Buyers chase easyJet shares higher

Back in the FTSE 100, the budget airline is performing like a blue-chip, writes our head of markets.

21st January 2020 10:20

by Richard Hunter from interactive investor

Back in the FTSE 100, the budget airline is performing like a blue-chip, writes our head of markets.

easyJet (LSE:EZJ) has started its new year in fine fettle, with an ongoing focus on costs and increased revenues propelling performance.

Low levels of competitor capacity have been a boon, while the unfortunate demise of Thomas Cook (LSE:TCG) has also provided opportunities. For its part, easyJet has increased capacity, passenger numbers and the load factor, which, at over 91%, is indicative of an efficient operation.

Meanwhile, there are promising early signs from the Berlin hub, and the easyJet holidays launch is still expected to result in a break-even performance in its first year.

Overall group revenues for the first quarter of its financial year grew by an impressive 9.9%, comprising a 9.7% increase from passenger revenues (which account for around 80% of the total) and 10.8% from ancillary revenues.

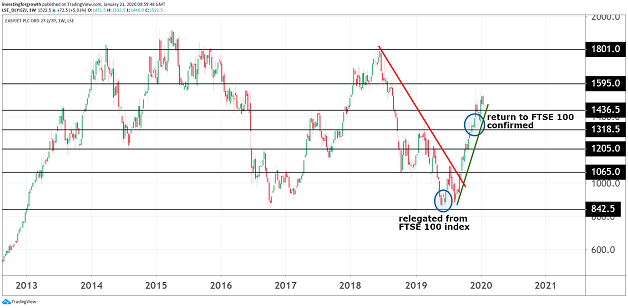

Source: TradingView Past performance is not a guide to future performance

The outlook statement offers further promise, with 75% of seats for the first half of the year already booked, revenue per seat guidance nudged higher, resulting in an expected (and seasonal) first-half loss which should show an improvement on last year.

At the same time, there are, as ever, potential flies in the ointment.

In this period, costs increased due to unavoidable inflationary increases to items such as ground handling costs and crew pay deals, while a comparison of revenues and costs per seat continues to highlight the wafer-thin margins on which easyJet operates.

Faced with such brittle conditions, temporary setbacks such as the air traffic control strikes in France have an immediate impact, let alone the broader occasional threats coming from the likes of a higher oil price, adverse weather conditions, or even virus outbreaks which in total have been enough to signal the end for smaller competitors in recent times.

Even so, easyJet runs those parts of the business within its control with a laser focus and the early signs for prospects are promising. The initially warm reaction to the update adds to a particularly volatile but positive period for the airline, which, during the course of 2019, saw it relegated from the FTSE 100 in June, only to regain this status in December.

The net position is that, over the last year, the shares have delivered an increase of 24%, as compared to a 10% gain for the premier index, with a turbocharged 32% hike over the last six months.

This is a sector which receives particular scrutiny from investors, such that the current market consensus of the company as a “hold” is reflective of the shares being up with events at the moment. That being said, with a following wind and continued momentum as currently in evidence, upgrades to the general view cannot be discounted.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.