividend payments reached a record high in the third quarter of 2018, but which individual shares paid the most? Tom Bailey names them here.

Companies around the world handed out a collective $354.2 billion in the third quarter of 2018, according to Janus Henderson's Global Dividend Index.

That puts headline growth for global dividend payments at 5.1% compared to the same quarter last year.

At the same time, the United States, Canada, Taiwan, and India all saw all-time record quarterly payouts, while Chinese dividends finally returned to growth, after three years of decline.

At the same time, strong underlying growth was masked by a stronger dollar. Underlying growth, which strips out exchange rate volatility and special dividend payments, stood a 9.2%.

Which companies paid the most in dividends?

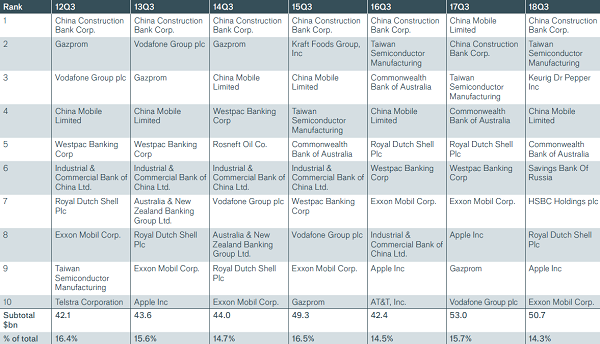

While the gross amount paid out increased, total payments from the ten largest dividend payers declined from a collective $53 billion in the third quarter of 2017 to $50.7 billion in the third quarter of 2018.

The contribution of the top 10 largest payers declined from 15.7% of the total in 2017, to 14.3% in 2018.

However, despite this increased dispersion of dividend returns, companies in the top 10 still saw strong growth. Taiwan Semiconductor, for instance, was able to further increasing its dividend, seeing it rise to third place among third-quarter dividend payers. In total the company will distribute $6.8 billion this year, almost tripling its payout in three years.

Meanwhile, Keurig Dr Pepper, the US drinks conglomerate, rocketed up the rankings, becoming the third largest payer in the third quarter thanks in large to paying out a large special dividend. The company paid a $5.3 billion special dividend following Keurig's acquisition of Dr Pepper Snapple.

China Mobile, the state-owned telecommunication company listed in Hong Kong, lost its position as the world's largest dividend payer. The company slipped to fourth place after its 2017 special dividend payments were not repeated in 2018.

Commonwealth Bank of Australia saw a slight dip in the rankings – from fourth place to fifth. With very high payout ratios and profits under pressure in Australia's banking sector, the company was only able to increase its dividend by a token 0.5%. Meanwhile, Westpac Banking Corp fell out of the top 10.

Source: interactive investor

Click here to enlarge table.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.