Can Rosebank replicate Melrose stock market success?

The team that transformed a minnow into a FTSE 100 powerhouse have brought a new investment vehicle to AIM. Investors are keen to see if it can do the same again.

11th July 2024 15:48

by Graeme Evans from interactive investor

The dealmakers behind the success of FTSE 100-listed Melrose Industries (LSE:MRO) have returned to AIM by launching a new venture built on the same Buy, Improve, Sell strategy.

Dealings got under way this morning after Rosebank Industries earlier raised £50 million placing shares with investors including BlackRock and two sovereign wealth funds.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

As with Melrose in 2003, the seed capital will provide the foundation for Rosebank to target under-performing industrial businesses via transactions worth up to $3 billion.

The venture will aim to repeat the success of Melrose, which in the 19 years after its first deal in 2005 returned £8.3 billion to its shareholders and generated a 3,396% total shareholder return.

Two of the three original Melrose co-founders, Simon Peckham and Christopher Miller, and four other leading members of its senior management team, are involved in Rosebank. Peckham left Melrose earlier this year, having overseen its promotion to the FTSE 100 in 2012.

- ii investment performance review: Q2 2024

- Best UK stocks, sectors and markets in first half of 2024

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Melrose is now focused on GKN Aerospace after recently spinning off GKN’s automotive and powder metallurgy operations into the FTSE 250-listed Dowlais Group (LSE:DWL).

Earlier turnaround examples included FKI, where Melrose improved operating margins from 10% to 15% and generated a return of 2.6 times on shareholders’ investment.

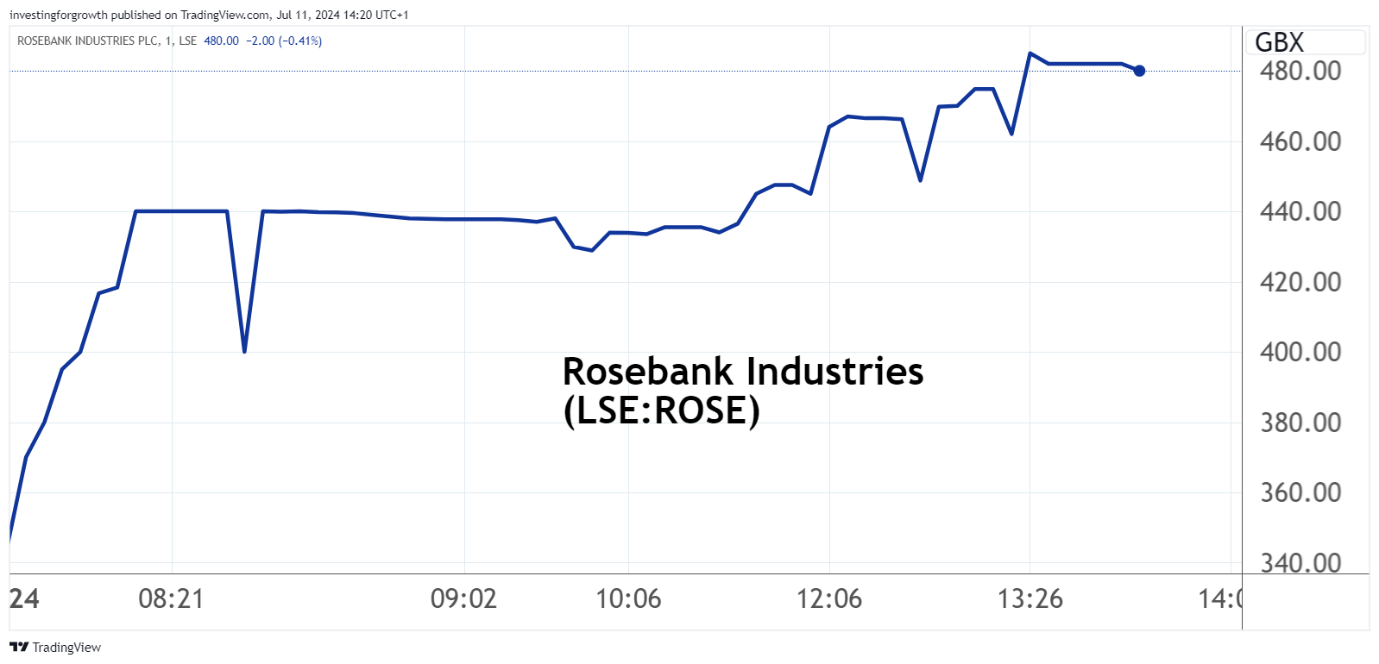

Having placed the shares at 250p, Rosebank got off to a strong start in today’s dealings to trade this afternoon at 477.5p.

Source: TradingView. Past performance is not a guide to future performance.

Peckham, who is Rosebank’s chief executive, said this week: “We are grateful for the support we have received from incoming investors, many of whom have supported us over many years.

“We are now totally focused on the continued successful implementation of the ‘Buy, Improve, Sell' business model we have practised for over 20 years and look forward to repaying the trust placed in us.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.