Year of the Dragon: time to invest in China again

China was once the place everyone wanted to invest, but the mood has changed, and most have headed off to pastures new like India. But ignore cheap Chinese stocks at your peril, warns ii’s Head of Funds Research.

9th February 2024 09:01

by Dzmitry Lipski from interactive investor

How can investors saddle the Chinese Dragon?

Chinese equities underperformed global stock markets in 2023 for a third consecutive year and have had a difficult start to 2024. But despite recent volatility, there are more reasons to be positive about the outlook for Chinese markets.

As the world’s second-most populous country celebrates the Lunar New Year on 10 February, the government there has shown it is prepared to stimulate the economy through monetary easing measures. Most recently, the reserve ratio requirement (RRR) for banks was cut by 50 basis points in early February, with the country’s central bank, the PBOC, indicating there is room for further easing of monetary policy.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

China is also considering a market rescue package worth about 2 trillion yuan, intended to restore investor confidence in the market and tackle the ongoing property crisis, which saw indebted property giant Evergrande liquidated. Despite more news of further US sanctions on Chinese technology companies, the stability in US-China trade relations seems the desired outcome for both parties and should reduce concerns among investors.

As the Chinese economy continues to mature and become more open, government policy changes and resultant volatility should be no surprise, and short-term sell-offs can create buying opportunities for long-term investors.

China’s economy grew at 5.2% in 2023 and the target for 2024 is around 4.5-5%, which is still above that of most Western economies. With further targeted government stimulus, the Chinese consumer is expected to bounce back. This should also be beneficial for other regional economies, with millions of Chinese tourists travelling overseas each year. Furthermore, China plays an integral part in global innovation and supply chains of critical markets, such as electric vehicle (EV) production and clean energy supply, which bolsters its position on the global stage.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Fidelity China Special Situations to benefit from merger with rival

The long-term case for investing in the Chinese growth story remains intact. Growth of the middle class and the refocusing of China's economy towards domestic consumption are expected to be key drivers of economic growth and the stock market in coming years.

While there are short-term challenges such as property and geopolitical risk – the threat of conflict with Taiwan is a concern right now - improving fundamentals, strong consumer and technological advancements will be key drivers of the market.

And as China is increasingly recognised as being a major driver of global growth, investors should consider having exposure to China when building a balanced portfolio. China currently represents nearly 18% of world GDP but less than 3% of world market capitalisation, having previously comprised over 5% in late 2020.

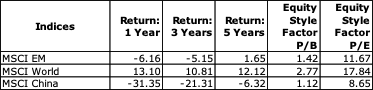

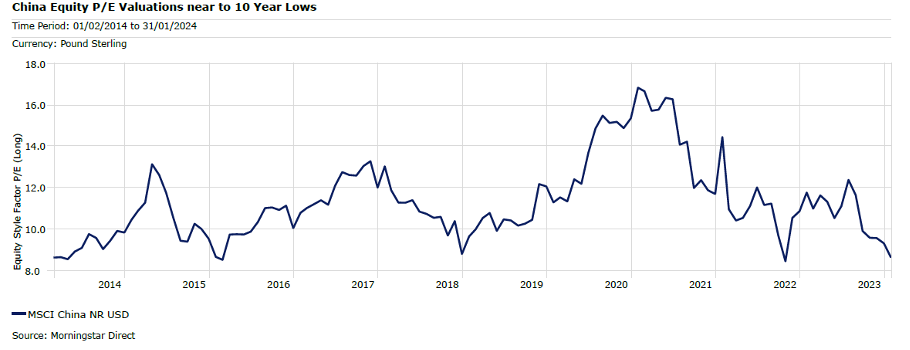

The broad derating of Chinese companies over the past two years means that valuations look attractive, both when compared to historic averages and versus other world indices. Valuations are supported by strong MSIC China consensus earnings estimates of more than 14%.

For these reasons, the recovery in Chinese equities should continue considering depressed/compelling valuations versus history and other developed markets combined with institutional holdings the lowest in five years, the risk/reward ratio for Chinese equities is favourable.

Source: Morningstar as at 31 January 2023. Past performance is not a guide to future performance.

Past performance is not a guide to future performance.

China’s share of global equity markets is much smaller than its share of GDP, in contrast to other major economies and it is expected that over time this gap should close, and Chinese markets are likely to take up a significantly larger share of major equity benchmarks.

Therefore, I believe investors should be thinking seriously about China today to take advantage of expected future demand.

There are a number of ways to gain exposure to China, but funds and investment trusts are the most straightforward way in.

Fidelity China Special Situations Trust (LSE:FCSS) provides broad, diversified exposure to Chinese equities, including 'H' shares listed in Hong Kong and mainland-listed 'A' shares. It has been managed by Dale Nicholls since April 2014. He focuses on faster-growing, consumer-oriented companies with robust cash flows and capable management teams. Due to the trust's single country exposure, its bias to small and mid-sized companies and its ability to use gearing, its return profile is likely to be more volatile, making it higher-risk and a satellite (adventurous) holding in a well-diversified portfolio.

KraneShares CSI China Internet ETF GBP (LSE:KWBP)provides exposure to Chinese internet companies listed in both the United States and Hong Kong. Chinese internet companies that provide similar services to Google, Facebook, Twitter, eBay, Amazon, etc, are benefiting from increasing domestic consumption by China's growing middle class. The ongoing charge is 0.75%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.