Dewhurst: Are these shares cheap enough to buy?

Find out what our share expert’s forensic analysis of this 100-year-old British company revealed.

24th January 2020 15:30

by Richard Beddard from interactive investor

Find out what our share expert’s forensic analysis of this 100-year-old British company revealed.

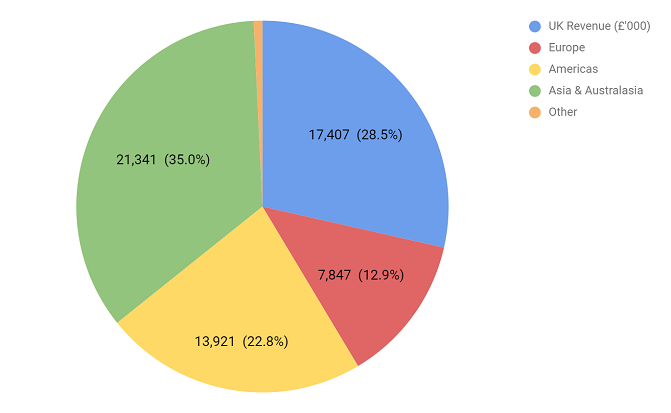

Apart from celebrating its 100th birthday, the big news at Dewhurst (LSE:DWHT) in the year to September 2019 was the disposal of Thames Valley Controls (TVC) on the last day of the financial year. TVC manufactures the brains of a lift, the systems that control and monitor where and how fast lifts go.

Manufacturing the old way (Source: Dewhurst annual report)

The disposal leaves Dewhurst as a manufacturer and distributor of more prosaic lift components. Dewhurst UK, the mothership, its Canadian cousin, Dupar, and US subsidiary ERM, manufacture pushbuttons and assemble them into car operating panels incorporating additional components like emergency telephones, keyswitches, and sometimes touchscreens.

They also make hall lanterns, which tell us when the lift has arrived, and destination control systems, which direct people to a lift that will take them to their floor. Through subsidiaries in the UK, Australia, Hong Kong, and the Middle East, many of them acquired over the last two decades, Dewhurst supplies a wider range of lift components from electrical cables to lift doors.

But it no longer provides the brains. Dewhurst is a relatively small group of companies that earned £56 million in revenue and about £6.5 million in profit after tax in 2019. It has found it increasingly difficult to fund product development because lift controllers have become so complex. Upgrades to the current generation of product were “onerous”, and, having restored TVC to a meaningful level of profitability after some years when it was operating near break-even, Dewhurst has baulked at developing the next generation. It has sold the firm to Vantage, a US rival, restoring its healthy cash surplus after the acquisition of A&A, a UK distributor of lift components, in 2018.

While it’s disappointing the only British designed lift control system is now in foreign hands, it is probably the right decision. TVC has much bigger rivals and little in common with Dewhurst’s other businesses, which do not sell TVC’s systems. Architects and lift consultants who specify lift components for their customers, generally select from a range of suppliers, so there is no imperative to sell everything. Dewhurst should be focusing on what it does best.

TVC’s return to form, and A&A’s first full-year contribution to Dewhurst’s revenue and profit, had a positive impact on Dewhurst’s performance in 2019, lifting revenue by 23% and adjusted profit by 28%. Return on operating capital was 22%, slightly above the average of 20% over the last nine years.

The lift business is in good health - especially in Australia, where the company believes collaboration between its subsidiaries is reaping rewards. In 2019, Dewhurst fulfilled an order for the London Underground, which is installing lifts in all surface stations, and it expects more of this business in 2020. It is also supplying fixtures for the Riyadh metro, which is near completion and reportedly the World’s biggest urban transport system outside of China.

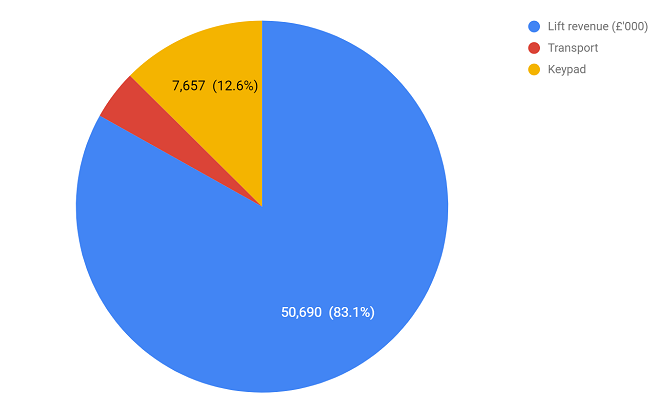

Things are not so rosy at Dewhurst’s smaller operations which make road infrastructure like bollards, and keypads for ATMs. Together they bring in less than 17% of total revenue:

Source: Dewhurst

In transport, Dewhurst’s TMP subsidiary positions itself as an innovator, but it in revenue terms (4% of the total in 2019) it has barely treaded water since Dewhurst acquired it in 2006.

The keypad business may be contracting. Dewhurst principally manufactures keypads for one ATM manufacturer, thought to be NCR. Revenue rose somewhat in 2019 as Dewhurst’s customer geared up the production of a new ATM model. In 2020, though, demand should wane as stocks of the older model run down. Long-term, the population of ATMs is likely to dwindle, and with it the demand for keypads, as alternatives to cash grow in popularity.

In lifts too, Dewhurst faces a digital challenge due to the increasing use of touchscreens in operating panels and destination despatch systems. But physical pushbutton layouts are often mandated in regulations so blind people can operate lifts even where there is a touchscreen, touchscreens are overkill in low traffic areas, not as resistant to vandalism, and since Dewhurst supplies bought-in touchscreens powered by its own software, it is keeping up with technological change in human interfaces.

It’s reassuring that Dewhurst’s chairman, Richard Dewhurst, writes about the next hundred years in the annual report, and, “the importance of being able to adapt to changes in the market”.

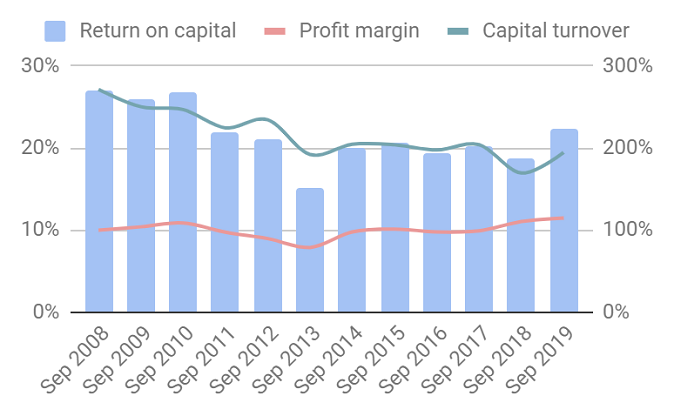

Does Dewhurst make good money?

Yes. Profitability is high, and with the exception of 2013 (an aftershock of the financial crisis five years earlier), return on capital has been consistently 20% or so:

Cash conversion is a bit weak as Dewhurst routinely shovels money into its defined benefit pension fund, which is closed to future accrual but in deficit. The average cash conversion ratio is 62% over the last nine years.

Score: 1

What could prevent it from growing profitably?

The lift industry is competitive, with big names like Kone and Otis and a large number of local and regional suppliers vying for business, but Dewhurst has a hard-won reputation for quality and service, particularly in less fashionable markets like council flats and refurbishment. This is valuable because many of the components are relatively low cost, but expensive to put right if they fail.

Digital disruption could increase the amount of bought-in components, which might reduce profit margins.

Score: 2

How will it overcome these challenges?

Dewhurst has vertically integrated as it has transformed itself from being a manufacturer of individual components to a supplier of assemblies like car operating panels. It has also bought a number of its customers, suppliers of lift components, and a broader suite of products, which bring with them knowledge of local regulatory codes, and relationships with more customers.

The acquisition of A&A, which distributes tens of thousands of product-lines and advertises “massive stock”, gives Dewhurst the opportunity to broaden the range of products it sells overseas, transplant A&A’s service ethos to its subsidiaries, and use the superior buying power of the group to drive down the price of products it resells, improving profitability.

Score: 2

Will we all benefit?

Dewhurst is run by brothers Richard and David, who have successfully managed the twin challenges of the financial crisis and technological change, and globalised the business since the 1990’s. Due to the surge in underlying profit, this year executives received slightly immodest bonuses, conspicuous because of the modesty of prior years. They were not accompanied by even more immodest and less transparent share option awards, though, as is so often the case at other companies. The Dewhurst family has a controlling interest in the shares and gives every impression of running the firm in the long-term interest of all stakeholders.

Score: 2

Are the shares cheap?

No. A share price of £10.75 values the enterprise at about 18 times adjusted profit.

Score:-0.1

With a score of 6.9, Dewhurst is ranked 8 out of the 30 shares I follow most closely. The shares are not cheap, but they may well be good value over the long-term.

Richard owns shares in Dewhurst.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.