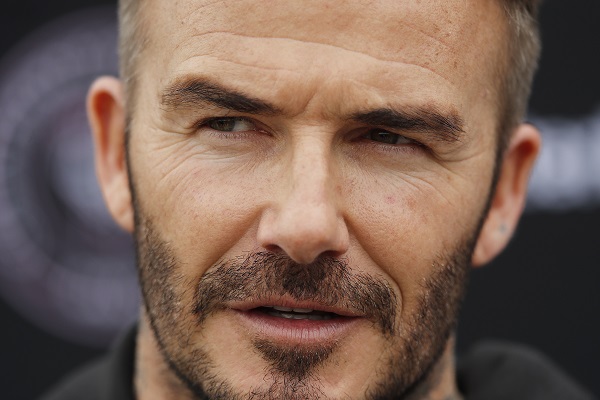

Is David Beckham's Cellular Goods about to get interesting?

28th September 2021 07:46

by Alistair Strang from Trends and Targets

Shares rocketed when this company listed on the stock market, but it's been downhill ever since. Here's independent analyst Alistair Strang's opinion on prospects.

Optimism, we suspect, may be allowed here. We previously reviewed David Beckham-backed Cellular Goods (LSE:CBX) in March, a few days after they launched, bringing the first listing of a cannabinoid company to the London Exchange.

In the period since, the share tanked from its initial highs and languished. The company website, far from being informative and encouraging, remained a boring black & white affair. Prior to producing this article, we again visited the website this morning, discovering nothing had changed. However…

A final glance this evening, intending to take a spiteful screenshot of their logo, changed everything. The Cellular Goods website has been updated, the presentation literally improving as the evening went on. As can be seen below, their new logo makes some sense.

If something important is about to happen with the company, we’re slightly interested as the low of Monday has the potential to present itself as a logical bounce point.

Additionally, we’d marked September as the time for a second look at the share price, due to us believing a change to government rules regarding cannabinoid products was also due at the end of this month. Of course, now when we search, we cannot find reference to an impending UK rule change.

We should emphasise, by our normal logic, the share price is trading in a region where The Big Picture legislates against us calculating any realistic ‘ultimate bottom’. Instead, we’re forced to speculate on key trigger levels, should the price start recovery.

Visually, the biggie will come should the share ever exceed 27.5p (or close a session above 19p), the high on the day of launch. By viewing transatlantic behaviour for shares vaguely in this field, this is apparently the point where it becomes “safe” for the longer term, as truly amazing potentials make themselves known.

Source: Trends and Targets. Past performance is not a guide to future performance

For the present, we shall be interested at any bounce capable of exceeding just 6.25p as this calculates with the potential of a move to 7p. While perhaps not the most exciting scenario on the market, above the 7p level works out as useful, giving a future 9.1p as a possible point of hesitation. Should the price discover a reason to close above 9.1p, it becomes probable some real strength is making an early showing.

Also worth remembering is the “star quality” of the company backer, Mr Beckham. It’s easy to suspect a frenzy could develop for the share price, perhaps on the basis of his expertise in investment or, more probably, plugging the company's products on telly.

This one has the potential to become fascinating. Alas, the share price needs to start going up first as it’s in a zone where we must emphasise we cannot calculate any logical bottom!

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.