A compelling story, so is it time to buy these shares?

It’s such a good story that our companies analyst feels a strong compulsion to buy.

29th November 2019 15:02

by Richard Beddard from interactive investor

It’s such a good story that our companies analyst feels a strong compulsion to buy.

One of the hardest things for long-term investors to do, is to work out whether claims like this one:

...that Softcat’s competitive advantage is its corporate culture, are true, or not. Softcat’s annual reports are full of them.

Prosperity built from inside-out

Culture is particularly important for a firm like Softcat (LSE:SCT), which sells IT to businesses and government, because there’s nothing particularly remarkable about the product. Many companies sell Microsoft (NASDAQ:MSFT), Cisco (NASDAQ:CSCO), HP (NYSE:HPQ), Dell (NYSE:DELL), and so on, and even though Softcat works with all the major IT suppliers, if it is to have an advantage that sticks then it needs to be more fundamental than that. It has to come from the inside, from a unique set of capabilities, and if they are not vested in the product or its own intellectual property, then it is going to have to be the people.

Reassuringly, Softcat is highly profitable in terms of return on capital, and it boasts of 14 consecutive years of profit growth. It has grown revenue for even longer but, thanks to a change in the accounting standard for revenue recognition that has reduced reported revenue in 2019, this is no longer obvious in the data. Having restated revenue in 2018 using the new accounting standard, Softcat increased revenue by 24% in 2019. Adjusted profit rose by a similar percentage. Perhaps there is something special about it.

Radical origins

An interview, now sadly lost to the Internet, with the company’s founder Peter Kelly, reveals how in the 1990’s employees democratically elected their managers annually and put pay rises to the vote. New employees could choose which team they joined until it became apparent they were unwittingly consolidating into racially self-selected groups, which horrified a visiting customer.

In echoes of these radical origins, Softcat gives us a flavour of its culture in this year’s annual report. It has the confidence to give local offices autonomy because it only opens a new office when it has an employee to promote from within to run it. Most employees are sales people, who it recruits exclusively at entry level so they do not have to worry that their career prospects will be stymied by senior appointments parachuted in from outside. This year, Softcat introduced a new workplace benefits platform “Perklife” and reduced the working week by two hours.

Employee first culture

Softcat says its purpose “is to help customers to use technology to succeed by putting our employees first.” If you take out the word “technology”, you have the fundamental reason for the success of numerous sales-oriented businesses from Marks & Spencer in its heyday to the world’s largest low-cost airline, Southwest.

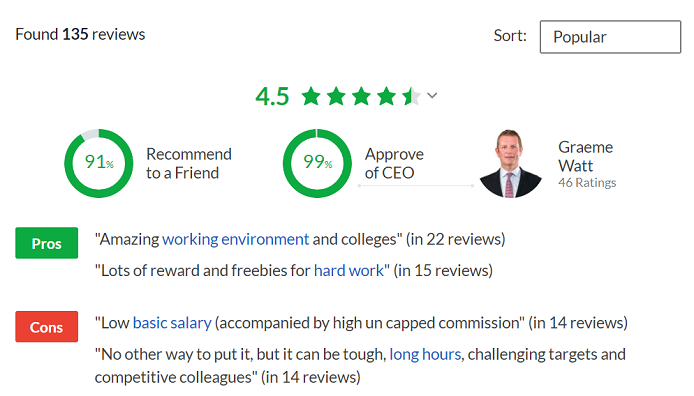

I have yet to meet anyone who has worked at Softcat, but external validation comes in the form of glowing reviews from staff on Glassdoor, a recruitment website. Staff reviews are as flaky as any other kind. Disaffected staff are more motivated to review their former employers than happy employees are, but companies sometimes orchestrate reviews to improve their image too.

Even so, Softcat’s profile is about as good as any I have come across:

Reviews on Indeed, another recruitment site, are mixed but there are only eight of them to Glassdoor’s 135, so they are less representative (it gets 3.5/5)

Customer first too...

An employee-focused culture aids the retention of sales staff who are the vital link with customers. Though Softcat provides advice and consultancy, this is often supplied free of charge to facilitate the sale of hardware and software licences and subscriptions. Generally, there are no contracts binding customers to Softcat, but the company’s finance director says:

“We believe that the trust we establish with customers over many years working together provides an even stronger platform for repeat business.”

He reports that Softcat is accelerating its investment in skills and expertise, particularly in new technologies, so customers know it is in for the long-haul. While that investment is not obvious because it is expensed immediately rather than added to the balance sheet as an asset, Softcat is spending to grow the business for the long-term, which should be music to the ears of long-term investors as well as customers.

Gratifyingly, the company monitors both employee engagement, and customer satisfaction. 92% of employees feel positive about their employer, and 96% of customers are satisfied.

You might take these statistics with a pinch of salt, but they are backed up by the company’s financial performance and also the amount of repeat business it wins. Gross profit per customer has increased over the last three years from 12,000 to 17,200, while the pool of customers has increased, from 11,400 to 12,300.

Reasons to be cautious

It is such a compelling story, I feel a strong compulsion to buy the shares without further ado. But four uncertainties are keeping my instincts in check.

The first stems from the pace of change in IT. It is clear, not just from Softcat’s results but also from listed rival Computacenter's (LSE:CCC) performance, that they are experiencing a boom in IT as companies seek to gain advantage over each other, evidenced by current trends in cloud computing, big data, and cybersecurity, for example.

Maybe this is the “new normal”, or a wave of innovation like the technology bubble of the late 1990’s. The subsequent bust, was painful for many so-called “box-shifters”. Some have found it hard going ever since (here’s looking at you, Northamber).

Second is the changing emphasis of the business. For a long time it was focused on small and medium sized firms, but now it is targeting all sizes of business and government, a huge market in which it has only a 7% UK market share.

Third, the company may be finding it more difficult to maintain its culture as the influence of its founder recedes (he retired in 2015) and since Softcat floated on the stock market in the same year. Recently, employee engagement and customer satisfaction scores have slipped, admittedly from fantastic to extraordinary. The employee retention rate also declined in 2019, and executive remuneration is ramping up.

The first three factors are perhaps minor concerns to be investigated and monitored. They would not necessarily be impediments to investment, but for the fourth, Softcat’s valuation. To my mind Softcat is priced for perfection, which means no doubts.

Provisionally, because this is the first time I have scored it, I am adding Softcat to the Decision Engine. As usual each criterion is scored out of 2:

Does Softcat make good money?

Although profit margins are middling at best (about 7%) Softcat prospered through the financial crisis, perhaps because a significant proportion of spending, like software renewals, updates and subscriptions, is routine and often not discretionary. Remarkably, Softcat has never had any debt.

Score: 2

What could prevent it from growing profitably?

Softcat’s collaborative sales culture is probably an unstoppable force unless it fails to sustain it, which is the number one risk listed in the principal risks section of the annual report. There are some tentative indications it might be fraying.

Score: 2

How will it overcome these challenges?

Founder Peter Kelly still owns 32% of the shares and, although he is retired, he retains the right (as yet unexercised) to nominate a non-executive director to the board. His successor Martin Hellawell, who had been managing director since 2006, retired as chief executive in 2018, but remains as chairman and describes himself as “the company memory”. He too has a significant shareholding.

Both men’s holdings have declined since the flotation, and it is slightly disappointing, given the company’s preference for internal promotion, that the relatively new chief executive was an external appointment. Even so, the new bosses seem fully cognisant of the importance of Softcat’s culture and the old ones still wield influence.

Score: 2

Will we all benefit?

Softcat is employee and, by extension, customer focussed. Both stakeholder groups benefit from Softcat’s existence and extending that notion one step forward, this focus is the source of the company’s profitability, which benefits shareholders.

In 2018, the company seemed to be reigning in executive remuneration, saying the business is simpler than similarly sized rivals and so pay should be pegged to the lower quartile of the group. For 2020, though, it has upped the maximum bonus, dropped the lower quartile stipulation, and appears to be giving itself scope to step on to the executive pay escalator with most of its peers.

In 2019, chief executive Graeme Watt earned £920,000 including bonuses and share options, 24 times the median pay at Softcat (£39,000), itself way above the national median. Surely that’s more than enough?

Score: 2

Are the shares cheap?

No. A share price of £11.35 values the enterprise at about £2.25 billion, or about 32 times adjusted profit. The earnings yield is 3%.

Score: -1.6

A score of 6.4 is less than my arbitrary hurdle of 7, which means Softcat is no bargain. But it is also a long way above the equally arbitrary level of 5 at which I might lose confidence in a long-term investment.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.