10 top funds from 2019

Many of the best funds were UK-focused. Saltydog analyst reveals why they could continue to do well.

6th January 2020 14:12

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Many of the best funds were UK-focused. Saltydog analyst reveals why they could continue to do well.

Last year, most global stock markets ended up making reasonable gains. In the US, the main indices recorded new all-time highs in December and the Dow Jones Industrial Average ended the year up 22%. The S&P 500 did better, up 29%, and the Nasdaq beat them both, gaining 35%.

The UK markets didn’t do as well, but the FTSE 100 index still went up by 12%.

Each week we look at the performance of the most readily available UK domiciled Unit Trusts and OEICs. Last year, the annual returns ranged from a loss of 14%, for the LF Miton UK Smaller Companies fund, to a gain of over 45%, for the ASI UK Smaller Companies fund.

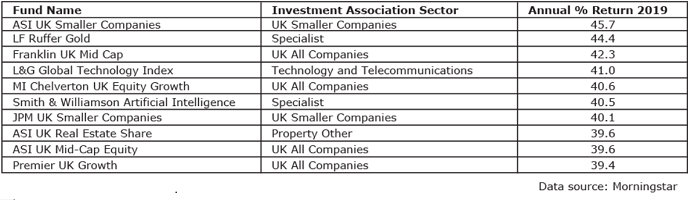

Here’s a list of the top 10 funds:

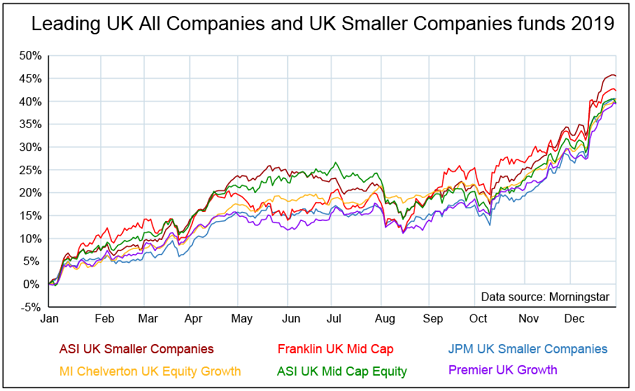

Six of the funds are from the UK Smaller Companies or UK All Companies sectors.

They all had a good start to the year and by the end of April were up somewhere between 15% and 25%. They then levelled off during May, June and July before dropping back at the beginning of August.

Much of the volatility was caused by the uncertainty over Brexit, and many commentators believe that this has left UK Companies significantly undervalued.

During October and November these funds started to pick up again, and they all got a boost in December when the Conservative Party won the General Election with a working majority.

It’s early days, but if there is more stability in the UK, and the Government is able to negotiate a reasonable trade deal with Europe, then these funds could continue to perform well.

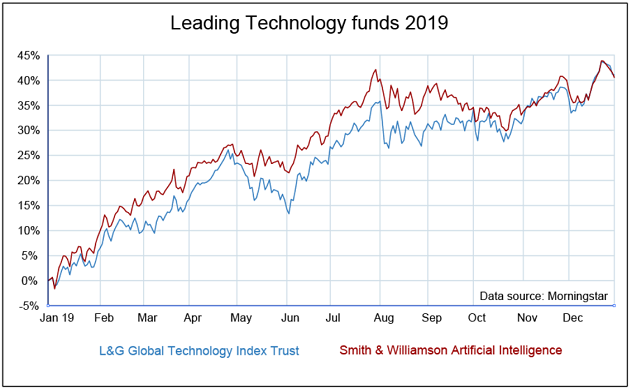

Although overseas markets performed well last year, particularly in the US, it was difficult for UK investors to take advantage of this because of the strengthening of the UK currency – especially in the second half of the year.

However, the L&G Global Technology Index and the Smith & Williamson Artificial Intelligence funds did make it into the top 10, but gains were skewed toward the first half of the year.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.