Data pours cold water on the hope of a V-shaped recovery

Weaker than expected growth figures means many are doubting the recovery will take the shape of a V, wit…

14th July 2020 15:05

by Tom Bailey from interactive investor

Weaker than expected growth figures means many are doubting the recovery will take the shape of a V, with a return to pre-Covid output levels taking much longer.

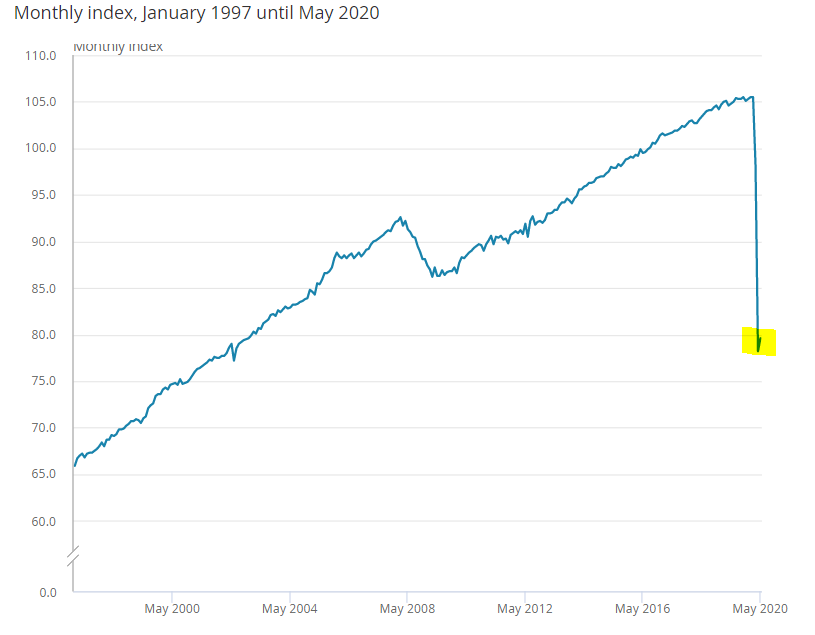

The UK’s economic recovery has got off to a disappointing start, according to the latest GDP growth figures from the Office of National Statistics, casting doubts on the UK economy staging a V-shaped recovery.

The stats showed that, between April and May, the UK economy grew by 1.8%. While that figure means the UK’s economic output has started to grow again, it was way below consensus estimates, which had forecast a rise of 5.5%.

The strongest parts of the UK economy in May were manufacturing and housing, which experienced growth of 6% and 8.2%. Retail growth picked up slightly, growing by 0.9% on the month.

However, as Jonathan Athow, deputy national statistician for economic statistics at ONS, notes much of the growth came from record online sales. He continues: “With lockdown restrictions remaining in place, many other services remained in the doldrums, with a number of areas seeing further declines.”

Over a longer timeframe, figures show the UK economic output is well below potential. In the three months to the end of May, GDP fell by 19.1% compared to the same three months a year before. This was also worse than the consensus estimate of -17.5% for that time period.

Meanwhile, measured from January’s peak, before the effects of Covid-19 had hit the economy, GDP was down by a total of 24.5% in May.

A V-shaped recovery?

This throws cold water on the hope of a V-shaped recovery.

Ever since the threat of Covid-19 to the UK economy became apparent, there was speculation about the shape the coming recession and recovery will take. The most optimistic of forecasts was that the UK would see a sharp downturn followed by a strong rebound, creating a “V” shape.

As the table from the ONS below shows, the slightly positive month-on-month growth figures does suggest the beginning of a pick-up, albeit small, that would suggest a V-shaped bounceback could still happen.

However, the weaker than expected growth figures means many are doubting the recovery will take the shape of a V, with a return to pre-Covid output levels taking much longer.

Richard Hunter, head of markets at interactive investor, argues that sluggish growth means the recovery will be more likely to take the shape of a “Nike swoosh”. He continues: “This seems more realistic given that the absolute financial impact of the pandemic is unlikely to become apparent for a considerable amount of time, let alone how the UK economy can react to the challenges and changes to business, some of which could become entrenched in the ‘new’ economy.”

Pantheon Macreoconomics estimates that GDP will start to see a fuller recovery in June, with their current estimates being an 8% month-to-month increase. The economics consultancy notes: “A variety of unconventional indicators, such as energy consumption, transport usage and mobility data, suggest that the recovery quickened in June.”

However, despite expected stronger growth figures in June, Pantheon Macroeconomics still expects output to remain below January’s peak. They note: “With surveys showing that households remain very fearful of contracting the virus, social distancing rules likely to limit the consumption of services until the population is vaccinated and employers set to layoff many furloughed workers in the autumn, we think that GDP still will be about 5% below its pre-Covid level by the end of this year.”

With output unlikely to recover to January levels this year, it seems unreasonable to describe the recovery as taking on a V shape. Indeed, as Samuel Tombs, Pantheon’s chief UK economist pointed out: “If it doesn’t happen this year, surely we can all agree we haven’t had a V-shaped recovery.”

More headwinds ahead

According to Robert Alster, head of investment services at Close Brothers Asset Management, the latest GDP figures cast doubt on the wisdom of the chancellor’s planned withdrawal of the Jobs Retention Scheme in October.

Alster continues: “Jobs, both on the high street and in industry, are disappearing at an alarming rate and there are no signs yet of any real improvement in the UK labour market.

“With jobs critical to supporting consumption, it’s difficult to know whether the Chancellor is being too bullish in his determination to withdraw the Jobs Retention Scheme by October. There’s no question that this decision risks more economic contraction.”

Meanwhile, Charles Hepworth, investment director at GAM Investments, says that Brexit concerns will still act as a drag on economic growth. He argues: “Hard Brexit concerns with no workable trade deal will likely continue to build over the summer months and this will weigh on sterling fortunes in an economy that is now almost a quarter smaller than it was at the start of the year.”

Hepworth continues: “There are just too many negatives weighing on the UK economy in the short run which continue to batter both consumer and business confidence.”

Negative rates?

Poor growth figures also increases the prospect of the Bank of England going down the path of negative interest rates. As RBC’s European economist, Cathal Kennedy notes: “Today’s relatively tepid initial recovery is likely to reignite the debate around whether the MPC [Monetary Policy Committee] will be forced to undertake further rate cuts, possibly taking Bank rate negative.”

Kennedy argues that the latest ONS data appears to paint a picture of a more muted recovery than that previously presented by the Bank of England’s chief economist Andy Haldane late last month. As a result, RBC expects the Bank to cut rates below zero by the end of the year.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.