A cheap bank share with knockout dividend yield

It's one of the world's top 10 financial services companies with everything an investor is looking for.

3rd July 2019 10:49

by Rodney Hobson from interactive investor

It's one of the world's top 10 financial services companies with everything an investor is looking for.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Spanish bank Banco Santander (XMAD:SAN) came to prominence in the UK by stepping in to rescue ailing former building societies such as Bradford & Bingley and Abbey National at the height of the financial crisis 11 years ago. It suffered along with rest of the global banking sector before recovering, but it has fallen out of favour again lately. This could be a good time to take advantage.

It looks as strong as any European bank and its shares can also be bought priced in sterling on the London Stock Exchange (LSE:BNC), although you will have to pay the 0.5% stamp duty on purchases.

Santander's operations are spread across Europe, Latin America and the US. It is the world's ninth-largest financial services company by revenue.

Many investors have tarred all European banks with the same brush, seeing them as a generally risky prospect since the financial crisis. Ultra-low interest rates combined with rising levels of bad debts have left them struggling to recover the levels of profitability enjoyed before the crash.

Santander is still looking for opportunities in the UK. It has just livened up the battle to buy £3.7 billion worth of mortgages from Tesco Bank in an opportunist move. With the UK housing market slowing down, mortgage rates have tumbled and Tesco is a tiny player getting squeezed. Santander has the financial clout to tough it out until the market picks up. Its previous forays into the UK mean it has the knowledge and experience to make the most of this market.

Having bought clapped-out rival Spanish bank Banco Popular for a nominal €1 in 2017, Santander last month tidied up arrangements for selling insurance, asset management and pensions in Spain, giving it a stronger position on its home turf.

Santander paid €937 million to acquire the remaining 60% of Allianz Popular, the joint venture between global insurance giant Allianz and Banco Popular. The combined business has been selling insurance to Popular’s customers since 2011 and accounted for around 10% of Allianz’s overall gross written premiums in Spain.

So despite the original nominal price tag, the acquisition has not come cheap. Indeed, Santander asked shareholders to stump up €7 billion to cover the cost of sorting out the mess at Popular, another reason why Santander's shares fell out of favour – and another reason why it is seen, unfairly, as just another European bank that needed a rights issue.

In fact, the acquisition is already bearing fruit, helping to boost net profit by 28% last year, the first full year of ownership.

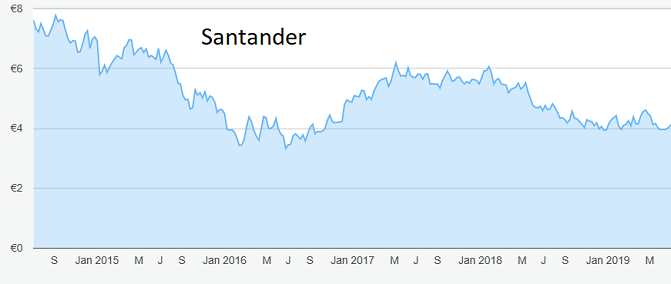

Santander's shares collapsed from €14.60 to under €5 in 2008 before bouncing back to €11 by the end of 2009. Since then they have been on the slide and two rallies petered out at €7.60 and €6.20 respectively. They currently trade at €4.12, where the price-earnings (PE) ratio is an undemanding 9.5 and the yield an attractive 5.6%. A firm floor has been established at €4 over the past nine months and should hold again.

Source: TradingView Past performance is not a guide to future performance

The bank slashed its dividend from an unsustainable 60 cents to a realistic 20 cents in 2015, but has restored its progressive dividend policy since, raising the payout by 1 euro cent a year, not a lot but heading in the right direction, and the dividend has been covered more than twice by earnings in each year.

It is raising revenue and pre-tax profits year by year. The economic slowdown in the eurozone and in the UK is a worry but this is a bank that can ride out the storms.

Hobson's choice: Buy at under €4.30. A company that is consistently raising revenue, profits and the dividend is what investors should be looking for.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.