Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. Tax treatment depends on your individual circumstances and may be subject to change in the future. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

You could keep more money for your future with our low, flat-fee Personal Pension (SIPP) and enjoy a cashback boost.

Get £100 to £3,000 cashback when you open a SIPP and deposit or transfer a minimum of £20,000. See more details on this offer.

Offer ends 28 February 2026. Terms and fees apply.

Important information: It’s important to take your time before transferring your pension. Make sure to consider what the best option is for you. Don’t transfer just to qualify for the offer, and don't rush any decision to meet the offer deadline. We periodically run offers, and there will likely be other opportunities in the future.

Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as, guaranteed annuity rates, lower protected pension age or matching employer contributions.

When you're drawing an income from your pension, the last thing you want is to worry about extra charges eating into your retirement pot.

Drawdown and withdrawals fees usually charged by many other pension providers can add up over time, potentially leaving you with less in your pension. This could mean rethinking how much you take as income or as a tax-free lump sum.

With the ii Personal Pension, there are no additional charges for taking income from your pension - whether that’s through tax-free cash, income drawdown, lump sum (UFPLS) or a combination that best suits your needs.

You can usually take up to 25% of your pension tax free, even if you don't plan to take the rest until later.

Take a tax-free lump sum of up to 25%, and set up regular or one-off payments for the rest.

Take your pension in lump sums, as and when you need them. The first 25% of each lump sum is tax-free, and the rest is taxed as income.

Many providers charge a percentage of your pot, so fees increase as your investments grow. With ii, you pay a low, flat monthly fee that also covers any withdrawals you make from your pension - helping you keep more of what’s rightfully yours.

With the ii Personal Pension, there are no drawdown setup or ongoing administration fees. You’ll pay the normal trading fees if you sell investments to allow cash withdrawals.

It’s easy to set up pension withdrawals online. You can also manage withdrawals or make changes whenever you need to as well. And each time you withdraw taxable income, you’ll get a payslip that you can download or view online.

Unlike percentage-based fees charged by many providers, with ii you will always pay a low, flat fee. This could dramatically increase your retirement wealth over time.

Start on our Core plan at £5.99 a month and upgrade when you want access to a wider range of benefits - or when your portfolio grows above £100,000.

It’s a transparent, cost-effective way to invest in your pension, with everything you need in one place.

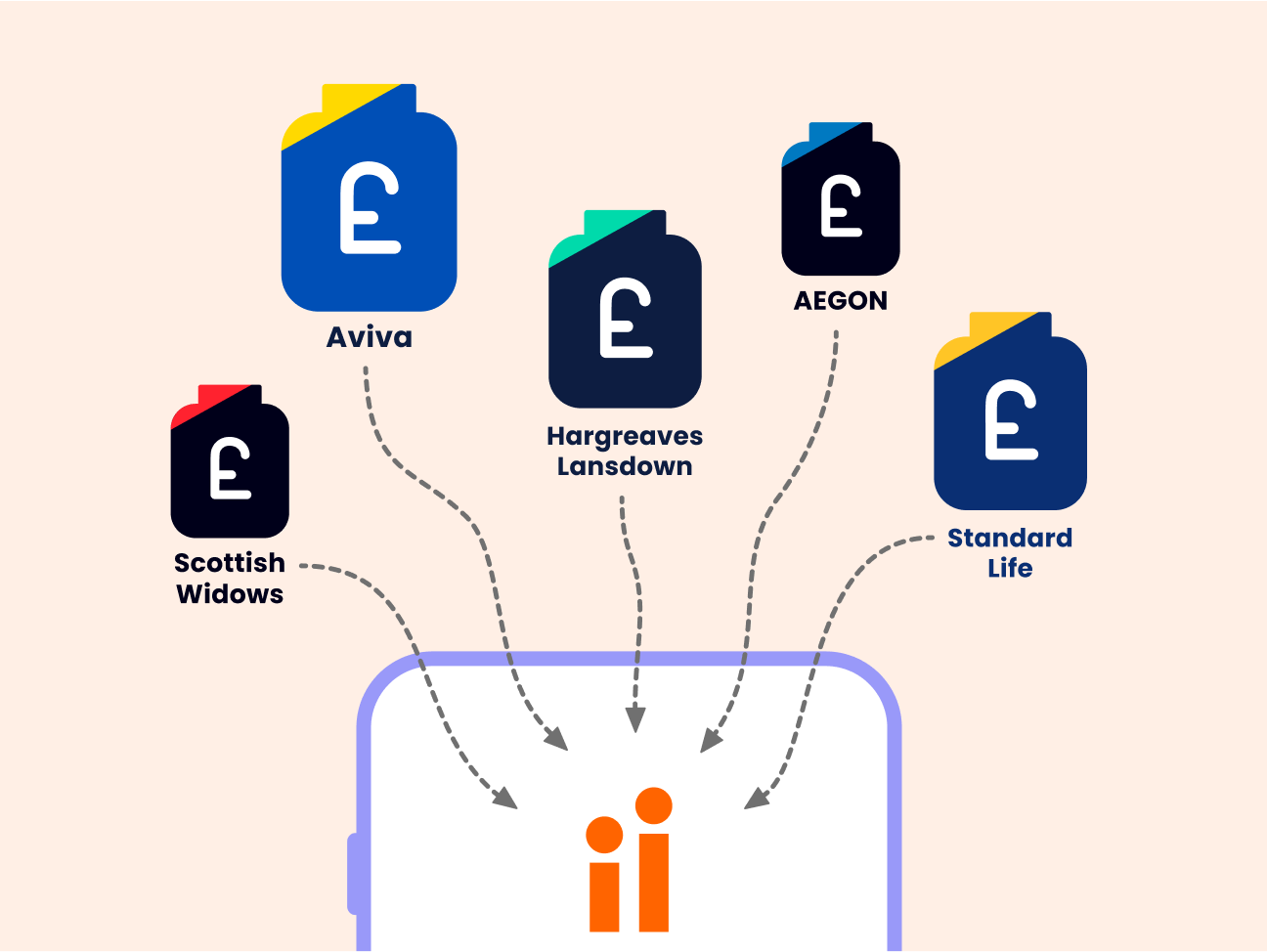

We accept pensions of all shapes and sizes to the ii Personal Pension. Thousands of people transfer their pensions each year from companies like Aviva, Standard Life, Hargreaves Lansdown and many others. And if you have a whole pension already in drawdown, we accept these too.

It’s free and easy to transfer your pensions to the ii Personal Pension, with our simple online process and the support of our UK-based top-rated team.

It takes less than 15 minutes to open an ii Personal Pension. You can apply online and our award-winning customer support team is here to help if you need it.

Also, you won’t be charged until you add money or transfer to your ii account.

You can do this quickly, easily and entirely online once you open our pension.

Choose to do a full or partial transfer, with cash or investments. If your whole pension is in drawdown, you can transfer it to ii in full only.

You can move some or all of your Personal Pension into a drawdown pot using your online account. If you're transferring a whole pension that's already in drawdown, you can make changes to how you would like to make income withdrawals via your online account too.

Call our award-winning UK-based support team on 0345 646 2390.

You can reach one of our friendly SIPP specialists between 8am-4.30pm, Monday to Friday.

If you’re thinking about retiring soon and want to understand your options, make sure you speak to someone at Pension Wise.

Pension Wise is part of the government’s Money Helper service, offering free and impartial pension guidance to the over-50s. They can also help you decide if transferring your pension is the right choice for you.