The Analyst: best sectors in each phase of the economic cycle

Professional investors often use sector rotation strategies based on their assessment of the economic cycle. Analyst Dzmitry Lipski reveals which sectors to own based on economic conditions.

24th June 2025 11:05

by Dzmitry Lipski from interactive investor

Global equities broadly recovered following April's volatility, which was caused by fears about President Donald Trump’s punitive US tariffs.

Markets have shown resilience, reflecting the assumption that while protectionist rhetoric may persist, there is still room for negotiation. This strength is underpinned by a robust US labour market, which has remained firm despite softening indicators and the prospect of future Federal Reserve rate cuts. However, persistent inflation continues to complicate the outlook.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Geopolitical risks remain elevated. Despite the ceasefire, ongoing tensions between Israel and Iran, and most recently US involvement, have increased global risk aversion, and the real impact on the markets and the economy remain uncertain.

Despite a strong recovery, markets have struggled to make further gains in recent weeks. However, sector performance gives us a more detailed insight.

| Market performance and valuations | Return: YTD | Return: 1 year | Return: 3 years | Return: 5 years | Return: 10 years | Historical P/E | Forward P/E |

| MSCI World/Utilities | 6.56 | 11.91 | 5.52 | 7.95 | 9.70 | 18.10 | 16.71 |

| MSCI World/Industrials | 5.74 | 11.44 | 15.10 | 14.64 | 11.97 | 23.27 | 21.82 |

| MSCI World/Comm Services | 5.16 | 20.68 | 19.19 | 14.18 | 9.42 | 20.97 | 18.95 |

| MSCI World/Financials | 5.16 | 21.75 | 15.61 | 18.64 | 11.61 | 15.47 | 14.05 |

| MSCI World/Consumer Staples | 3.93 | 6.70 | 4.93 | 6.89 | 8.42 | 24.89 | 20.74 |

| MSCI World/Materials | 0.84 | -6.46 | 0.55 | 8.97 | 8.44 | 21.72 | 17.43 |

| MSCI World | -2.54 | 7.36 | 10.66 | 12.21 | 11.30 | 22.59 | 19.66 |

| MSCI World/Energy | -7.10 | -11.72 | 0.34 | 16.94 | 5.98 | 14.25 | 13.92 |

| MSCI World/Health Care | -7.46 | -10.04 | 0.33 | 4.14 | 7.98 | 23.88 | 16.34 |

| MSCI World/Information Tech | -7.68 | 8.49 | 19.09 | 17.95 | 20.93 | 35.54 | 28.37 |

| MSCI World/Consumer Discretionary | -8.93 | 10.51 | 10.10 | 10.65 | 11.68 | 23.93 | 23.71 |

Source: Morningstar as of 31 May 2025. Total returns in GBP. Past performance is not a guide to future performance.

The MSCI World Index remains negative for the year, dragged down largely by the technology sector, which has fallen almost 8% in 2025 after very strong returns in 2023 and 2024.

In contrast, sectors such as communication services, industrials, financials, and utilities have seen renewed interest.

- Investors optimistic again, but not for all markets

- Why Warren Buffett could back Britain in final mega-deal

Meanwhile, consumer discretionary, energy, healthcare, and technology have lagged. Despite recent setbacks, technology remains a long-term outperformer.

Healthcare’s underperformance is partly attributed to political headwinds in the US, particularly surrounding healthcare reform. Whether this rotation will be sustained remains uncertain.

Sector rotation explained

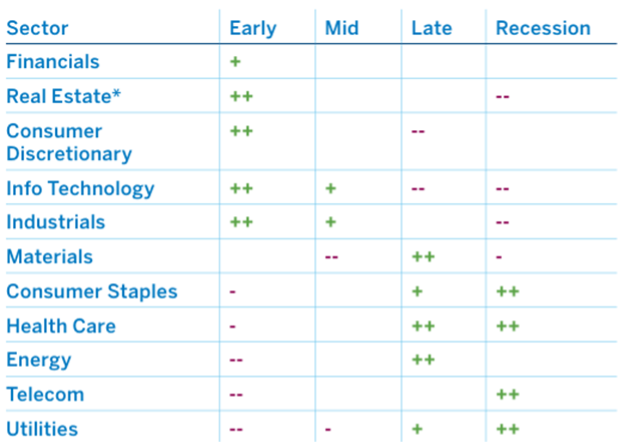

Sector rotation is an investment strategy that capitalises on the tendency of different market sectors to outperform at various stages of the economic cycle.

During periods of economic expansion, cyclical and growth-oriented sectors such as technology and consumer discretionary often lead the market. Conversely, in downturns, defensive sectors such as healthcare, consumer staples, and utilities tend to offer greater stability.

The economic cycle typically comprises four phases:

- Early cycle (recovery) – characterised by improving economic growth and credit conditions

- Mid-cycle (expansion) – marked by strong growth and rising business activity

- Late cycle (contraction) – growth begins to slow, and inflationary pressures may rise.

Source: Fidelity

Sectors are broadly categorised as cyclical or defensive based on their sensitivity to economic trends:

- Cyclical sectors (e.g., consumer discretionary, industrials, technology) typically benefit during periods of economic growth, as consumer and business spending rises. However, they tend to underperform in recessions

- Defensive sectors (e.g., healthcare, consumer staples, utilities) offer more stable performance due to consistent demand for their products and services, regardless of economic conditions. These stocks are often valued for steady dividends and lower volatility.

Understanding how these sectors perform during economic cycles should help investors build a resilient portfolio. While cyclical sectors can boost returns during expansions, defensive sectors help preserve capital during downturns. A mix of both enhances diversification and supports more consistent long-term performance.

Balancing growth and safety through sector rotation

As we enter the second half of the year, investors should remain cautious, closely watching for clarity around US trade policy and the potential resolution of geopolitical conflicts. In such an environment, sector rotation could serve as a great strategy to navigate uncertainty and not only protect capital but potentially enhance returns.

While cyclical sectors such as consumer discretionary remain highly sensitive to trade tensions and economic slowdowns, defensive sectors such as healthcare and consumer staples offer relative stability, particularly as central banks begin easing interest rates. Energy and miners can also serve as a hedge in turbulent times.

Ultimately, diversification remains essential. Balancing exposure across regions, market cap and sectors, can help mitigate volatility, especially if cyclical sectors continue to face headwinds.

- Fund types offering investors a chance to ‘buy low’

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Professional investors such as fund managers often use sector rotation strategies based on their assessment of the current stage in the economic cycle. They may also adjust sector allocations in response to unexpected events such as geopolitical developments or policy shocks.

The GQG Partners Global Equity fund invests in high-quality companies with strong long-term growth potential across both developed and emerging markets. The fund manager adopts a flexible approach, rotating between sectors based on where the most compelling opportunities are identified.

Most recently, the portfolio has been rebalanced away from high-growth tech and communication services stocks towards more defensive, value-oriented sectors such as energy and utilities. The fund has delivered strong long-term returns for investors.

Retail investors who are prepared to tolerate more risk can also explore sector-focused exchange-traded funds (ETFs). Some of the most popular options are offered by iShares, State Street SPDR, and Amundi.

Investors should recognise that while sector rotation has the potential to enhance returns, it requires significant skill, discipline, and in-depth research. Accurately forecasting economic cycles and timing the market is inherently challenging, and frequent trading may lead to higher transaction costs.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.