Board ‘very surprised’ investment trust bought Russian company on day of invasion

17th March 2022 14:41

by Sam Benstead from interactive investor

ScotGems bought shares in London-listed Fix Price Group but has seen its investment marked down to zero.

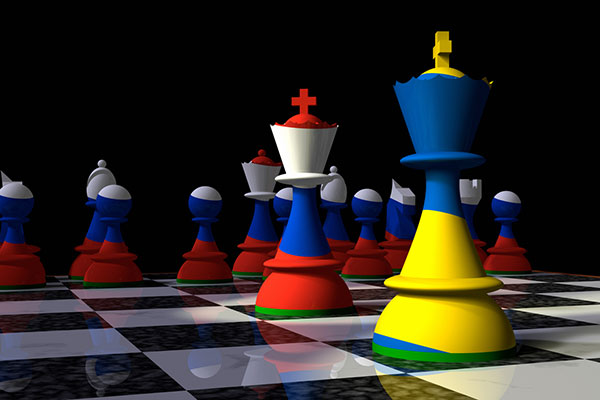

The board of underperforming emerging markets trust ScotGems (LSE:SGEM) has expressed its shock that its fund managers invested in a Russian company on the day of the Ukraine invasion last month.

On February 24, the £38 million closed-ended fund added a 1.1% position in Fix Price Group, a Russian retailer listed on the London Stock Exchange. That investment is now worthless as trading in its shares has been suspended.

Before this, ScotGems (LSE:SGEM) had avoided Russian shares on environmental, social and governance (ESG) grounds.

- Ukraine invasion triggers FTSE 100 slump

- The funds, investment trusts and ETFs with exposure to Russia

Chair William Salomon said: “The board were very surprised with such a decision being made, and even more so that First Sentier Investors permitted such a trading instruction to be processed, in the prevailing circumstances.

“Given that stock market trading in all London listed Russian companies has subsequently been suspended, this investment is now held in the portfolio at nil value.”

The fund is managed by Tom Prew and Chris Grey of Stewart Investors, part of Australian investment group First Sentier.

However, on 9 March First Sentier resigned from managing the trust. Prew and Grey will remain in charge of the portfolio until a new manager has been appointed.

Since the trust was launched in 2017 it has lost 32% while its benchmark, the MSCI Emerging Markets Small Cap Index, returned 27%.

Salomon said the disappointing performance was due to a low weighting to Asia and a high weighting to Africa.

- When markets fall heavily, here's what to avoid doing

- Sea of red across global stock markets as Russia invades Ukraine

China, South Korea and Taiwan account for nearly 50% of the benchmark index and have been the best performing regions in it over the past few years.

The fund managers said the market had punished it for focusing on “value” shares that make a lot of money today rather than promising but unprofitable “growth” companies.

They said: “ScotGems (LSE:SGEM) owns a lot of ‘jam today’ companies – by which we meant well-stewarded businesses which we can value according to actual cash flows rather than hopes, dreams, and powerpoint presentations."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.