A cheap small-cap share, but is it worth buying?

Look at it one way and this AIM share is like a Porsche. Find out how our analyst scores the business.

11th October 2019 15:22

by Richard Beddard from interactive investor

Look at it one way and this AIM share is like a Porsche. Find out how our analyst scores the business.

You're frowning Richard. S'up?

With some shares I just can't see the wood for the trees. Belatedly I may be realising Alumasc (LSE:ALU) is one of them.

Go on. What's wrong with Alumasc?

Well that's the problem. I don't really know where to start. It's a bit like a Porsche SUV. Look at it one way, and it's a Porsche. Glance it from another angle it's a wobbly blancmange.

You don't know much about Porsches do you?

Nope, perhaps we'd better stick to Alumasc, ask me the big questions and I will give you my scores. I want to keep this simple...

Ok then, one thing first though. What does Alumasc do?

It owns a clutch of businesses that make premium building materials. Not bricks, tiles and paving slabs, but flat and green roofs, solar shading, gutters and downpipes and drainage systems. Many of these products end up on large commercial or public sector structures. It supplied a drainage system for Spurs' new stadium, though frankly I think it could do better than that. Arsenal perhaps.

It also owns Timloc, a relatively small but surprisingly profitable manufacturer of housebuilding widgets, things like loft hatches, and ventilation products. It makes a big fuss of Invisiweep in the 2019 annual report, which enables water to drain from walls.

Does Alumasc make good money?

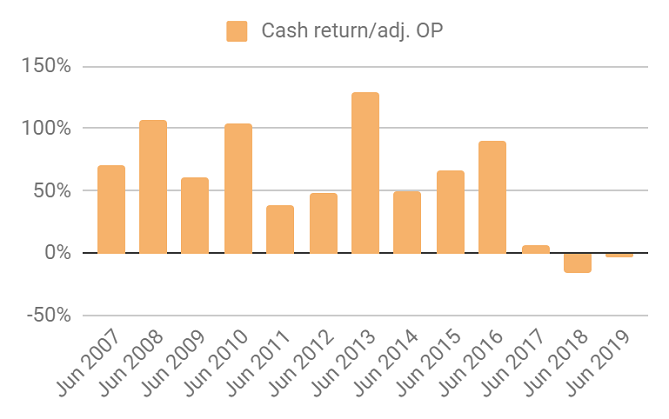

Well, as I said it depends on how you look at it. Alumasc has achieved an average return on capital over the last decade of 17%, but it has only earned about half that in cash terms mainly because it is shovelling money into its pension fund (Over £3 million in the year to 2019, compared to just under £6 million underlying operating profit). In recent years, when it has also been investing, moving Timloc to a bigger premises and bringing together some of the operations of its disparate businesses, free cash flow has been slightly negative.

Score: 1

What could prevent it from growing profitably?

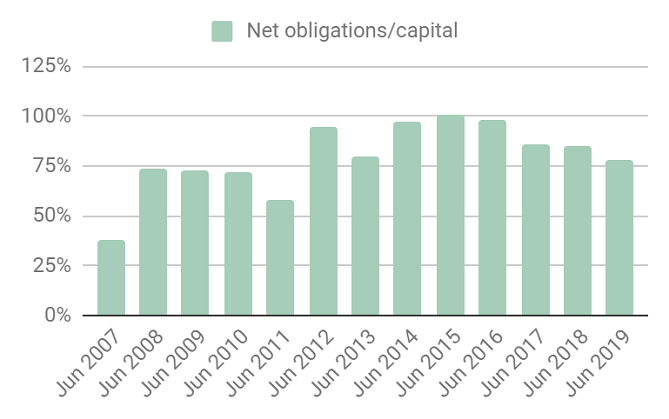

Though the company describes borrowing as modest, Alumasc is financially stretched when you add the money it owes the pension fund and (roughly) what it owes landlords. This chart shows Alumasc is mostly funded by external capital of one kind or another, which makes me nervous, especially when you consider how volatile profitability can be, which we will in a minute.

I wonder if Alumasc's finances would be strong enough to withstand a big recession in the construction sector.

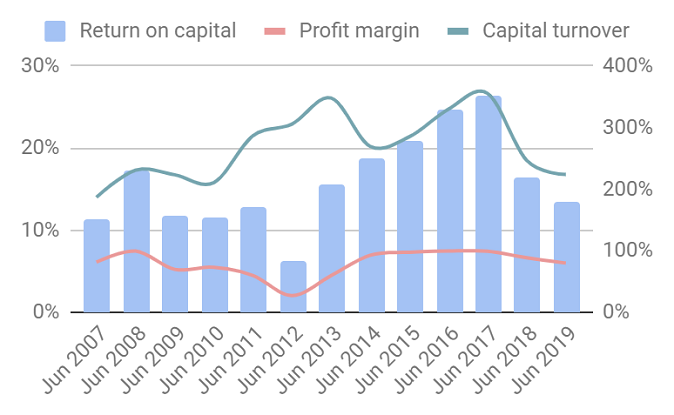

In 2012, when the shockwave of the financial crisis three or for years earlier was still coursing through the construction industry, Alumasc's return on capital was a sub-par 6% but it was the company's precision engineering business that misfired that year and the construction businesses performed reasonably well. I'm inclined to overlook 2012, because Alumasc has divested all its non-construction businesses.

For a while, in the middle of the current decade, it looked as though Alumasc might have found the answer to increased profitability in specialisation, but early in 2018 a cold snap reduced building activity and was followed by a slump in commercial construction activity that continues today. That downturn is currently manifesting itself in losses at Levolux, Alumasc's solar shading business, which is most exposed to commercial construction.

Score: 1

How will it overcome these challenges?

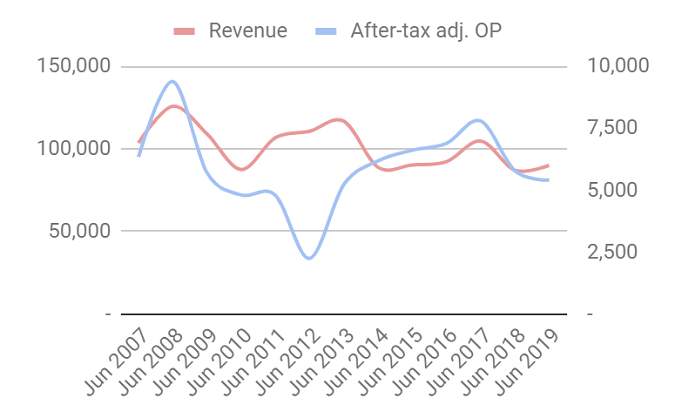

Well, the first thing to say is that Alumasc has been grappling with its pension liability and growth for many years and, at best, the result has been underwhelming. Revenue and profit has not grown convincingly over the long-term.

Through disposals and acquisitions, it has focused the business on building products it believes will be in high demand. It says 80% are either specified by architects or required by building regulations.

Many of the brands are market leaders in the UK, Alumasc says, and since they affect the environmental performance of buildings, improving energy efficiency and drainage for example, and make them look good too, perhaps Alumasc is justified in attaching the 'premium' tag to them.

In 2018, Alumasc sold-off a scaffolding business and early this year it sold Alumasc Facades which renders the walls of public sector housing. Both companies were just about breaking even.

In their stead it acquired Wade International, which makes drainage products. Since Wade is earning good profits, the company reckons it has swapped two mundane businesses for one good one at very little net cost, but it also has the effect of expunging poor results from the divested business from Alumasc's results because they are treated as discontinued operations.

I cannot say with any confidence that, for all Levolux's churning (it was once a much more diversified conglomerate), it's a bigger or better business, although it certainly has more focus, and it says it is done with disposing of businesses.

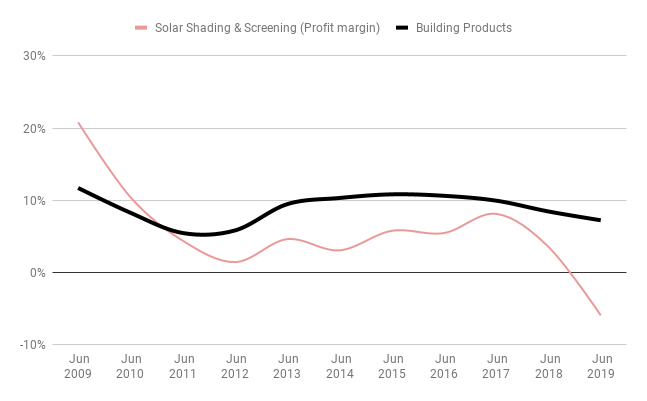

Considering Alumasc thinks Levolux is one of its strongest brands, it's worrying that it lost money in 2019. Levolux makes solar shading and it has not been much of a money spinner since the financial crisis. This chart plots Levolux's profit margin against the average for Alumasc:

Levolux is the only one of Alumasc's businesses that mainly uses its own installers, and the company's response to the losses is to get out of installation except when customers will pay it a good margin. This should reduce fixed costs and perhaps mitigate the effect on profitability when demand falls. However, the company also admits it's experiencing more competition, and I'm not sure if using third-party installers helps with that. Alumasc will bundle Levolux (solar screening and shading) with its roofing and walling businesses within the group's divisional structure and in its sales pitches to architects and specifiers. It hopes they will choose a wide range of Alumasc products for the "building envelope".

The pension deficit has come down in recent years but the fund's total obligations are over £113 million, or nearly twice the value of the capital invested in Alumasc itself. Although, "other things being equal", the company's payments will have plugged the deficit within eight years, other things are never equal when it comes to the size of pension deficits. They are determined by a whole bunch of variables, and eight years is a long time for investors to wait until they can lay claim to a full share of the company's surplus anyway.

Score: 1

Will we all benefit?

Quite rightly because of previous underfunding, holders of the pension scheme (now closed) are benefitting from cash flows at the expense of shareholders. Management too, who received no bonuses in 2019, still earn pretty high salaries given the size of the company.

Even so, Alumasc's financial director, is off "to develop the next stage of his career outside the group", which is a surprise, because, like the chief executive (appointed 2003), the finance director, appointed in 2006, seemed entrenched. The chairman was the founding chairman and chief executive (appointed 1984) and remains a major shareholder. His deputy was appointed in 1992. Under their tenure the company has survived, but it has not prospered enough to give shareholders a particularly good return in the decade I have been following it.

I am sceptical of the board's claim that Alumasc grew revenue more than 2% faster than the construction sector as a whole. The construction sector had a flat year, and Alumasc grew revenue 4%. But the company adopted a new accounting regulation during this year (IFRS 15), and had it used last year's rules it would have only reported a 1% gain. While the 4% figure is widely quoted, the 1% figure can only be calculated from note 30. Maybe I am splitting hairs, but the effect on "underlying profit", which fell 7% according to Alumasc, was much greater if we apply the old rule for a true like-for-like comparison. It fell nearly 20%.

While it is common for directors to present a positive impression of the company's progress, this is not the first time I have felt Alumasc's board could have been more forthright.

Score: 0

Are the shares cheap?

Yep. A share price of 86p values the enterprise at £63 million, about 12 times adjusted profit.

Score: 2

Sometimes I think there may be a Porsche at the heart of Alumasc. One day, if its pension scheme is in surplus, its current brands have shown their mettle through thick and thin, and it is earning mid-teen returns on capital in cash terms from a group of specialist businesses, it might even be obvious.

But those days are becoming increasingly rare. Today it looks more like a wobbly blancmange.

A score of 5 out of 10 means I can't recommend Alumasc for the long-term.

Richard owns shares in Alumasc.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.