Alex Sebastian: supply chain troubles are hidden threat to your finances

16th September 2021 13:43

by Alex Sebastian from interactive investor

People only talk about company supply chains when there is a problem with them, but their role in your finances should not be underestimated.

Supply chains. An innocuous term that most people pay little regard to or even fully understand, but they have become the hidden danger to households’ finances.

Much is made of how wages, consumer demand and increasing the money supply via quantitative easing (QE) cause inflation, but supply chains are also playing a dangerous role.

A supply chain for a company is a bit like a goalkeeper to a football team. If it does its job as expected, there is little fanfare around it. When something goes wrong however, everybody notices and the consequences can be dire.

Many companies, from food producers to car makers are finding it harder and more expensive to get hold of the goods and materials they need to meet customer demand.

The harder and more costly to obtain these things are, the less goods and services can be made, and the more expensive what is produced becomes.

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

- Visit the ii Knowledge Centre for a wide range of investor education content

- ii Super 60 investments: quality options for your portfolio, rigorously selected by our impartial experts

The main driver of this is the huge disruption to labour markets and logistics networks caused by the pandemic over the past 18 months.

Lockdowns and well-meaning state interventions, such as furlough schemes, have made it harder for many companies to recruit and retain staff. The problem is particularly acute in crucial areas such as lorry driving and warehouse staff.

With governments meeting many people’s financial needs through furlough payments there is less overall willingness in the population to do hard, manual jobs with long hours like driving a truck.

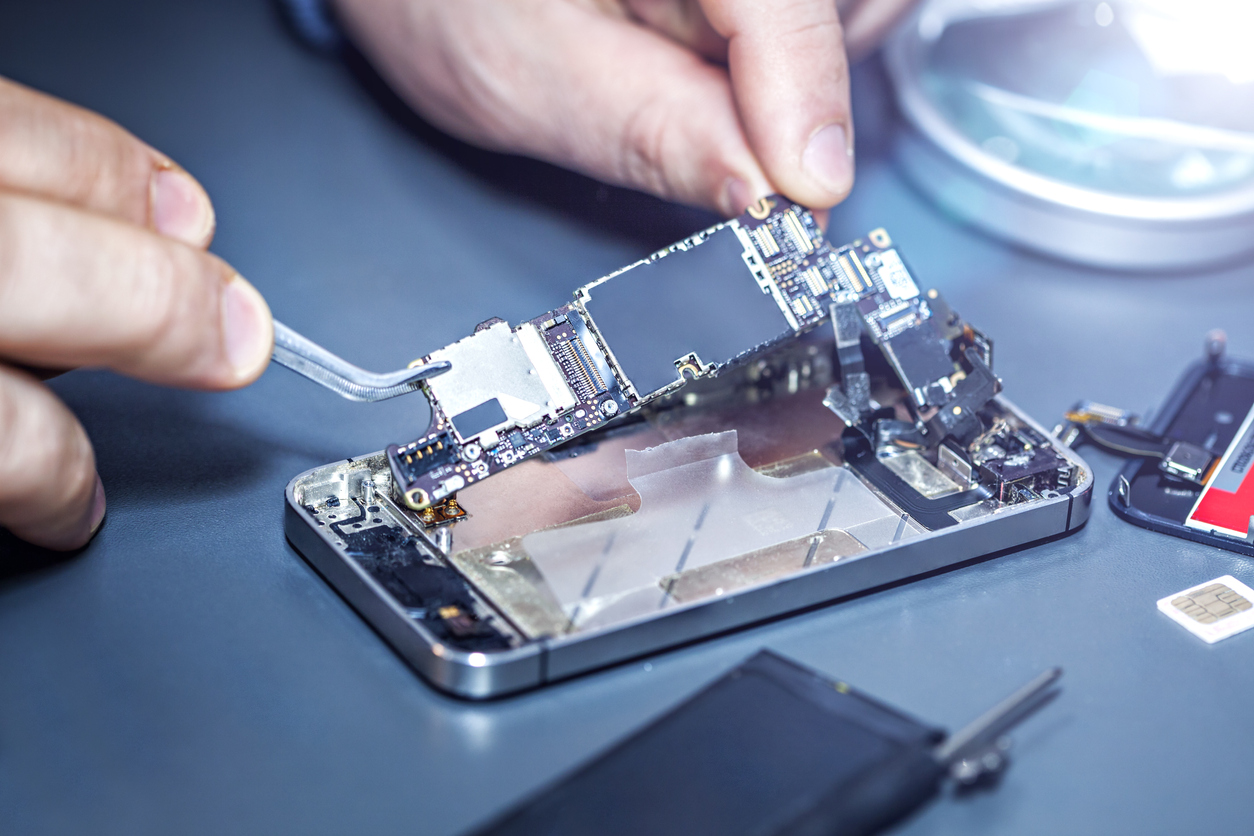

There are also shortages of various key ingredients to many production lines. One particular choke-point in global supply chains is silicon chips. For the best part of a year now, there has been a serious shortage of the chips that power our many electronic devices.

There are a number of factors behind it, with the pandemic obviously having a huge impact. The problems with chip shortage can’t all be placed at the door of the virus though. Other fundamental issues exist. There is a limited supply of ‘rare earth materials’ that are key to making computer chips, but ever-growing demand for them.

Also, the world is filling up and a greater proportion of the population is becoming affluent enough to buy multiple electronic devices or cars, and more things that use computer chips are being developed every year.

The second issue is an overdependence on a small number of factories. Intel is the biggest American chipmaker, but the majority of computer chips used all over the world are made by just two firms in Asia: Taiwan Semiconductor Manufacturing and Samsung Electronics.

America and Europe have no production facilities of the same scale as these two giants, and this needs to change.

- Will ‘transitory’ inflation start to be worryingly persistent soon?

- The inflation-proof shares fund managers are backing

- A guide on how investors can protect against inflation

A supply chain crunch can really wrongfoot central bankers trying valiantly to manage the economic recovery and associated inflation risks.

It opens the door ajar to stagflation – a very undesirable situation where prices are rising but there is no underlying economic growth.

Even if central banks manage to control the demand side of the inflation equation, prices could still climb at uncomfortable rates if supply chains are overstretched.

The hope is that with furlough schemes ending and pandemic lockdown restrictions largely lifted, supply chains will naturally ease back into good shape. The question is how quickly though and whether the shortages of some raw materials continue.

Until the world’s supply chains have recovered to somewhat normal levels, households will inevitably feel the pinch both in terms of specific purchases, and their general cost of living over time.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.