The anxieties stalking retirement dreams

interactive investor research shows that more than a third of retirees dream about money.

31st August 2021 09:38

by Rebecca O'Connor from interactive investor

interactive investor research shows that more than a third of retirees dream about money.

- More than a third of retirees dream about money and of these, 28% dream that they are winning or being gifted large amounts.

- Other money dreams are less positive: 16% say they had dreamed about losing something valuable, being scammed out of money (14%) or misplacing money (13%).

You might leave work when you retire, but it appears work does not always leave you.

Research conducted by Opinium on behalf of interactive investor, the number one flat-fee pension platform, found that dreams about work peak between one and two years after retirement begins, with 47% of people who retired less than two years ago dreaming frequently about work.

- Invest with ii: What is a SIPP? | Are SIPPs worth it? | Best SIPP Investments

Among those who dream about work, panicking about projects or deadlines or difficult colleagues haunts over a quarter (26%), followed by difficult clients or customers (21%). One in five recent retirees (21%) said they feel anxious when dreaming about work.

For a quarter of recent retirees, giving up work has meant a loss of self-identity (24%), which is felt more strongly by women (29%) than men (18%). A third of retirees miss work, rising to 69% of those who say they have lost a sense of identity. The majority of retirees who miss work are missing former colleagues (65%); having a sense of purpose (51%) and the stability and structure that work brings (39%).

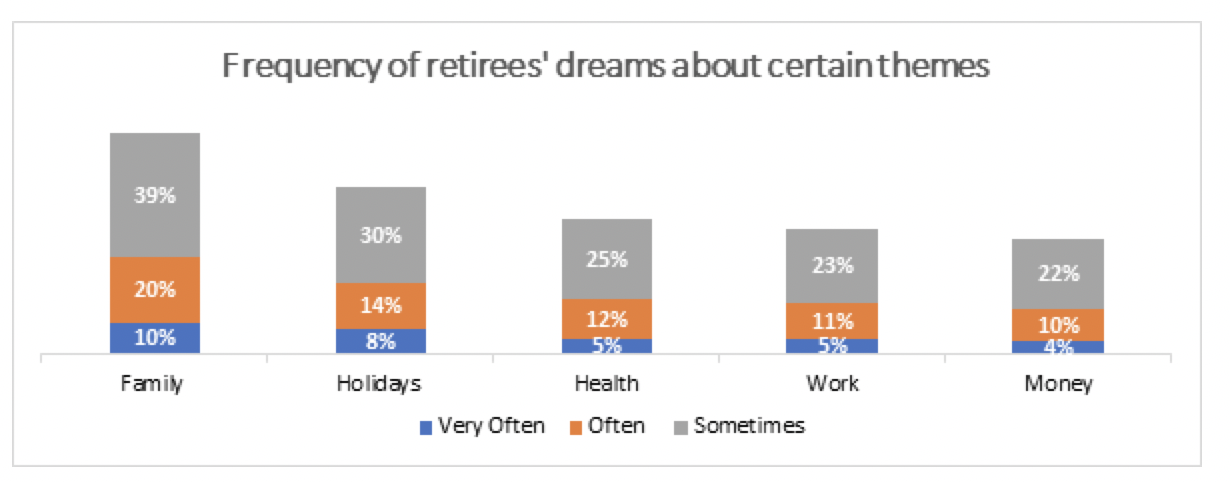

The dreams of the recently retired suggest a more pleasant shift in priorities: the research showed that family dominates the dreams of people who have retired in the last five years, with 69% saying they dream frequently of family, followed by holidays (53%) and health (42%). Generally, retirees were more likely to say they dream about family, holidays, health and money more often than when they were working, and less often about work.

However, not all dreams about family, money or holidays seem to be enjoyable. The research suggests one in 10 reported feeling happy in their work dreams – higher than the 7% who feel happy dreaming about family or money.

Of the 36% who dream about money, 28% dream that they are winning or being gifted large amounts. Other money dreams are less positive: 16% say they had dreamed about losing something valuable, being scammed out of money (14%) or misplacing money (13%). Two in 10 retirees feel anxious when they dream about money.

Becky O’Connor, Head of Pensions and Savings, interactive investor, said: “Retirement is a monumental life shift and carries with it a huge range of practical and emotional challenges. Leaving work behind might sound great in theory but in practice, for many people, it can mean losing their sense of self, as well as daily structure and a well-liked group of people. The shift towards dreams about family and holidays shows a change in priorities for retired people away from work, while more frequent dreams about health suggest, understandably, that poorer health as we get older becomes a more pressing concern.

“The research suggests that retirement can also mean more money worries, as income dries up and you have to make a finite pot of money last. This can involve a new set of budgeting and investing skills that many newly retired people have to learn quickly. It’s no surprise that the financial dreams of the newly retired are a mix of optimistic fantasies of winning big and concerns about losing it all.”

Tips for making your pension pot last and alleviating retirement money worries:

- Work out the amount of income you think you will need roughly per year of retirement, to cover your predicted outgoings. Remember there may also be unexpected bills, such as domestic or car maintenance.

- Use a calculator to work out how long your pension pot is likely to last giving you the amount of income you require. interactive investor has a special drawdown calculator https://www.ii.co.uk/ii-accounts/sipp/pension-drawdown-calculator.

- Consider drawing down what you need from your pension when you need it, rather than taking out a lump sum and keeping it in cash savings, where it may be eroded more quickly by inflation. Leaving as much as possible invested means a higher chance that your pot will continue to grow.

- Set aside an amount to cover possible care costs if you can, should you need to pay for later-life care.

- Plan how to leave money to family in a tax-efficient way, whether through your pension or property. You may save a tax bill on your estate when you die through planning.

- Check you are taking advantage of all benefits available to you as a retired person, including discounted shopping and travel, as well as things such as Pension Credit if you are on a low income.

Notes to editors

- Spokesperson available.

- Carole Murray, dreams analyst, available for interviews.

- Opinium conducted research between Friday July 2 and Wednesday 7 July 2021 and interviewed 1,003 UK adults who retired in the last five years.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.