Churchill China: One for buy and hold investors?

Restaurants may be closing, but this company that makes the plates, keeps growing revenue and profit.

11th May 2018 12:49

by Richard Beddard from interactive investor

Restaurants may be shutting down, but Churchill China, the company that makes the plates we eat off, keeps growing revenue and profit. Richard Beddard gives his view on the shares.

Year by year tableware manufacturer Churchill China (LSE:CHH) invests in its factory, introduces more efficient manufacturing processes, experiments with new materials, designs new tableware, and sells more of it for a bit more money. It opens its annual report with this statement:

"Our aim is to deliver a balance between improved performance year on year and investment in support of our long term strategies."

It may be rather boring, but I think that sentence should be tattooed on of all chief executives when they take office - to remind them to build something of lasting value.

In the year to December 2017, the company increased its manufacturing capacity, increased revenue (by 5%) and increased profit (by 17%).

Steady business

Churchill primarily sells tableware to the hospitality industry: restaurants, pubs, and hotels, for example, but also other caterers like sports arenas and conference centres.

Customers require attractive tableware that can take a bashing in commercial kitchens, and, Churchill says, they pay a premium for quality. They also value good service, for example the ability to supply repeat or replacement orders at fairly short notice.

Long product life spans, repeat orders, and loyal customers mean business ought to be pretty stable, and with about 25% of the UK market, Churchill is the leader.

Its location in Stoke-on-Trent, for centuries the centre of the UK pottery industry, gives it an advantage along with other UK potters. It starts with the ball and china clay they use, which comes mostly from Devon and Cornwall these days.

The clay makes earthenware, rather than the porcelains produced elsewhere. Earthenware is more durable. It allows a deeper range of colour because of the way it is fired, which lasts through more dishwasher cycles because it is applied under the glaze surface, rather than on, or in it.

The importance of the clay is such that Churchill China, Dudson, a competitor, and Portmeirion (LSE:PMP), which is less of a competitor these days, are partners in Furlong Mills, which supplies the industry with materials.

Incremental improvements

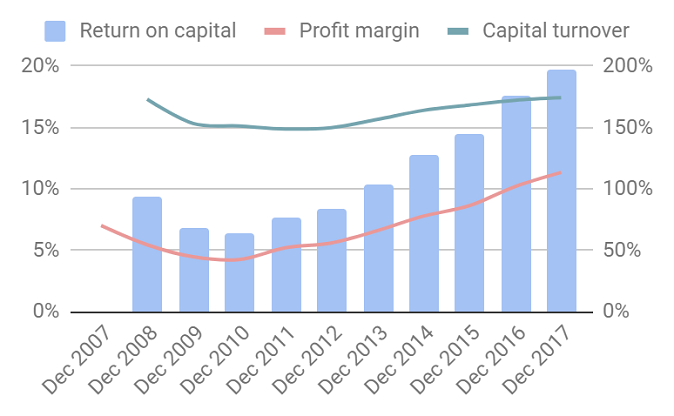

Churchill made a 20% return on capital in the year to December 2017, which is very healthy.

Source: interactive investor

It used to be much less profitable, so either something remarkable has happened within the business, or it has been helped by outside factors.

Outside factors have played a part. For the entire period the hospitality industry has boomed as people choose to spend more of their disposable income eating out. Although that remains true, business has become much tougher for restaurants (and consequently their suppliers) lately because new restaurant openings have outstripped our growing appetites, resulting in oversupply and restaurant closures.

The chart also suggests profitability at Churchill is susceptible to recession. During the financial crisis, return on capital fell briefly to 6%, but I think it's a different company now, and capable of sustaining higher levels of profitability in future.

A decade ago, Churchill sold most of its tableware in the UK and a greater proportion to retailers like department stores. Cheap Chinese imports were making the retail market more competitive and in hospitality, Churchill mostly manufactured plain white tableware, much like its competitors.

The steady improvement in the firm's figures belies dramatic changes within the business, changes that make the firm more competitive.

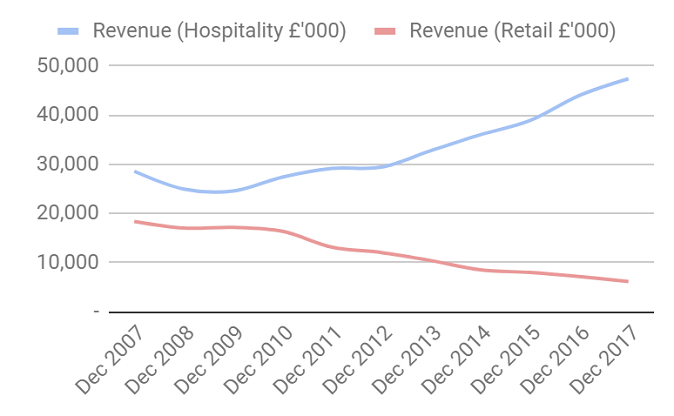

Source: interactive investor

In 2008, Churchill earned earned 59% of revenue from hospitality and 41% of revenue from retail. Today hospitality's contribution has increased to 81% and retail's contribution has dropped to 11%.

Churchill has focused its resources on hospitality because profitability is higher and morestable:

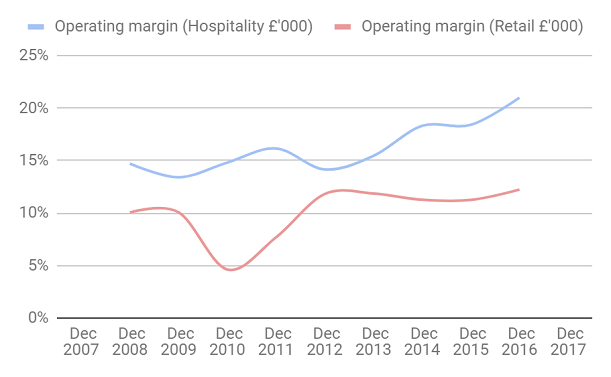

The increase in profitability since 2012 has been driven by innovation, particularly the introduction of coloured and textured ranges that are, due to technical innovations relatively cheap to produce. Churchill calls these ranges 'value added'.

In my opinion they look great. Churchill says they "frame the food". As a shareholder I'm biased, but they've improved my eating experience (yes, I check under the plates when I eat out to see who makes them).

'Value added' products earn the highest profit margins and 40% of hospitality revenue fell into this category in 2017, compared to 34% in 2016, and just 12% in 2011. When a growing proportion of growing revenue is from the most profitable products, the strategy is working.

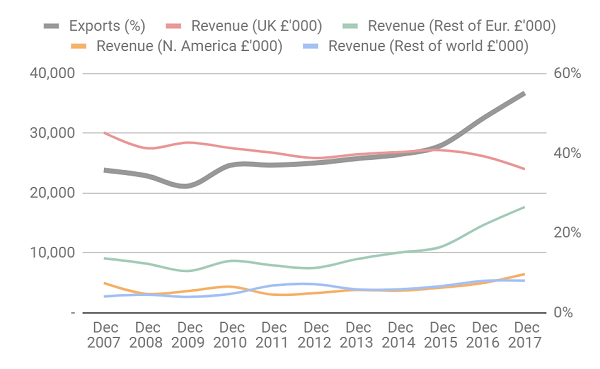

The balance of Churchill's trade has also shifted, perhaps decisively, in favour of exports:

Source: interactive investor

Because of contraction in the UK focused retail business, UK sales have actually declined over the last ten years even though the restaurant industry has boomed. The UK decline hastened in 2017 due to a 6% contraction in hospitality.

Looming challenges

Churchill says it is spending more on product development and marketing to defend its leadership position in the UK while the industry adjusts to overcapacity, and it faces potential challenges in Europe. Its benefitted from anti-dumping duties on Chinese imports since 2012 but the duties are scheduled to expire this year, though they may be extended or renewed because of continued dumping. Brexit too poses an unknown threat, in the form of potential tariffs and trade barriers and the negative effect it could have on the UK economy.

Fundamentally, Churchill's first line of defence against changes in the terms of trade or the economy is its products, which are increasingly popular and profitable. Its second line of defence is to focus more resources on sales in other parts of the world where it has increased investment. The third line of defence is a contingency plan to build a long-term business presence in Europe.

I can't help but admire the business. This is how I score the investment. As usual I score each category from 0 to 2 except valuation, which is scored from -2 to 2:

[2/2] How well does it makes money?

Churchill is a highly profitable businesses and likely to remain so due to heritage, innovation and long-term planning. It has twice moved into more profitable markets, from retail to hospitality, and from standard white tableware to colored and textured.

[2/2] How will it make more money?

Incremental improvements in materials, design, manufacturing, and marketing have built on the company's strengths. Churchill is focusing on added value products and export markets, to make more money.

[1/2] What could go wrong?

Churchill's export strategy could be impeded by protectionism. The strategy addresses the risks.

[2/2] Will all stakeholders benefit? Churchill's a family owned business building wealth for the next generation without aggrandizing the current one. It’s just made staff training and development a core element of strategy.

[0/2] Are the shares inexpensive? Adjusted for cash, shares in Churchill trade at about 19 times adjusted profit. That's top whack for me!

A total of [7/10] means I think Churchill China is worth considering for buy and hold investors.

Richard owns shares in Churchill China.