Biomarin’s share price drop could spell opportunity for investors

Pharma company specialises in curing rarer illnesses, but could be at risk of regulatory interference.

26th August 2020 12:56

by Rodney Hobson from interactive investor

Pharmaceutical company specialises in curing rarer illnesses, which could be attractive to investors happy with the risk of regulatory interference.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Buying shares in pharmaceutical companies tends to be risky because of the constant need for them to discover new blockbuster drugs. With large broad-based pharmaceutical stocks, that risk is at least spread widely across a range of potential products and illnesses.

Specialised drug companies carry a heightened risk of failure, although the potential rewards are correspondingly enhanced.

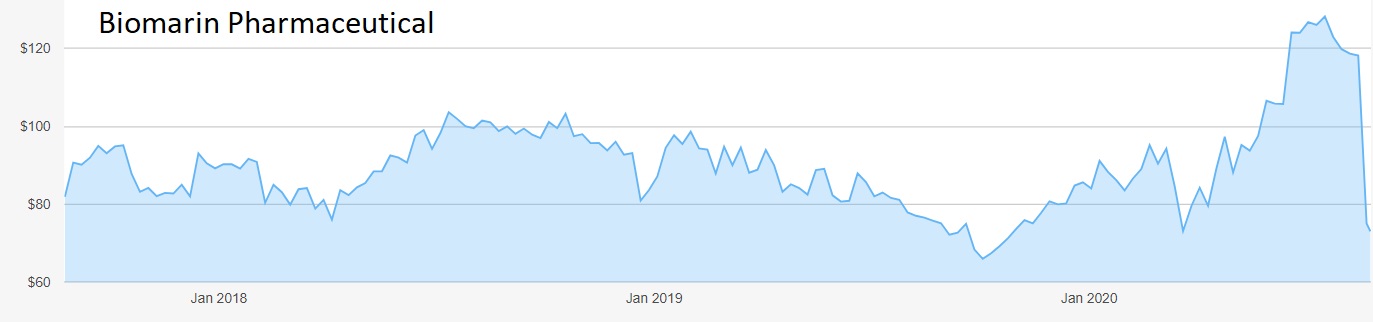

Shareholders in Biomarin Pharmaceutical (NASDAQ:BMRN) have learned over the past few months what a rollercoaster ride it can be.

The company specialises in producing what are known as ‘orphan’ drugs - those that treat rare medical conditions. Large pharmaceutical companies avoid this part of medicine as being unprofitable, since the number of patients is too small to justify the high cost of researching, developing and rigorously testing potential treatments.

However, the United States and the European Union both grant tax breaks and other financial benefits for drugs that are granted orphan medicine status by the regulatory bodies, the Food and Drug Administration (FDA) and the European Medicines Agency.

- ii view: Hikma Pharmaceutical – a Covid-19 winner

- Will world’s biggest chemical firm clear Covid-19 hurdle?

Although there may be only a small number of sufferers for each illness, in aggregate the number is surprisingly large. For example, it is estimated that 30 million people living in the European Union suffer from a rare disease.

Biomarin has a portfolio of orphan drugs to treat rare genetic diseases. Such drugs tend to command high prices since they have no competitors. Several promising new drugs are in the late stages of testing, including gene therapy, where treatments seek to modify faulty genes. Any successes could well be bought out by large pharmaceutical companies on lucrative terms.

The company is still loss-making – its latest quarterly result to 30 June showed net income at minus $29 million (£22 million) despite a 10% rise in revenue to nearly $430 million. But when analysts suggested that Biomarin was significantly undervalued the shares soared from $71 to $130 as stockmarkets recovered from the pandemic crash.

Source: interactive investor. Past performance is not a guide to future performance.

Alas, an unforeseen stumbling block was lurking. The FDA demanded further tests on a promising gene therapy for haemophilia called Valrox, which helps patients’ blood clot normally. Phase three tests indicated that the treatment was not as effective over the longer term as had been shown in phases one and two.

- GlaxoSmithKline keeps dividend but warns of ‘notable risks’

- Worldwide Healthcare Trust: why it’s time to buy

- Worldwide Healthcare Trust’s best drug stocks

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

This is a real setback for Biomarin, as current treatments for haemophilia, a life-threatening genetic condition, are very expensive, so the opportunity to make money with a new treatment was considerable.

The trouble with gene therapy is that it is supposed to provide a permanent or at least long-term cure, which is great when it happens but can be rather difficult to prove until patients complete their lifespan. Further tests are not likely to be completed until November 2021, by which time a rival treatment being tested by Roche (SIX:RO) could be available.

The shock news promptly caused the shares to collapse from $120 to $73, barely above the nadir of mid-March. They have steadied only slightly at $74.40. Investors are worried that the FDA may be embarking on a tougher line for orphan drugs, which have been approved in the past after tests on comparatively few patients.

It would be wrong for investors to ignore these fears, but they may be overdone. Biomarin has other treatments well underway, including vosoritide to treat children with achondroplasia, the most common form of dwarfism, for which no drug is approved yet.

Hobson’s choice: The sharp fall in the share price over the past few days opens up a buying opportunity for investors willing to take a risk. Do not pay more than $80, and consider taking profits if the shares reach $120 again. There will be no dividend for the foreseeable future so any payback will have to come from a capital gain.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.