Can Debenhams rebrand revive boohoo's share price?

With shares trading near record lows and boohoo losing younger customers, management hopes an old high street favourite can save the business. Independent analyst Alistair Strang tells us what his charts say.

12th March 2025 07:37

by Alistair Strang from Trends and Targets

The decision by Boohoo Group (LSE:BOO) to rebrand themselves as Debenhams has probably caused a sharp intake of breath among the online fashion industry. Boohoo, a brand that has been predominantly aimed at the younger sector of the market, are surely liable to wonder why they’re no longer attractive, Debenhams historically being associated with older buyers.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Currently, Boohoo's share price isn’t in a happy place, the famously fashion conscious stock market obviously questioning their latest decision.

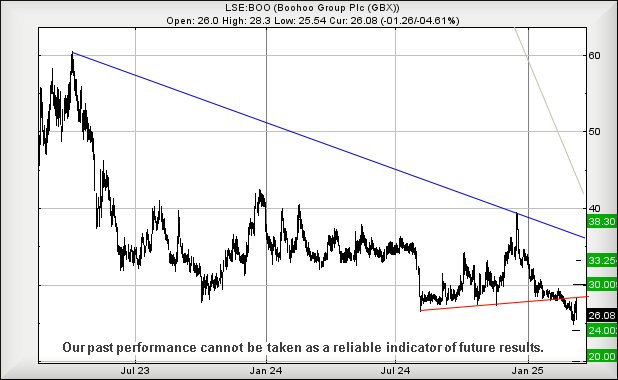

From a chart perspective – probably the safest stance from folk who regard waxed cotton jackets and wide brimmed hats as the pinnacle of style – Boohoo (or Debenhams as the renaming had immediate effect) are seriously in a pretty unhappy place.

At present, weakness below 25.5p indicates the potential of reversal to an initial 24p with our secondary, if broken, at 20p. We cannot calculate any target level below 20p without emplacing a minus sign in front of any number, such is the precarious position of Boohoo.

Currently trading around 26p, Boohoo's share price needs (from our perspective) to exceed 26.25p, ideally triggering recovery toward an initial 30p with our secondary, if bettered, at 33.25p. Movement such as this would be significant, placing the share price in danger of achieving a distant game-changing 38p and a return to long-term optimism.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.