Analysis: gold, Wall Street and Ferrari

21st March 2022 07:21

by Alistair Strang from Trends and Targets

There's lots to discuss as US stocks power higher, gold spikes and Ferrari achieve a one-two in the Bahrain Grand Prix. Independent analyst Alistair Strang brings you up to speed.

A single sentence on our Friday report summed everything up; “we’re curious about Ferrari NV (NYSE:RACE), suspecting they may not be outsiders this time."

It proved the case, the market really did know best, the red team conclusively winning the Bahrain Grand Prix in a fashion not seen since 2019.

It’s all quite strange, a series of market movements indicating confidence in Ferrari's ability. Just how this could be the case utterly defeats us. If we were to fully embrace the old adage “The Market Always Knows!”, we’d now be banging a drum in praise of the pandemic being over and matters in Russia/Ukraine resolved in a manner the marketplace wholly approves of.

Certainly, Monday should prove interesting, with the Moscow Stock Exchange opening for the first time since Mr Putin fired the metaphorical and literal starting gun for conflict.

Source: Trends and Targets. Past performance is not a guide to future performance

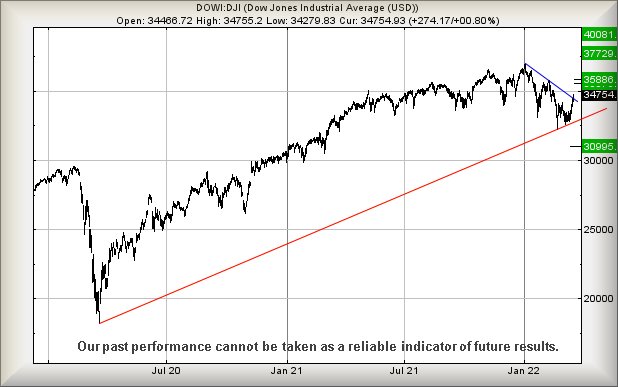

We’re choosing to start the week with the two traditional indicators for “How’s It Going?”, Wall Street and the price of gold. Conventional thinking leans toward gold being expensive in times of trouble, Wall Street becoming decidedly weak should unrest prevail. At this time, the converse appears true for each derivative, gold risking weakness, Wall Street risking a leap over tall buildings with a single bound.

If we glance at the US from a near term and quite conservative perspective, it appears movement now above 34,760 points can easily justify price movement to an initial 35,576 points initially. If exceeded, our ‘longer term’ secondary (a feature which can mean later that week, the way the markets currently behave) works out at 35,886 points.

While we’re cheerfully speculating on a potential 1,000-plus point rise, the truly important detail comes should the secondary be exceeded. A miracle such as this dumps the index value in a cycle, where ongoing traffic to 37,729 calculates as possible, a new all-time high and once again trapping Wall Street in a zone where an eventual 40,100 should be promoted as a level where some future volatility can be expected.

To justify hysterics, Wall Street needs drop below 32,750 points, a movement capable of proving a near 2,000 point tumble.

Gold

Source: Trends and Targets. Past performance is not a guide to future performance

Unlike the current strong Wall Street view, gold appears at risk of experiencing a slight melt down.

To be honest, the risk is so obvious we almost distrust it. The low price for gold on Wed 16th rather neatly matched a series of price movements at the end of February. It looked like the market was indulging in a pictorial set-up, saying “Watch this, it’s about to make a rock solid ‘lower low’,” in a fashion capable of making traders open shorts, just before a Gotcha spike upward.

Regular readers will know we’re painfully suspicious about the precious metals markets, an attitude which is often fully justified. For instance, at time of writing, gold is trading around $1,925 and we shall not be aghast if it spikes up toward $1,960 prior to a surprise drop. Only above the $1,960 level is a rise liable to prove genuine as it allows a visit to $2,004.

Should we opt to work on the basis of playing safe, apparently it is now the case that below $1,897 should trigger gold price reversal to an initial $1,850 with secondary, if broken, down at a potential bottom of $1,754.

Visually, there’s a heck of a strong argument favouring the concept of a bounce at $1,850, thanks to the downtrend since 2020. For some reason, when a price matches a point of trend break, invariably something happens to arrest a drop cycle – but rarely with sufficient strength to make a bounce a long term proposition.

For now, gold feels like some slight reversal is possible.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.