Can Xaar and Crawshaw shares recover from terrifying plunge?

30th August 2018 12:53

by Graeme Evans from interactive investor

Both Xaar and Crawshaw have had their moment in the sun, but their share prices just collapsed. Graeme Evans looks at what went wrong.

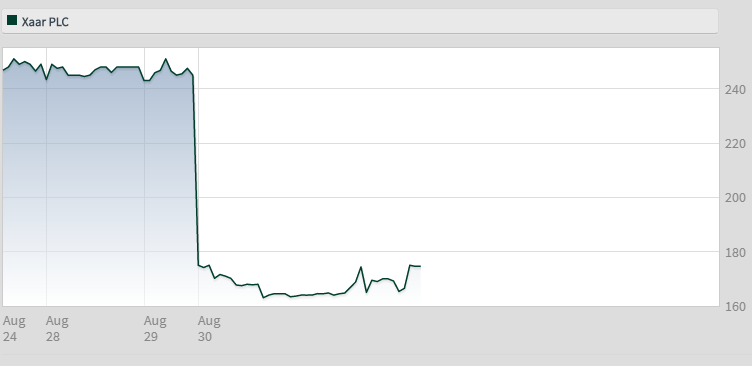

Time is running out for Xaar to deliver on its "2020 vision" after another downgrade from the inkjet technology company tested the patience of supporters who have stayed loyal to this high-yielding stock.

Having previously set out ambitious plans to grow annual revenues to £220 million by 2020 - from the £96.2 million achieved in 2016 - the target looks more challenging than ever as today's latest sales warning sent shares crashing by a third to their lowest level in eight years.

The setback comes just two months after Xaar warned that revenues from its legacy ceramics business had been below expectations. Sales have continued to disappoint since then, but what will most concern shareholders today is that adoption of one of the company's newer ranges has been "significantly slower than expected".

Source: interactive investor Past performance is not a guide to future performance

The success of products such as the 1201 printhead, which uses thin film technology for printing wide-format graphics including banners, is vital for a company that spends around 18% of its revenues on research and development.

Only 5% of traditional analogue printing has so far transferred to digital modes, which is why many in the City continue to stand by the company and its longer term prospects.

After June's sales downgrade, Canaccord Genuity said it remained a buyer of the stock, with a price target at the time of 700p.

Its analysts wrote:

"While the recent share price performance is entirely understandable, it does not in our view reflect the substantial potential for future value creation."

They noted an array of large industrial end-markets as well as the benefits of Xaar's open architecture approach and new product suite. And at the current depressed share price, Canaccord said that "industrial logic may attract a predator for this unique asset".

Source: interactive investor Past performance is not a guide to future performance

Xaar is also underpinned by a strong balance sheet, while it has rewarded shareholders with a dividend yielding in the region of 4%. The pay-out has risen from 4p a share in 2012 to a total dividend of 10.2p for 2017.

Revenues peaked at £137.1 million in 2013, when adjusted profits of £41.1 million were also recorded. Since then, however, Xaar has been focused on shifting away from being a single product, single market business.

By last year, 80% of revenues had come from new products or businesses introduced in the previous two years. Unfortunately for the company, decreasing demand for legacy products has been more aggressive than expected, while there’s been a slower than expected take-up of newer products.

It has protected profitability through cost savings, while it is also undertaking a review of strategic options to see if it can roll out more extensive partnering to exploit the ongoing analogue to inkjet conversion within print markets.

By last year, Cambridge and Nottingham-based Xaar had more than 317 patents and patent applications, with R&D staff representing 19% of the total workforce.

Crawshaw Group, "the UK's leading value butcher", had a nightmare, too. Worth over 80p a share as recently as two years ago, they more than halved in value to a new low of just 2.8p following more bad news.

Source: interactive investor Past performance is not a guide to future performance

Following a string of profit warnings, management blamed rising shop rents and high business rates plus lower footfall and increased discounter competition for another downgrade in profit expectations.

The slump in like-for-like sales accelerated slightly to 13.2% for the half year from 12.9% in the first 20 weeks, and we’re warned to expect an operating loss of £3 million this year.

New leadership will reveal how they plan to turn the business around at interim results on 26 September. It had better be good!

Source: interactive investor Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.