Default fund for non-workplace pensions proposed

25th November 2021 11:52

by Rebecca O'Connor from interactive investor

interactive investor responds to the opening of an FCA consultation into the provision of default funds for non-workplace pensions.

The FCA this morning opened a consultation into the provision of default funds for non-workplace pensions.

The regulator said: “Currently, consumers buying and saving into a non-workplace pension have to choose their own investments from an increasingly wide range of options. This complexity can make it hard for some consumers who do not take advice to choose investments that meet their retirement needs. They may end up with investments that are not appropriately diversified and with too much or too little risk. In addition, more consumers are now buying non-workplace pensions without advice.

As well as poorly chosen baskets of investments, we are concerned that some consumers hold cash in their non-workplace pension. Over the long term, cash holdings are at risk of being eroded by inflation. Investing in growth assets rather than cash is likely to deliver a larger pension pot at retirement.”

Becky O’Connor, Head of Pensions and Savings, interactive investor, said: “It’s really important that investors who want to do it themselves feel free to do so, while those that need a helping hand can access this, too.”

“You don’t have to be an investment whizz to use a Self-invested Personal Pension (SIPP). Interactive investor offers a range of six ‘Quick-start’ funds, which are low-cost, ready-made investment portfolios, including three ethical options, based on different risk levels and giving a choice of active or passive strategies, which can be used by pension investors.

“It is true that there is a huge choice of funds, trusts, ETFs and direct equities out there for those who want to make their own choices. Investors can also face choices between different asset classes, geographies and themes. That’s why access to good research and education is so important. For some confident investors, this ability to make their own informed choices, based on their own goals and time frames, is the appeal of a SIPP.

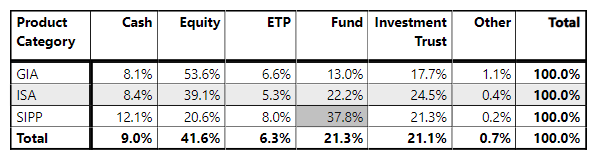

“On the risk of cash, generally speaking, SIPP investors do not hoard cash. They hold a slightly higher proportion than ISA and trading account customers on interactive investor. They can hold cash for a variety of reasons, for example, taking opportunities in the market.”

Source: interactive investor Private Investor Index

Notes to editors:

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.