The cryptocurrency tragedy might not be over yet

Bitcoin, Ethereum and Ripple all took nasty knocks yesterday. What’s next?

24th February 2021 08:40

by Alistair Strang from Trends and Targets

Bitcoin, Ethereum and Ripple all took nasty knocks yesterday. What’s next?

Bitcoin, Ethereum, Ripple

Despite UK regulatory warnings about the risks of consumers losing money on cryptocurrencies, there are plenty who still trade the products.

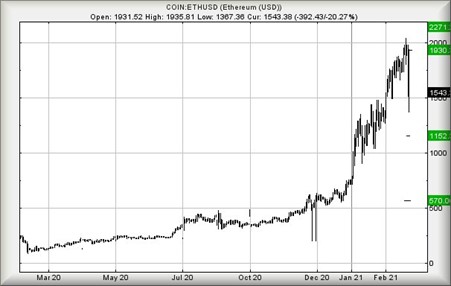

On 23 February, with considerable horror, traders watched Bitcoin (COIN:BTCUSD) losing $13,000, (£9,168), Ethereum (ETHUSD) dumping $600 and XRP (XRPGBP), also known as Ripple, tossing 11p in the bin!

Perhaps percentage terms shall prove more relatable. Bitcoin lost 22%, Ethereum lost 29% and Ripple lost 26%.

It is probably safe to say it was not the finest session for many traders. For legendary Bitcoin miners, it was a nasty cave-in, and we're not certain the tragedy is over yet.

But then again, it might be!

With Bitcoin, the immediate cycle which led to its $57,000 price had been presenting the threat of reversal to $43,250. But when the price imploded the value ‘only’ shrunk to $44,888. Perhaps this is an implication of strength as our bottom number was not troubled.

Using the same logic, Ethereum has presented the potential of $1,300 but on the day, it bounced from $1,367. Again, an implication of strength. Finally, XRP hit a low of 0.2950 rather than bother our calculation of 0.27250.

- Regulator sounds warning on cryptoassets

- Why reading charts can help you become a better investor

- Backing from Elon Musk’s Tesla sends bitcoin price rocketing

We've a (sometimes dodgy) logic which tells us to be cynical if price drops fail to breach target on the day of the initial correction.

Even though our target level may be broken in future days, we're cautious advocating flat panic in the event prices bounce just above targets. In the case of each of the three cryptocurrencies we are loathe to suggest they present an immediate short opportunity.

Needless to say, we can give some potentials for the insanely brave.

With Bitcoin below $43,000 now permits reversal to around $37,000 with secondary, if broken, at a bottom of $31,000. The visuals even make sense. Alternately, we can present a scenario with a trigger level at $51,000 which calculates with the potential of $54,500 with secondary, if exceeded, $60,000 and yet another high.

For Ethereum, below $1,300 carries the potential of a visit to $1,150 and hopefully a bounce.

If broken, our secondary is pretty vile, at a bottom of around $570. The other side of the coin, if we take a positive viewpoint, allows for strength above $1,780 to now bring recovery to £1,930 with secondary, if exceeded, at $2,271, an all-time high.

Finally, Ripple XRP. Weakness next below the 0.27 level shall prove troublesome, allowing an initial 0.22 with secondary, if broken, down at 0.14. We cannot calculate below such a level. On a happier note, it need only exceed 0.47 to suggest an initial ambition of 0.60 with secondary, if bettered, a significant 0.74.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.