East signals big changes at Rolls-Royce

14th June 2018 14:09

by Graeme Evans from interactive investor

As Warren East prepares to start his fourth year in charge at Rolls-Royce Holdings, there's no doubting that much progress has been made in the company's turnaround.

But as today's devastating jobs blow for its UK workforce shows, there are still massive challenges ahead for the engines giant if East is to meet his aim of creating a business lean and capable of competing with the likes of GE.

His key benchmark is focused on delivering annual cash flows of £1 billion by 2020, compared with the paltry £100 million achieved during the company’s dark days in 2016. That was the year the dividend was cut for the first time in 24 years and Rolls racked up a record loss of £4.6 billion.

Free cash flow improved to £273 million in 2017 and is forecast by City analysts to reach £403 million this year and £726 million the year after. The achievement of this target will be vital for sustaining investment in R&D programmes, as well as keeping shareholders onside through progressive dividend payments.

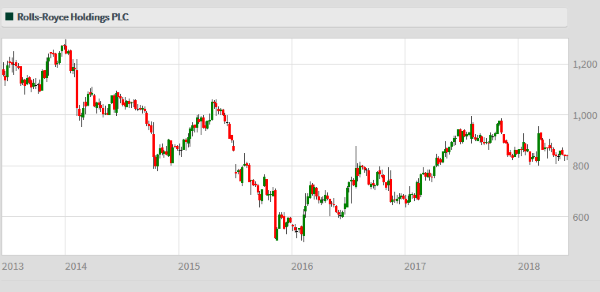

Source: interactive investor Past performance is not a guide to future performance

JP Morgan analysts have speculated that extra cost cuts could increase cashflows to £1.2 billion by 2021 - a view endorsed by East today after he said his mid-to-long-term aim was to deliver cash flows well beyond the £1 billion target.

He said Rolls had world-leading technology but that in order to generate significant profitable growth it needed a more streamlined organisation "with pace and simplicity at its heart".

Announcing plans for a fundamental restructuring, East added:

“We have made progress in improving our day-to-day operations and strengthening our leadership, and are now turning to reduce the complexity that often slows us down and leads to duplication of effort.

“It is never an easy decision to reduce our workforce, but we must create a commercial organisation that is as world-leading as our technologies. To do this we are fundamentally changing how we work.”

The planned reduction of 4,600 roles will result in annual cost savings of £400 million a year by the end of 2020 at a total cash cost of £500 million. The company is already simplifying from five to three operating divisions so it can act with greater pace and take advantage in areas such as digitalisation.

East expects a clearer focus on customers and markets going forward, particularly in widebody engines, where the company aims for a 50% share of the market.

Further details of his strategy will be disclosed on Friday when Rolls meets analysts and investors to discuss its plans for capital spending, as well as to shed more light on its key performance indicators.

So far, Rolls shares have failed to track the improvement in analyst sentiment, with the blue-chip stock down 6% in the past year. One factor not helping the performance has been incremental costs associated with further recent Trent 1000 in-service issues.

Consensus forecasts compiled by the company up until the end of May also show that analysts have become a little more cautious in their expectations for shareholder returns since the company’s annual results in March.

They've pencilled in a dividend of 13p in respect of this year’s trading, rising to 14.3p in 2019 and 16.1p in 2020. For 2017, Rolls announced an unchanged full year dividend payment for 2017 of 11.7 pence at a cost of £216 million.

Rolls generated underlying revenues of £15 billion in 2017, around half of which came from the provision of aftermarket services. The order book stood at £78.5 billion at the end of the year.

The company, which employs 55,000 people in 50 countries, also spent £1.4 billion on R&D last year.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.