Are these two recruiters canaries in the economic coalmine?

Weakness in the recruitment sector typically spells danger for the wider economy.

8th October 2019 12:30

by Graeme Evans from interactive investor

Weakness in the recruitment sector typically spells danger for the wider economy.

Robert Walters (LSE:RWA) and Page Group (LSE:PAGE) added to the market's October jitters today as profit warnings from the recruitment pair heightened fears about the direction of the global economy.

There's uncertainty pretty much wherever you look at the moment, with Robert Walters citing Brexit, US-China trade tensions and Hong Kong protests among a "unique set of cumulative headwinds". Confronted with this, it's little wonder that potential candidates are thinking long and hard before they decide to move jobs.

Robert Walters now thinks that 2019 profits will be in line with the previous year's £49.1 million, which is still a decent showing given that the figure for 2018 was up 21%. Net fee income rose 2% in the most recent quarter, despite an 11% slide in its Brexit-hit UK division.

Page Group also brought forward its quarterly trading update by a day to reveal that operating profits will be between £140 million and £150 million, compared with the current consensus of £157 million. Its 2% quarterly net fee growth was lower than the market forecast at 5%.

It warned that the deterioration in trading conditions seen in the three months to September 30 were anticipated to continue. Signs of slower conditions in Germany and the United States are a particular worry, while China continues to be impacted by trade tariff uncertainty.

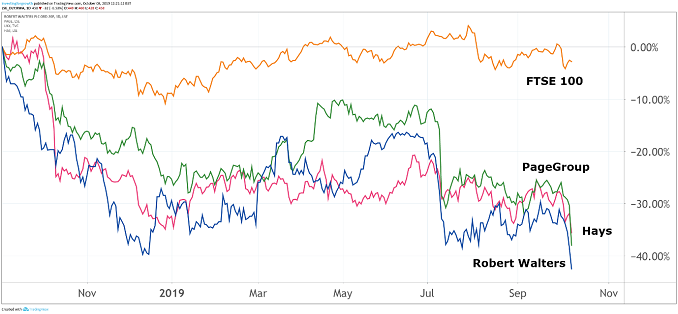

The updates drew a predictable response on the stock market, with Robert Walters down 7% to 457p and 30% since the start of July. Page fell 11% to 373p and is off 27% on the start of the third quarter. Hays, which is due to report Q3 figures on October 15, was off 6% at 134p.

Source: TradingView Past performance is not a guide to future performance

These are cyclical stocks, well used to managing their balance sheets according to the trends in the global economy. While a regional spread of offices has helped to diversify revenue streams and offered some resilience, weathering the uncertainty has been made much harder by the number and severity of geopolitical storms currently raging.

Robert Walters generates around 69% of its net fee income through permanent positions, which makes it more vulnerable to a slowdown in the global economy. Page achieves 59% of its revenues from temporary placements but 76% of its profits from permanent roles.

The key for Robert Walters is in targeting markets where there are skills shortages, such as in the technology or data science sectors and where its expertise can be beneficial for clients.

This strategy paid off during stronger economic times, with the company's shares among the best performing in 2017 after a series of profit upgrades. The stock peaked at 779p in August 2018, buoyed by a 22% increase in the total dividend to 14.7p during the year.

Page has also been rewarding shareholders, with its run of special payments since 2015 including last year's £40.8 million special dividend of 12.73p for a total dividend yield of 5.7% at the year end share price.

Its balance sheet remains strong, with net cash of £92 million at the end of the third quarter up £10 million on the previous quarter. Shareholders are tomorrow also due to receive interim and special dividends worth £54.5 million or 17.03 pence a share.

Analysts at UBS and Morgan Stanley valued Page shares at 440p and 485p prior to today's profits warning.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.