Booming bonds: the funds that stand out

There wasn’t much to get excited about in last week’s data, but central banks have come to the rescue.

30th March 2020 13:26

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

There wasn’t much to get excited about in last week’s data, but central banks have come to the rescue.

Central banks come to the rescue

Each week we analyse the performance of a wide range of individual Unit Trusts and OEICs, and also look at how the Investment Association sectors that they belong to are doing relative to each other.

When we reviewed the data last week, there wasn’t much to get excited about - all sectors were down over four weeks, and most were also down over 12 and 26 weeks as well.

However, within the sectors there were a few funds that stood out.

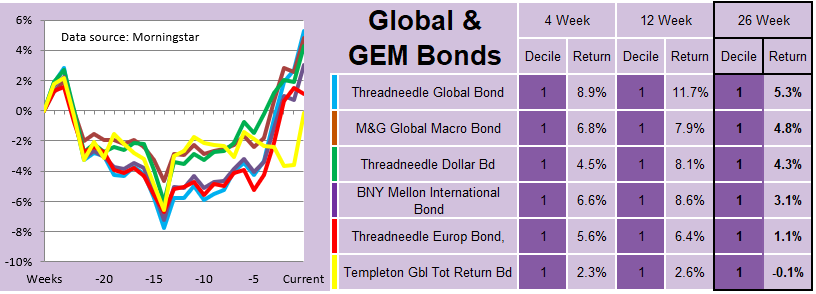

For example, in the combined Global & Global Emerging Market Bonds sector there are a handful of funds that have done reasonably well over the last three months.

Last week’s report showed that the sector as a whole had gone down 3.1% in the previous week, and it was also down over 12 and 26 weeks, however the leading funds had done considerably better than the average.

I haven't researched each of these funds and so the reason for their out-performance may well vary, but I did have a quick look at the Threadneedle Global Bond. This is what I've found...

- Over 80% is invested overseas

- 57% is invested in US dollar denominated securities.

- Five of its top 10 largest holdings are in US Treasuries (the American version of Gilts)

- These alone account for more than 20% of the total value of the portfolio

US Treasury bonds, backed by the government, are seen as being very safe and have gone up over the last month as people have transferred into them from more risky investments.

Over the last few weeks central banks have been pledging to do ‘whatever it takes’ to keep their economies from failing. In the UK the Bank of England has cut interest rates and Chancellor Rishi Sunak announced a £30 billion package to boost the economy and fight coronavirus in his budget on the 11th March.

Within a week he had promised that a further £330 billion of loans and grants would be made available as the UK went into lockdown.

There have been similar measures taken around the world, but the most dramatic has been in the US where last week The House of Representatives approved a $2 trillion relief bill meant to respond to economic fallout from the coronavirus pandemic.

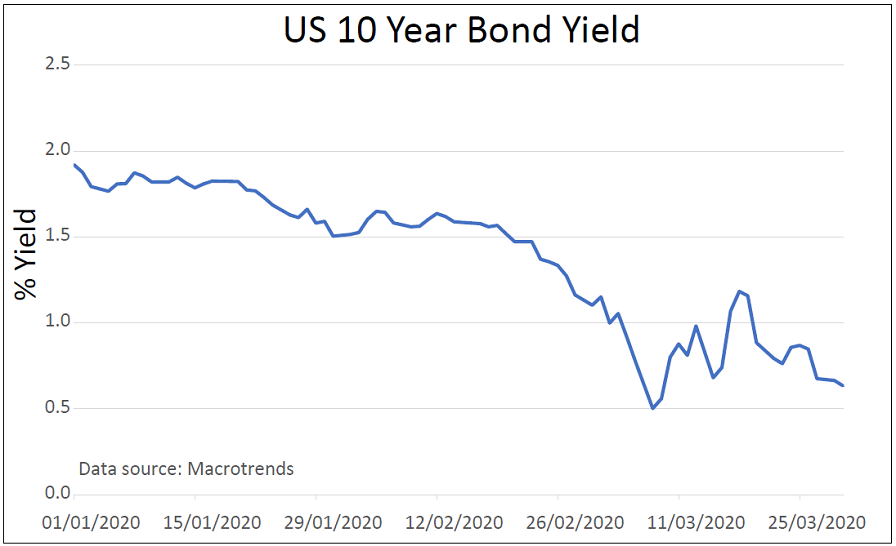

The Federal Reserve has cut interest rates, almost to zero, and said that it will buy an unlimited amount of government debt, as well as corporate and municipal bonds, in the largest ever extension of its QE programme. Buying bonds should increase demand and so put upward pressure on the price.

As the price goes up, the yield (the amount that the bond pays) goes down. Yields for 10-year US Treasuries have halved since the beginning of this year, and are less than a third of what they were at the beginning of 2019.

In addition, the pound has weakened against the dollar over the course of the month, from $1.30 to $1.24 (4.6%), which would have boosted US bonds when valued in sterling. (At one stage the exchange rate dropped to $1.16).

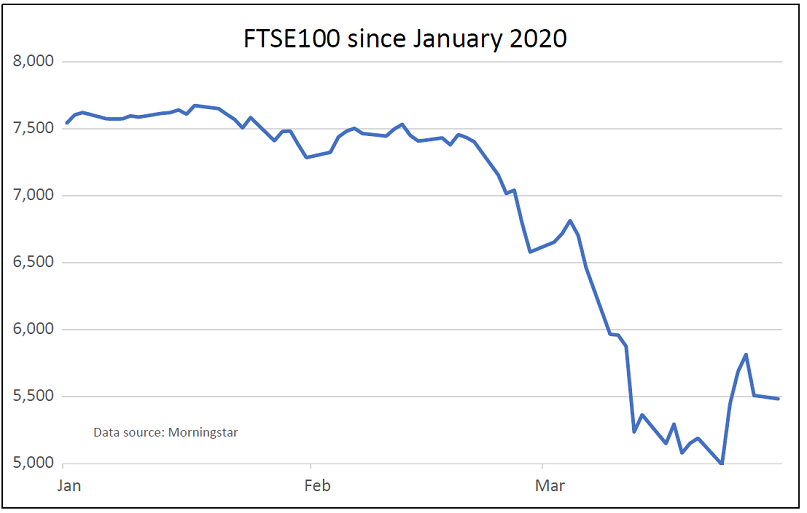

All this financial stimulus seems to have steadied the markets. The FTSE 100 closed just below 5,000 on the 23rd March. It hasn’t been any lower.

Now could be the time to call the bottom of the market, but I don't want to be too hasty.

When markets started falling at the end of February, the Federal Reserve reacted quickly.

On the 3rd March it cut interest rates and stock markets rallied. The Dow Jones Industrial Average recorded its largest one-day point gain ever, but then went on to fall by a further 28%.

Last week it had another record rise, gaining over 11% in one day, but who's to say it won't fall another 30% in the next few weeks. It would still be well ahead of where it was when it crashed in 2008/09.

I've got a feeling that, although there will be a lot of volatility in the next few weeks, markets probably won't go much lower than they've been recently, but my guess is as good as yours.

If the rally continues, then I would expect the 'equity' based sectors (the ones that have been hit the hardest) to start to recover, but if there's another downturn then the bonds will probably continue to perform well.

At the moment our demonstration portfolios are still considerably ahead of where they would have been if we hadn't gone safe earlier in the month, and so we are happy to sit back and wait and see what happens over the next few days or maybe weeks.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.