WPP shares and the odds of making it back from the brink

Plunging close to a 17-year low is no a good look for the famous ad agency's share price. Independent analyst Alistair Strang reveals his new forecasts.

16th October 2025 07:45

by Alistair Strang from Trends and Targets

A fascinating little detail about the world's largest advertising agency, WPP (LSE:WPP), comes from their humble roots when their full name decorated a shed in Northampton. The company was founded as Wire & Plastic Products Plc and manufactured wire shopping baskets for supermarkets. After about 10 years of irritating shoppers with terrible handle design, the company decided to grow by acquisition of other companies, and at the start of 1987, when they bought Scotland's largest advertising agency, their path was established into the media market. They now employ over 100,000 folk internationally.

- Invest with ii:Open a Stocks & Shares ISA | Top ISA Funds | Transfer your ISA to ii

Quite a lot is being made of their tie up with Google to use AI, aiming to accelerate the use of targeted advertising.

We hold a major source of concern for WPP, especially due to the class action by shareholders due to the companies announcements between February and July of this year which allegedly cost investors a share value trip from the 800p level down to 400p. This sort of thing tends to challenge investors' sense of humour, especially as they allege the company made inaccurate media releases. From our coldly logical perspective, this legal action and the danger it inflicts on the company share price value is a seriously big deal. Sometimes we discuss a thing called “ultimate bottoms” and the danger they represent.

Essentially, an ultimate bottom is a level below which we cannot calculate without prefacing targets with impossible minus signs, and when a share price stars flirting with such a concept, recovery can become seriously difficult, often needing a game changing announcement by the company to sharply propel themselves upward. Maybe it’s the case where WPP already has a goose laying golden eggs tucked away somewhere, news of which would bring extremely fast and positive change. But for now, the share price is both fascinating and dangerous!

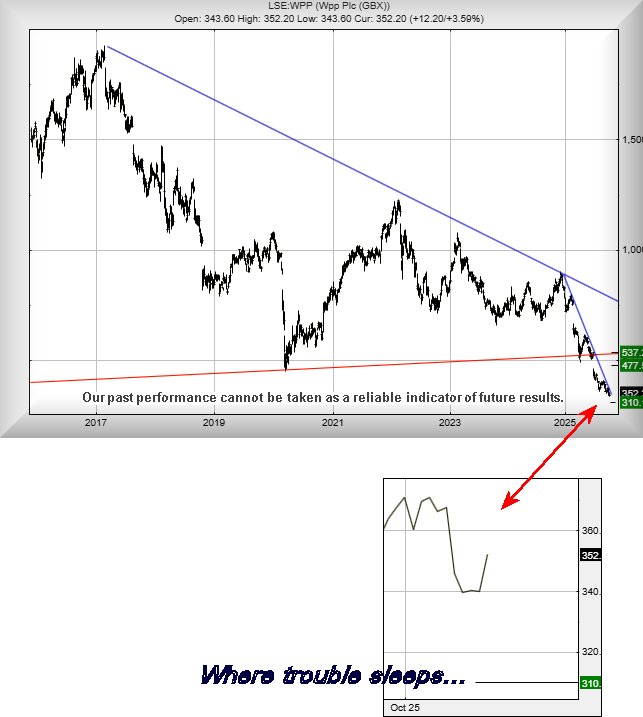

Our “ultimate bottom” for WPP calculates at 310p, and the recent dip to 330p and share price movement since tends to suggest the market has also realised the company is trading in a dodgy area. We’ve shown an inset on the chart of closing prices, a picture which shows the market has also noticed and reacted against the trouble which would be caused if it shrinks lower than they are currently trading at. To emphasise, below 310p risks triggering a plunge to oblivion.

It is now the case where we need the share price to exceed the immediate Blue downtrend of 370p to hopefully signal a panic recovery. Our calculations reveal above 370p should prove capable of a lift to an initial 477p with our secondary, if beaten, at 537p which would undo the consequences of the Red trend break back in July.

Should this occur – and we suspect it’s likely – it would suggest WPP has made an impressive return above an uptrend, something which usually has positive long-term consequences. We’re not even teasing with our level three calculations as we’d feel more comfortable analysing the path taken for recovery once it actually occurs. From our viewpoint, providing such just now would simply be clickbait, rather than a formula born consequence.

We think WPP shall be worth watching.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.