The Amazon of promotional materials is a long-term buy

Should you base an investment decision on the front cover of a company’s annual report? Possibly.

7th May 2020 15:53

by Richard Beddard from interactive investor

Should you base an investment decision on the front cover of a company’s annual report? Possibly.

I’m a sucker for a company that puts employees on the cover of its annual report. 4imprint (LSE:FOUR) does this every year.

The company is the biggest direct seller of promotional materials in the USA, where it earns the vast majority of revenue, and also over here. Although it’s a product company, supplying paraphernalia with printed brands and slogans, its success has more to do with the way the products are sold than the products themselves.

I have been following 4imprint at a distance for many years. When Kevin Lyons-Tarr became president of 4imprint Direct Marketing it was a catalogue business earning £30 million, a small subsidiary of a larger concern that also manufactured and distributed promotional products to the trade.

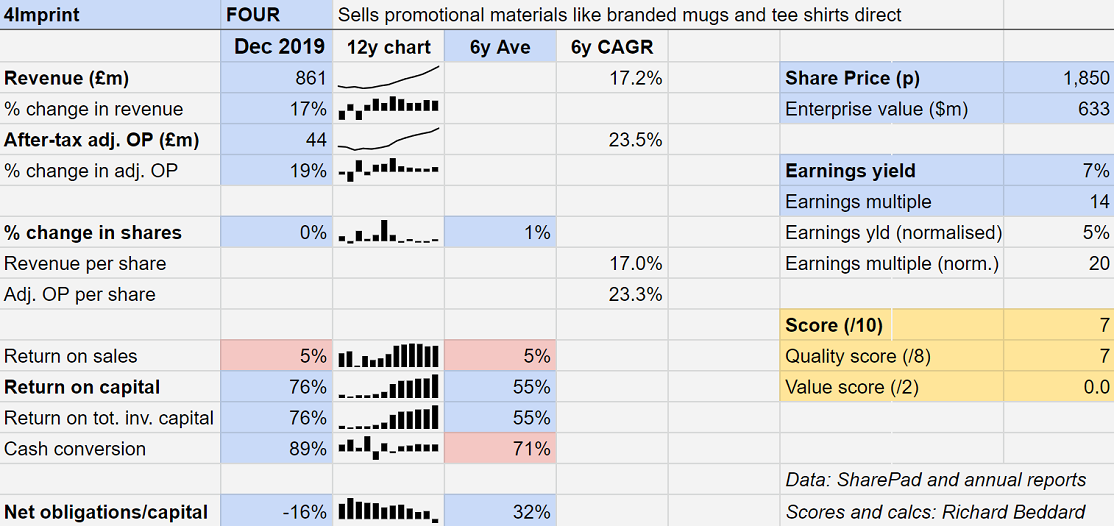

By 2013, 4imprint had sold off these businesses, and now it is the Direct Marketing Division. In the year to December 2019 it earned revenue of £861 million.

Treating others as you would wish to be treated

4imprint was quick to embrace the Internet, becoming in a sense the Amazon of promotional materials. But it wasn’t just quick, it also fostered a culture that gives employees a purpose, which is to put customers first.

Employee photographs throughout the annual report and the company’s website is the outward expression of this ethos, but it is also reflected in employee surveys, reviews on job sites, awards, the way the company talks about staff in the annual report (its “golden rule” is “treat others as you would wish to be treated yourself”), and its excellent financial performance since it divested less prosperous businesses:

The direct sales business has stood alone for the last six years, in which revenue, and even more so profit, has grown rapidly. The company does not have to invest much money in operations, it doesn’t do much manufacturing these days, which explains why 4imprint earns such high returns on capital.

Instead, the company connects customers to suppliers through its marketing and supply chain systems. Simply, customers give 4imprint the order, which it sends to suppliers who print and fulfill it themselves. 4imprint says being able to do this at high speed and in large volumes is what sets it apart from competitors, and allows it to guarantee customer satisfaction.

It also has a growing range of exclusive own-branded products. Somewhat modest returns on sales, though, show us this is a business that must supply large volumes to be this profitable.

Cowed by the pandemic

A 50% decline in the share price puts 4imprint on an earnings yield of 7%, equivalent to a debt-adjusted price/earnings (PE) ratio of about 14 times 2019 earnings. The twist in the tale is that there is no way it will be as profitable in 2020 and perhaps thereafter, depending on how the pandemic progresses, because it is not selling large volumes. Reporting in early April, 4imprint said the order count was about 20% of the prior year.

The pandemic has induced an extreme recession at 4imprint because promotional materials are often handed out at tradeshows and exhibitions, which have all been cancelled.

They are worn at work, but many of us are working at home. Customers will have slashed their marketing budgets because they cannot sell much when economies are locked down and they need to conserve cash.

A second wave of coronavirus in China could also be problematic considering 60% of blank stock, much of it held by 4imprint’s suppliers, originates from there.

Blank stock is blank tee-shirts, mugs, stationery, and so on, which will be printed with logos and messages once 4imprint receives an order.

The industry only maintained supply during the initial outbreak because US suppliers had stocked up in advance of the Lunar New Year, a Chinese holiday.

The company is in no immediate danger, despite the collapse in demand, because it is very conservatively financed, a deliberate policy to enable it to continue investing and paying dividends through normal downturns.

At the end of the first quarter of 2020 it had no debt, and $50 million in cash, although it is perhaps a sign of how seriously the company is taking the pandemic, that it is no longer recommending shareholders vote through the payment of the final dividend at the company’s Annual General Meeting this month.

I like the business, and believe it is almost certainly better financed and more dynamic than competitors. It is tempting to take the view that it will emerge from the pandemic in an even stronger market position.

Scoring 4imprint

Although not knowing how long the pandemic will impact economic activity makes the investment difficult, I’m going to score 4imprint for the first time, taking the view that we will find a way to live (and work) with the virus such that things return more or less to normal.

Does the business make good money? [2]

+ Yes. Average return on capital is very high

+ Average cash conversion has improved to high levels over the last four years

What could stop it growing profitably? [1]

- Companies reduce spending on promotional goods during recessions

+ 4imprint’s defined benefit pension scheme is now modest

+ It has minimal other financial obligations and the cash cushion provides security in downturns

How does its strategy address the risks? [2]

+ 4imprint invests in employees and technology (marketing and supply chain systems) to extend its competitive advantage

+ It is creating exclusive private label brands to fill gaps in the product range

Will we all benefit? [2]

+ Chief executive Kevin Lyons-Tarr and the chief financial officer have been with the business a long time

+ They are not egregiously remunerated

+ Employee purpose and customer satisfaction are at the heart of the strategy

Are the shares cheap? [0]

︖ Not obviously. A share price of £18.50 values the enterprise at about 14 times adjusted profit in 2019, but 2019 was a very good year. 2020 won’t be, and, pandemic aside, we can expect 4imprint to falter somewhat in recessions generally.

Given current trading, 4imprint is a somewhat contrarian investment and it is ranked 16 out of 31 potential long-term investments by my Decision Engine. But, with a score of 7/10, I think it’s probably a good long-term investment.

Capital: a clarification

Apologies to readers confused by the negative return on capital ratio reported for Quartix (LSE:QTX) in last week’s Decision Engine table. A very observant reader emailed to question how, if Quartix is so unprofitable I have given it a perfect 2/2 for profitability? The answer is not because the numerator of the ratio, return (profit), is negative. It is because the denominator, capital, is negative.

I calculate the capital required to operate the business as total assets minus non-operating assets and non-interest-bearing current liabilities. Once I’ve made these deductions, there’s less than nothing left!

I haven’t worked out a proper fix for this, which is awkward, because my next article will be about Quartix. One option is to register “n/a” for return on capital and also debt to capital (which is similarly corrupted), but that means two of the four statistics I use to evaluate every company are not available to us.

Instead I have adopted a kludge, which is to calculate return on total assets and debt as a percentage of total assets for Quartix. These are more conservative measures and therefore not comparable with the calculations for all the other companies, but at least they give us an indication of Quartix’s profitability and financial position.

As you can see, Quartix has been highly profitable (average return on total assets is 22%) and it was cash rich (cash (negative debt) is 20% of total assets) at the end of the last financial year:

The permanent solution may be to adopt a less aggressive capital measure across the board, but I need to think through the implications.

If you have come across this problem, and have an elegant solution, please do get in touch!

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.