With ‘Brexit day’ behind us, will the UK economy rebound?

Why there is strong potential for a Q1 rebound in 2020 following a weak previous quarter.

17th February 2020 10:25

by Tom Bailey from interactive investor

According to Pantheon Macroeconomics, there is strong potential for a first quarter rebound in 2020, following the previous quarter’s weak posting.

The UK’s economy was stagnant in the last three months of 2019, with political uncertainty to blame for a lack of business investment and consumer spending, according to the latest figures from the Office of National Statistics (ONS).

The latest statistics showed that in the final quarter of 2019 GDP growth came in at zero when compared to the same period in 2018. The third quarter of 2019 had seen an unexpectedly strong 0.5% expansion.

The UK economy has continued to perform poorly since the 2016 vote for Brexit, with uncertainty pushing the UK economy to the verge of recession on several occasions. However, with the UK finally outside of the European Union, will the UK economy start to rebound?

According to Pantheon Macroeconomics, there is strong potential for a first quarter rebound in 2020, following the previous quarter’s weak posting.

One key point made by the economic consultancy was that in the last quarter of 2019, part of the slowdown was the result of flat household spending – likely on the back of Brexit and election fears. As Pantheon notes:

“Households increased their spending merely by 0.1% in real terms; nominal expenditure was flat.”

However, they argue, there is evidence that over that quarter, household incomes rose. While there is not yet complete data, they point out that employees’ compensation rose at a rate of 0.7% in the fourth quarter. According to Pantheon, had household spending increased in line with this then GDP could have risen by 0.4%.

It remains to be seen whether Britain’s exit from the European Union will result in an uptick in consumer spending in the first quarter of 2020.

On the one hand, incomes are expected to rise this year due to several pieces of government legislation.

First, the National Living Wage is set to rise by 6.2% in April. In the same month, there will also be a substantial increase in the threshold for national insurance contributions, while working-age benefits (such as child benefit and Jobseeker’s Allowance) will see an inflation-linked boost, ending a four-year nominal freeze.

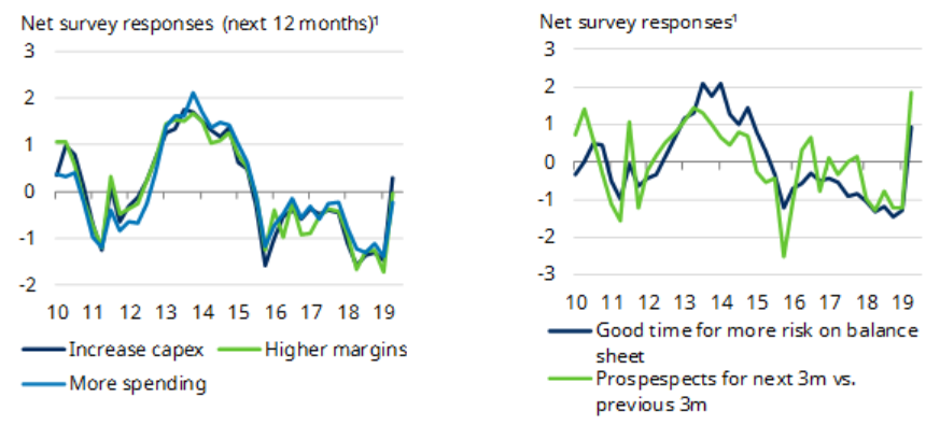

An intention to increase investment can also be seen by Deloitte Chief Financial Officers (CFOs) survey. CFOs surveyed are now indicating a pickup in spending activity, as can be seen in the charts below.

As Azad Zangana, a senior European economist and strategist at Schroders:

“The latest edition published results from the survey which was conducted after the general election in December. Interestingly, every major series saw a jump. CFOs are now reporting a stabilisation in activity.”

Of course, this is not to say that the UK economy won’t encounter potential weaknesses. The UK’s exporters will continue to see weak demand, largely the result of the backdrop of poor global economic growth.

Moreover, the world’s already slowing economy is now threatened by the continued shutdown of activity in China, as the government there attempts to stem the spread of coronavirus.

At the same time, many overseas businesses are likely to steer clear of investing in the UK with the final outcome of Brexit still to be decided. Principally, there remains the continued risk of significant trade barriers being erected in 2021 after the transition period.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.