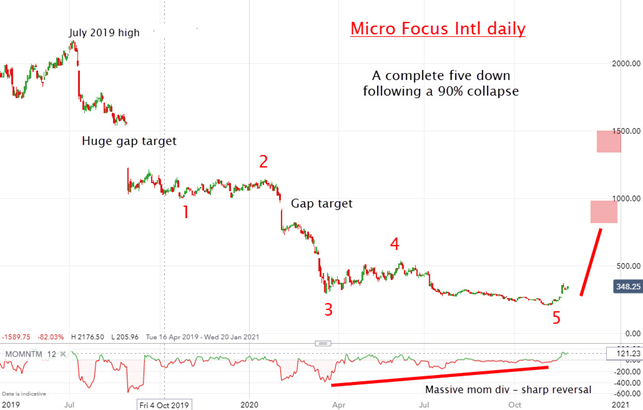

Chart of the week: are Micro Focus shares back from the dead?

Its decline was spectacular, but something has piqued analyst John Burford’s interest in these shares.

30th November 2020 12:32

by John Burford from interactive investor

Its decline was spectacular, but something has piqued analyst John Burford’s interest in these shares.

I have been tracking this former software high-flyer in its savage bear trend this year and believe it made a major low in early November. The rout has been so severe that it lost 90% of its value since July 2019.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Usually, as a member of the ‘90% Club’, it qualifies as a prime candidate for the company scrap heap, but I believe this share is an exception and has potential to recover much lost ground.

- Shares round-up: Croda rallies, RSA, bank sector bids, Micro Focus

- ii view: shares slump after Micro Focus plunges into the red

The latest report this month is encouraging in that revenues are still holding up, and Micro Focus International (LSE:MCRO) secured further backing in the form of low-interest loans. And, at last, the shares are moving up off their deep 4 November lows – here is the long-term weekly chart with the horror story (for the bulls) in full view.

Source: interactive investor. Past performance is not a guide to future performance.

There are several very notable features here – first, the collapse off the November 2017 high is in the clear form of an a-b-c three wave pattern. These are corrective, which implies the next major wave will be up. Second, at the low this month there appear huge momentum divergences, and that always implies smart money is buying cheap shares. So shall we join them?

Here is a close-up of the ‘c’ wave on the daily chart:

Source: interactive investor. Past performance is not a guide to future performance.

The shares have pushed up strongly this month from the £2.05 low to the current £3.60 for a decent 75% gain.

- Why reading charts can help you become a better investor

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

There are two gap targets on the way down. Recall that targets act as magnets, drawing the share price towards them following a major reversal. That sets my first target at around the £8 area, with the higher target at around £12.

Only a move below the £2 low would send me back to the drawing board.

I am putting this share on my Buy Low/Sell High list.

For more information about Tramline Traders, or to take a three-week free trial, go to www.tramlinetraders.com.

John Burford is the author of the definitive text on his trading method, Tramline Trading. He is also a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.