Active Income Portfolio's utilities losing their spark?

27th June 2013 00:00

by Nick Louth from interactive investor

The prospect of an end to US quantitative easing (QE) and a gradual rise in US interest rates gave the market a long-overdue setback at the start of June. It hit sentiment hard in utilities, because they had been the repository of much cash fleeing from low-yield government bonds.

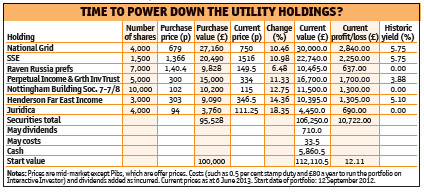

and , the two biggest constituents in Money Observer's Active Income Portfolio, fell more than 10% in a week, halving the gains they recorded since the portfolio started in September.

How justified is this? Looking at the charts of the two companies, which had raced away like small cap growth stocks this year, a pause for breath was overdue. National Grid - which went ex-dividend in June - had risen by 23% since the middle of February, and SSE by 18%.

For a more detailed look at one of these energy giants, read:Should I buy shares in National Grid?

Brokers had noted that UK utilities were already trading at a premium to European peers, with UBS observing that National Grid was trading 25% above the value of its regulated asset base. The broker did recognise that this was inspired by the company's lack of exposure to fixed costs in power generation and its overall greater reliance on regulated profits. For National Grid, with a large US exposure and 40% of its shareholders there too, any rise in US Treasury yields will hit hard, Citigroup reckons, suggesting the shares may ultimately fall to 640p, more than £1 below current levels.

It was something that we all knew would happen eventually. Even then, holders of government bonds will have to compare what will initially be fairly poor yields with the prospects of near-term capital losses as the tightening process continues. For UK investors there are very few such reliable dividend-generating machines as the small coterie of British utilities that have yet to be taken over or taken private. Both of our companies yield more than 5% at current prices. Moreover, the bid approach to water firm shows there are still attractive returns on capital in the sector.

I shall be sticking with these two stocks, but should I buy more? The portfolio is almost 10% cash, but seeing as the two utilities account for just over 40% of the portfolio even after the fall, that would seem unwise. In fact, on asset allocation grounds I will look for opportunities to trim the stakes on any strength.

Of the three investment trusts, was hit harder by the recent pull back, losing 7%. lost just a point or two, while , perhaps unsurprisingly, was almost unaffected. The pull back gives an opportunity to buy some more Perpetual, 2,000 at 335p, costing £6,733.50 with stamp duty.

There are three dividends that have been paid to the portfolio. The 3p a share quarterly for preferred, a total of £210; for Perpetual Income & Growth 3.55p for a total of £106; and half yearly payout of 3.937p, for a total of £394.