This AIM star is my kind of company

Amid the chaos, this university spin-out is a candidate for long-term investment at a decent price.

20th March 2020 15:54

by Richard Beddard from interactive investor

Amid the chaos, this university spin-out is a candidate for long-term investment at a decent price.

As opening sentences go, the banality of the one I had originally selected for this article seemed remarkable even to me, so I relegated it. Even I can’t ignore the elephant in the room. There’s a global pandemic, and secondarily the stock market is crashing because of justifiable fears the economy will.

Coming to terms with the crisis

I am just coming to terms with these events but hopefully my response will be more measured than the share price movements we have experienced. Like many others, my mind is filled with new priorities, most of them unrelated to investment. But one of my new priorities, which I will write about next week, is my investing strategy and whether there is anything I can do to shore it up.

One thing I have discovered is that it helps to write things down: tasks, priorities, and especially how I feel about things instead of carrying it all around in my head. I simply do not possess the bandwidth to deal with everything at this time. Some of these thoughts, particularly those relating to decisions and investment, are likely to leak into future articles.

The act of writing is cathartic, and so too is the act of sharing, which is why I want anyone reading this article who is feeling confused or uncertain and doesn’t have a platform to emote from to know they can email me. My address, as always, is at the end of this article.

Now for that banal opener. Brace yourselves: Today I’m going to give you my first impressions of Tracsis (LSE:TRCS), a group of businesses that supplies road and rail transport companies and government agencies. I suspect my reaction to the crisis will be to redouble my efforts to find very strong businesses, and Tracsis may fit the bill.

Generally, my impressions of Tracsis’ annual report for the year to July 2019 are positive. It's built from 14 acquisitions and three minority investments, but the report allied with the company’s website cuts through much of the complexity.

Making good money

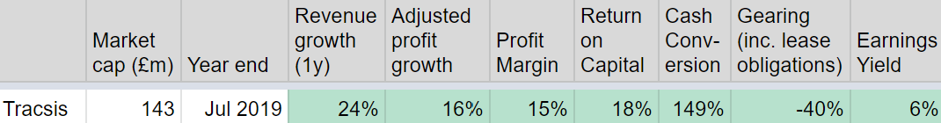

Tracsis was spun out of the University of Leeds' computing department, which had developed crew-scheduling software for railways. It floated three years later in 2007, when it earned just £0.7 million in revenue. Since then it has grown profitably.

In the year to 2019, it was debt free, earned revenues of nearly £50 million and a post-tax profit margin of 15%.

Unusually, Tracsis routinely reports higher earnings in terms of cash than profit. While Tracsis has issued equity along the way to part fund acquisitions and grant staff share options, the growth in revenue and profit has been orders of magnitude greater.

Acquisitions have diversified the business into other transport technologies and services, serving a growing but still quite concentrated customer base including government agencies like the Department of Transport and local authorities, Network Rail, the majority of UK transport operators, infrastructure companies and event organisers.

The most profitable division is Rail, which earns very high margins, mostly from software. Tracsis’ other division, Traffic and Data Services, is bigger in revenue terms, though, and its biggest earner is traffic surveys and analysis. Recent acquisitions have created a sizable event traffic management business.

Traffic and Data Services also provides software, but consultancy and services like manual traffic surveys are a much bigger component.

About a third of Tracsis’ total revenue comes directly from the jewel in the crown: hardware and software sales, which as well as scheduling and rostering includes risk management, delay-repay (a compensation management platform) and Remote Condition Monitoring (rugged systems for monitoring railway track, reporting on its condition and detecting and predicting failure).

Collecting niche businesses Tracsis can grow

Tracsis says it is focused on specialised niches that earn repeat business because it makes customers more efficient and saves them money. The strategy is to grow these niches and move into adjacent ones through innovation, expansion overseas, and acquisitions.

The company has been pursuing overseas growth for most of the last decade and although it operates in Ireland, Sweden, New Zealand and the USA it has not been very successful at winning new business. In 2019, it earned over 92% of revenue in Britain.

Tracsis describes the USA as a key market, but earns tiny amounts of revenue there from paid trials of Remote Condition Monitoring. Hitherto, Tracsis has been targeting products at markets with similar needs to its home market.

Through the acquisition of Dublin based Compass Informatics in January 2019, perhaps it signalled a shift to an accelerated acquisition strategy abroad.

In the UK, innovation and acquisitions have been the growth engine. The company grew revenue 9% under its own steam in 2019, but total revenue increased 24% thanks to the contribution of recent acquisitions.

Tracsis says it buys consistently profitable companies with good managers, many of which stay on to operate the businesses. It wants repeat revenues and unique propositions that it can sell more widely, as well as gain new customers for the rest of the business.

The acquisition of iBlocks earlier this month may be an example, augmenting Tracsis’ delay-repay product and bringing capabilities in ‘smart’ (paperless and account-based) ticketing. iBlocks was highly profitable in the year to February 2020, cash generative, and the management team is staying on.

In its focus on buying successful businesses, rather than trying to turn around unsuccessful ones, it reminds me of Judges Scientific and Cohort, two other successful serial acquirers (though it is more fussy about synergies than either of the other two).

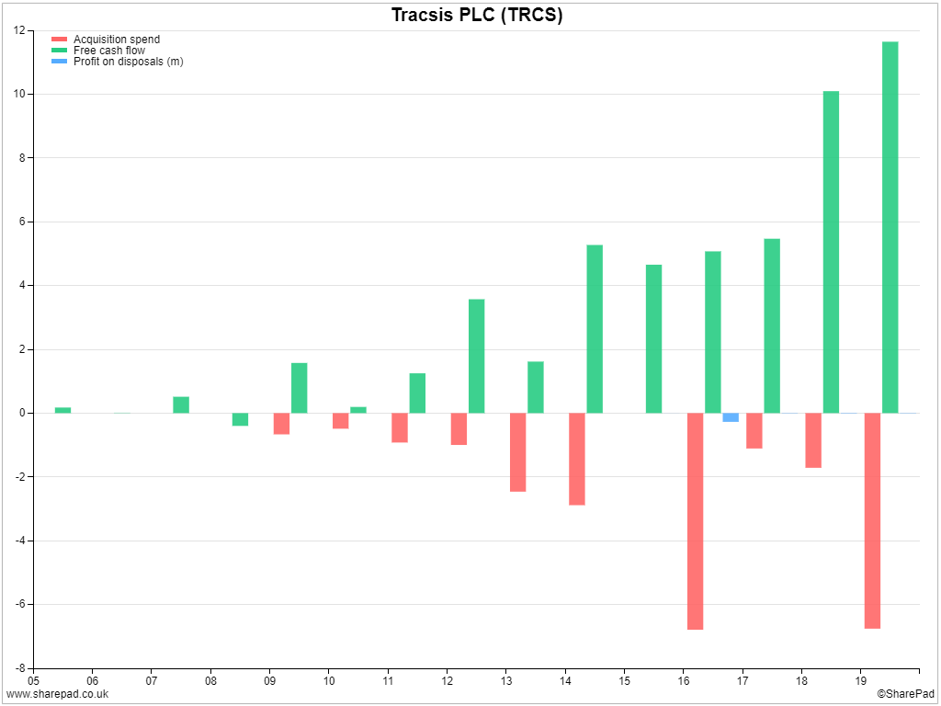

Return on operating capital in 2019 was 18%, so Tracsis is collecting very profitable businesses but to judge whether Tracsis is a good acquirer we need to see if it is generating good returns on the assets it requires to run the business plus the premium it paid for the business at the time, also known as goodwill and acquired intangible assets at cost.

A Return on Total Invested Capital of 9% is not bad, and perhaps worsened by the fact that 2019 was a particularly acquisitive year for Tracsis:

Source: SharePad

The red bars show spending on acquisitions was relatively high that year and big spending depresses ROTIC because the denominator, capital is spent all at once, in the expectation that the numerator, return or profit, will grow for many years. This chart also reveals that Tracsis does not spend beyond its means in pursuit of growth. The free cash flow bars are generally higher than the red acquisition spend bars are deep.

Risks, there always are some!

A natural consequence of having few customers is some of them will be big. The biggest earned 18% of revenue in 2019 (up from 14% the previous year) and it seems probable to me that this is either Network Rail or the Department of Transport.

There may be little danger of losing a big Rail customer, Tracsis appears to have unique products and services embedded in their operations, but the company admits Traffic & Data Services are more easily replicable, and susceptible to squeezes in government spending.

A more immediate concern is event traffic management, because events are being closed down even faster than the Coronavirus pandemic is escalating.Tracsis' existing events business was joined by the oddly named Cash and Traffic Management in 2019 and together they earned £10.2 million revenue, more than 20% of Tracsis’ total.

Since the division manages parking and admissions to events, it must be experiencing the full force of cancellations, and although Tracsis has yet to update the market on the likely impact, it will surely be dramatic.

Preliminary verdict. Good business, increasingly attractive price.

Tracsis is a candidate for long-term investment. It has lived within its means. It has valuable niche products and a growing reputation in transport.

The Events business is vulnerable now and I'm less enamoured with Traffic and Data Services in general. But the company seems to be upping the technological ante here too by incorporating more automation and artificial intelligence.

Co-founder and former chief executive John McArthur resigned in 2019 and no longer has a significant shareholding, although he still advises part-time on acquisitions. Other directors have modest holdings. Current CEO Chris Barnes joined from Ricardo in 2019 but finance director Max Cawthra is well versed in the business culture having joined in September 2010.

A note, tucked away in the remuneration report, may speak volumes about that culture. In 2019, Cawthra reassigned £14k of an £84k bonus to other members of his team to reward them.

Encouragingly the company’s acquisition strategy also emphasises that the target company must fit Tracsis’ “relaxed culture”. Mercifully, the remuneration report is only four pages long, and I detect no signs of egregious pay.

When I started researching Tracsis on 12 March its enterprise multiple was 22. A week later that multiple has fallen to 17. Compared to many of the multiples out there Tracsis looks expensive, but that too may be a sign of quality.

This is my first look at Tracsis, so I’m going to resist scoring it, but I think it’s my kind of company.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.