Big rally means we’re watching this sector closely

This sector led the way in July with a 7.7% one-month return.

4th August 2025 15:15

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

July was another reasonable month for most stock markets around the world. Of the 12 major indices that we regularly monitor, 10 made gains, the same number as in June, but slightly down from the clean sweep that we saw in May.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

| Stock Market Indices | 2025 | ||||||

| Index | January | February | March | April | May | June | July |

| FTSE 100 | 6.1% | 1.6% | -2.6% | -1.0% | 3.3% | -0.1% | 4.2% |

| FTSE 250 | 1.6% | -3.0% | -4.2% | 2.1% | 5.8% | 2.8% | 1.6% |

| Dow Jones Ind Ave | 4.7% | -1.6% | -4.2% | -3.2% | 3.9% | 4.3% | 0.1% |

| S&P 500 | 2.7% | -1.4% | -5.8% | -0.8% | 6.2% | 5.0% | 2.2% |

| NASDAQ | 1.6% | -4.0% | -8.2% | 0.9% | 9.6% | 6.6% | 3.7% |

| DAX | 9.2% | 3.8% | -1.7% | 1.5% | 6.7% | -0.4% | 0.7% |

| CAC40 | 7.7% | 2.0% | -4.0% | -2.5% | 2.1% | -1.1% | 1.4% |

| Nikkei 225 | -0.8% | -6.1% | -4.1% | 1.2% | 5.3% | 6.6% | 1.4% |

| Hang Seng | 0.8% | 13.4% | 0.8% | -4.3% | 5.3% | 3.4% | 2.9% |

| Shanghai Composite | -3.0% | 2.2% | 0.4% | -1.7% | 2.1% | 2.9% | 3.7% |

| Sensex | -0.8% | -5.6% | 5.8% | 3.7% | 1.5% | 2.6% | -2.9% |

| Ibovespa | 4.9% | -2.6% | 6.1% | 3.7% | 1.5% | 1.3% | -4.2% |

Data source: Morningstar. Past performance is not a guide to future performance.

In the UK, the FTSE 100 rebounded strongly, gaining 4.2% after a small loss in June, breaking through 9,000 for the first time. European markets did not fare as well, but the German DAX still rose by 0.7%, while the French CAC 40 went up by 1.4%. Both indices had fallen in June and are still below their May highs.

Across the Atlantic, the three main US indices posted gains for the third month in a row. The S&P 500 rose by 2.2%, the Nasdaq gained 3.7%, but the Dow Jones Industrial Average was barely changed, up just 0.1%. All three indices have made significant progress in the past three months and are still near record highs.

- Ian Cowie: two income investment trusts for the long haul

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The Asian markets were more mixed. The standout performer was the Shanghai Composite, which rose by 3.7%, matching the Nasdaq and making it one of the month’s top performers. Hong Kong’s Hang Seng index went up by 2.9%, and Japan’s Nikkei 225 added 1.4%. However, India’s Sensex dropped by 2.9%, making it the weakest performer among the major indices.

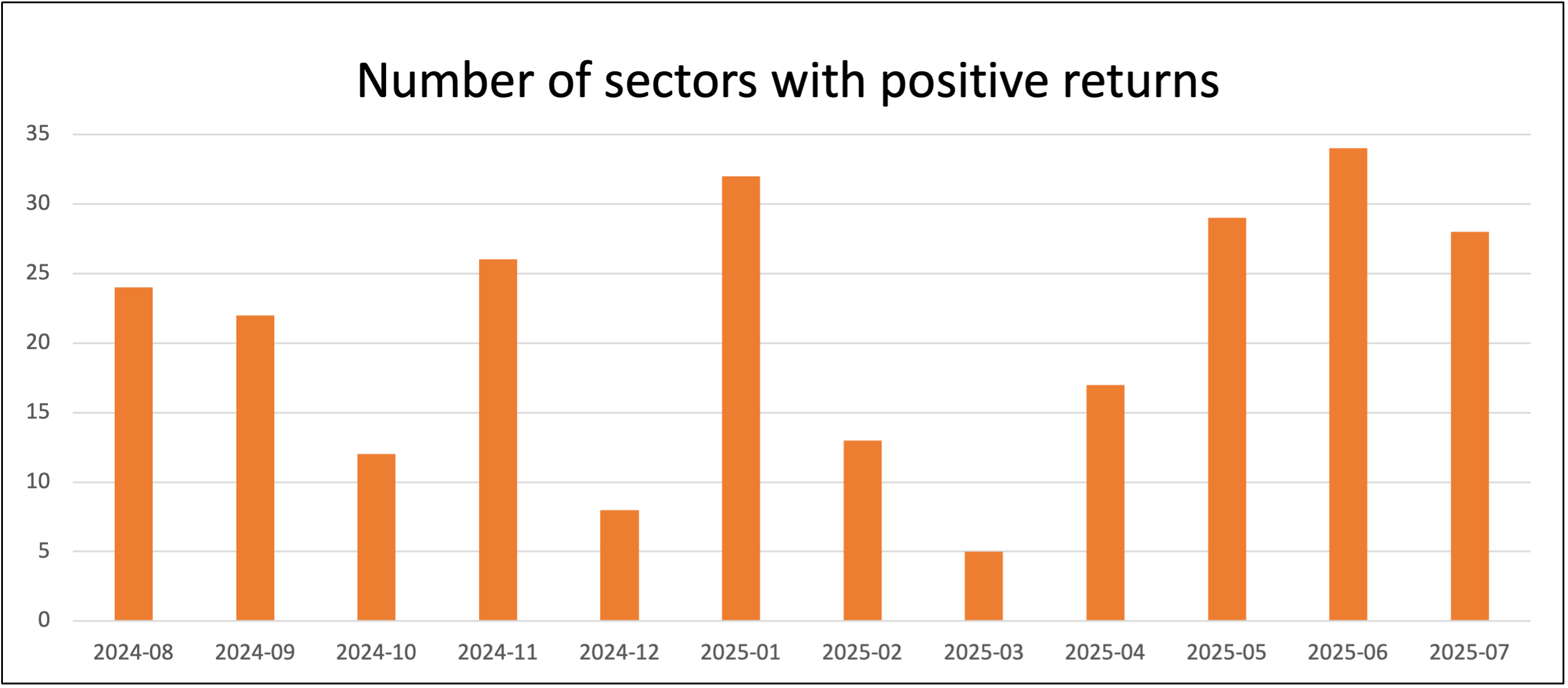

This performance was reflected in the Investment Association (IA) sector performance. Of the 34 IA sectors that we track, 28 made gains last month. A good result, but down from 34 in June and 29 in May.

Past performance is not a guide to future performance.

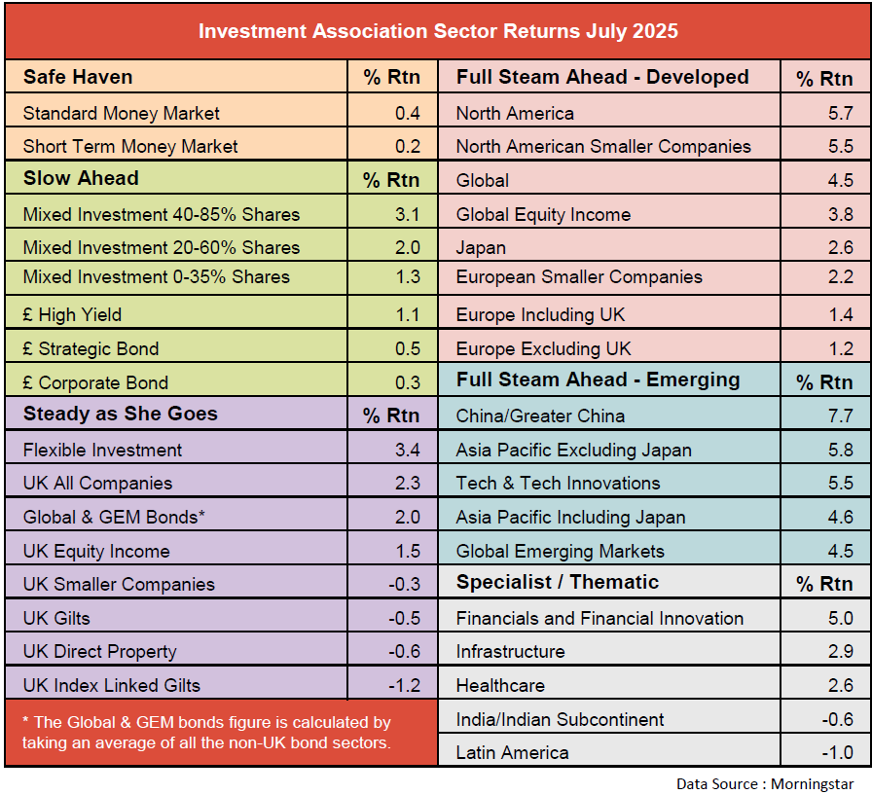

Once again, the strongest returns came from the sectors at the more adventurous end of the spectrum. The five top-performing sectors all came from our “Full Steam Ahead” groups.

Source Morningstar. Past performance is not a guide to future performance.

The sectors in our “Safe Haven” and “Slow Ahead” groups continued to make steady progress, along with the leading sectors from the “Steady as She Goes Group”. However, UK Smaller Companies, UK Gilts, UK Direct Property, and UK Index Linked Gilts all fell.

Most of the “Specialist/Thematic” sectors also made gains. Financials and Financial Innovation continued to do well, rising by 5% and adding to the 2% it made in June. Healthcare gained 2.6%, while Infrastructure rose by 2.9%. The only negative returns came from the India and Latin America sectors.

The best returns came from our “Full Steam Ahead” groups.

China/Greater China led the way with a gain of 7.7%, followed by Asia-Pacific Excluding Japan (5.8%), North America (5.7%), North American Smaller Companies (5.5%), and Technology & Technology Innovation (5.5%).

- Taking advantage of 25% discount in Hong Kong markets

- Funds and trusts four pros are buying and selling: Q3

This year, China’s government has announced stimulus measures focused on supporting economic growth through a mix of monetary easing, fiscal support, and sector-specific policies. Key actions included reductions in interest rates and a cut to banks’ reserve requirement ratio, releasing substantial liquidity into the banking system and making credit more available.

The ministry of finance also issued RMB 300 billion (about £32 billion) in ultra-long special sovereign bonds to fund consumer subsidies and infrastructure.The “Consumption Boosting Action Plan”, introduced in March, has expanded subsidies for household trade-ins (for example, cars and appliances), improved social safety nets, and provided targeted childcare, education, pension, and medical care support.

Global investors, previously underweight in Chinese assets, have started to return to the market. Easing trade tensions with the US,renewed strength in the technology sector, and attractive equity valuations, have added to the momentum.

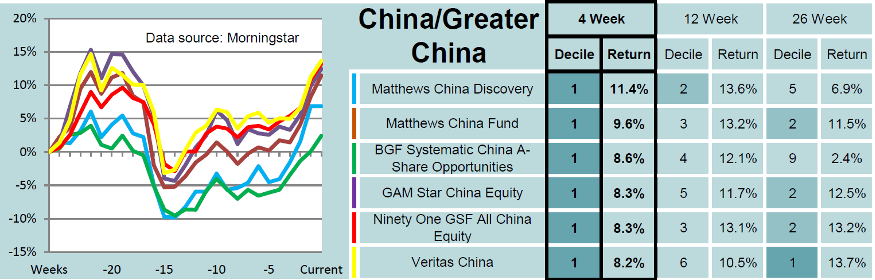

In our weekly Saltydog analysis, we highlight the leading funds in each sector over varying time frames.

Last week, these were the leading funds from the China/Greater China sector based on their four-week returns.

Past performance is not a guide to future performance.

Like most funds, they struggled during March and April, but have been on an upward trajectory since then. If the recent trend continues, they could remain among the more interesting funds to watch in the second half of the year.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.