Can JD Sports shares achieve even greater success?

12th January 2022 07:35

by Alistair Strang from Trends and Targets

This £11 billion FTSE 100 company is one of the UK stock market's great success stories. Independent analyst Alistair Strang scours the charts for signs the upward trend can continue.

We’ve received just a few email requests asking if we’d cover JD Sports Fashion (LSE:JD.). Surprisingly, it had also popped up on our radar, suddenly being shown as a “Strong Buy” among a few analysts too.

In some ways it stood out as a sore thumb, the most common “Strong Buy” allocations across Europe being designated toward oil companies. Even BP (LSE:BP.) is starting to look interesting, if their share price exceeds 386p!

However, JD Sports also fascinates us for quite a different reason.

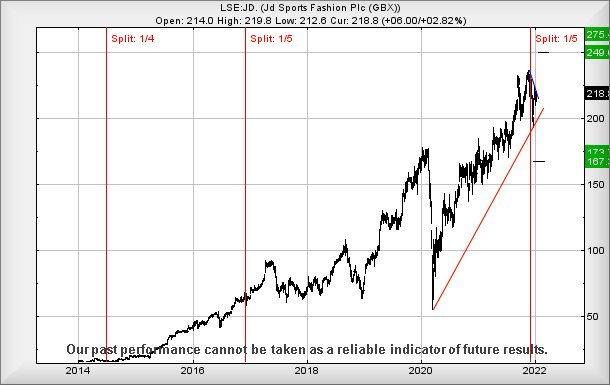

Since 2014, the share price has been diluted three times! We despise the converse movement by the market place, a familiar strategy, mostly on the AIM market, intended to make a struggling share price suddenly look a bit more respectable.

Importantly, it’s not just the AIM enacting such reprehensible behaviour. NatWest Group (LSE:NWG) (aka RBS) boosted their share price 10-fold a few years ago, taking back 10 old shares and issuing one new share in an ill-fated attempt to conceal the harsh reality of the bank's value. But when we see companies doing the opposite, essentially attempting to conceal their strength, those companies tend to grow from strength to strength. From Apple (NASDAQ:AAPL), Tesla (NASDAQ:TSLA), Alphabet (NASDAQ:GOOGL) (Google), this behaviour has become the mark of something we tend feel worth sitting back and watching.

- Why reading charts can help you become a better investor

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

JD Sports first played this game in 2014, issuing 4 shares for every existing share. This quartered the share price. Two years later in 2016, they issued 5 shares for every existing share, diluting the price by 80%. Once again, as 2021 drew to a close, the share price was again returned to sensible levels, a further 5 shares issued for each existing share. Unless our calculations are horribly wrong, the “true” value of JD Sports would work out around 60 quid per share, if measured in pre-2014 money.

As the chart below highlights, on each occasion JD Sports diluted the number of shares in issue, the share price has gone from strength to strength and this perhaps allows considerable optimism.

However, with the company issuing a trading update today, it certainly appears their share price may be worth watching.

Source: Trends and Targets. Past performance is not a guide to future performance

Presently trading at around 219p, the share price needs to exceed 224p to hopefully trigger movement upward to an initial 249p. With the price adjusted chart below, this will paint a new all-time high, justifying us calculating a longer term secondary at an eventual 275p.

- 27 dividend stocks for income seekers in 2022

- Best 39 growth stocks for 2022

- Watch our new year share tips here and subscribe to the ii YouTube channel for free

Our conventional logic would normally indicate the risk of hesitation at this secondary level but, thanks to the repeat changes in the numbers of shares in issue, we shall simple promise to take a further look, if 275p ever makes an appearance.

For things to go wrong, the share price needs below 200p to bring the potential of trouble, allowing reversal to an initial 173 with secondary, if broken, at a hopeful trampoline level of 167p.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.