10 top AIM stocks leading the small-cap surge

6th June 2018 17:38

by Ben Hobson from Stockopedia

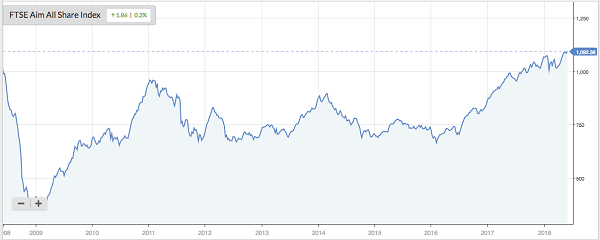

Ten years after stockmarkets crashed under the weight of the financial crisis, the Alternative Investment Market (AIM) has finally recovered the ground it lost.

The UK's market for smaller growth companies is particularly sensitive to wavering investor sentiment. But a decade after investors fled from risky small-caps, AIM is back at pre-crisis levels.

Source: interactive investor Past performance is not a guide to future performance

Part of this renaissance has been down to a consolidation on AIM. Over the past 10 years there's been a steady stream of companies exiting the market. Many were financially weak, while others were in sectors like natural resources that endured a torrid time. What remains is far higher quality.

Recent research shows that the market has become a much more attractive prospect for institutional investors, and that trading activity has increased as a result. Figures from UHY Hacker Young show that improving quality and a resurgence in natural resources sectors has had a big impact. Indeed, the average daily amount traded per company was £279,321 last December, the highest average for a decade.

Meanwhile, AIM's other vital signs are also encouraging. New company flotations raised £1.8 billion last year, the highest since 2013/14. In total 22% of AIM IPOs in 2017/18 were from the energy and mining sector, the largest percentage across all sectors, according to UHY.

While the figures on new listings are positive, there is also evidence that the number of delistings is slowing. The net number of companies leaving AIM fell from 48 in 2016/17 to 13 in 2017/18 as quality improved across the board and the energy and resources sectors recovered.

Hunting for high flyers

Improving quality and rising trading volumes are obviously welcome news. But it's still the case that investors should be careful with the market's smaller, less predictable stocks. Financial vulnerability comes as standard with small firms, so the investment case for individual stocks needs to be researched carefully. One way to get started is to filter the market for shares with the strongest quality and momentum (QM).

High "QM" stocks are the market's 'high flyers'. For a start, they display the signs of having strong business and financial quality - through strong and consistent profitability and financial strength.

They also have investor support, with strong momentum in their share prices. These features often mean the shares can appear expensive, but they can be statistically better bets than buying apparently cheap, low quality shares.

At Stockopedia we rank shares based on the strength of their quality and momentum, and that's what this week's screen uses. As always, it's important to remember that small-cap AIM shares can be unpredictable, but the strength of their combined quality and momentum could mean they're worth closer investigation.

| Name | Mkt Cap £m | Quality & Momentum Rank | Value Rank | 1 Year Price Change % | Yield % | Sector |

|---|---|---|---|---|---|---|

| Griffin Mining | 269.8 | 100 | 80 | 191.2 | - | Basic Materials |

| Polar Capital | 566.9 | 99 | 26 | 47.6 | 4.4 | Financials |

| Abcam | 2,618 | 99 | 6 | 30.2 | 1 | Healthcare |

| Patisserie Holdings | 482.2 | 99 | 15 | 28.2 | 0.8 | Consumer Cyclicals |

| Elecosoft | 67 | 99 | 18 | 84 | - | Technology |

| YouGov | 499 | 99 | 6 | 75.2 | 0.5 | Consumer Cyclicals |

| Craneware | 514.6 | 99 | 7 | 46.5 | 1.2 | Healthcare |

| Plus500 | 1,882 | 99 | 56 | 226.7 | 5.3 | Financials |

| Gamma Communications | 707.1 | 99 | 12 | 34 | 1.2 | Telecoms |

| Judges Scientific | 157.1 | 98 | 20 | 42.5 | 1.3 | Industrials |

Source: Stockopedia Past performance is not a guide to future performance

The appeal of using a high "QM" high flyer strategy is that it lasers in on the market's strongest stocks. Companies like Abcam, Patisserie Holdings, Craneware and Judges Scientific have long fallen into a basket of stocks that is popular among investors - and often seem expensive as a result - yet their quality has seen them continue to deliver.

The risk with high flyers, of course, is that their momentum suddenly snaps or the quality in the underlying business starts to decline.

It means that high flyers have to be watched carefully, especially when they are smaller stocks. But on the upside, the combination of quality and momentum creates a powerful dual-factor strategy that has proven in the past to pinpoint smaller companies that go on to become much bigger beasts.

About Stockopedia

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

Interactive Investor readers can get a free 14-day trial of Stockopedia by clicking here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.