A 34% profit but we're still buying this fund

Equity markets struggled over the summer, but Saltydog analyst found a winner and is sticking with it.

2nd September 2019 12:06

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Equity markets struggled over the summer, but Saltydog analyst found a winner and is sticking with it.

Gold funds go up as equities struggle through August

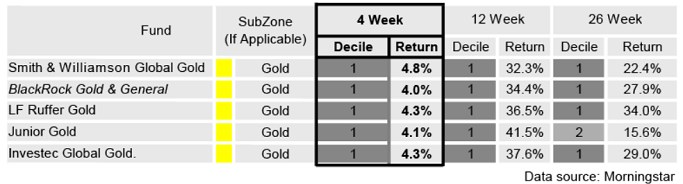

The gold funds have performed well over the last year and regularly feature at the top of our reports for the specialist sector.

Here are the leading five funds from the analysis that we produced last week:

We invested in the Investec Global Gold fund in June and since then it has gone up by 34%. We added to our holding last month.

During August the trade war between the US and China stepped up a gear when Donald Trump announced that additional tariffs would be imposed on Chinese imports. Investors are worried that this could put a brake on global economic growth. Stock markets around the world fell.

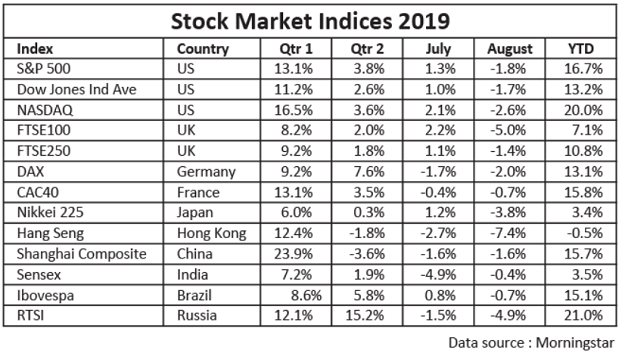

Although most of the major market indices are up so far this year, most of the growth came in the first quarter. In the second quarter the returns were lower, with the Shanghai Composite and the Hang Seng making losses. All of the indices in the table above went down in August.

Gold is often seen as a safe haven in times of political uncertainty and this may have been the case last month. As well as the rising tension between China and America, there are also problems closer to home.

Our new Prime Minister, Boris Johnson, has continued to play hardball with the EU and is determined to leave on the 31 October, even though there are many MPs equally determined to stop him. The EU has its own issues with political upheaval in Italy, and a shrinking economy in Germany.

Another reason given for investing in gold is that it holds value, unlike currencies which can be devalued. At the end of July the US Federal Reserve lowered interest rates, for the first time in 10 years, and stopped it's quantitative tightening policy – a sign that the US would be happy with a weaker dollar.

The Chinese briefly reacted to the US tariffs by letting their currency, the Juan, weaken. The pound has gone down in value as the likelihood of a no deal Brexit has increased, and the European Central Bank has indicated that it is considering a second wave of quantitative easing which could start this year. It looks like there could be a currency war looming, and gold might be the winner.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.