This dividend stock could reward your faith in science

This AIM firm’s strategy of buying the same company over and over again is simple and very effective.

24th April 2020 15:58

by Richard Beddard from interactive investor

This AIM firm’s strategy of buying the same company over and over again is simple and very effective.

Judges Scientific (LSE:JDG) entered the pandemic in good shape, having achieved record revenue, cash flow, profit and new orders in the year to December 2019. Despite paying a special dividend and a modest acquisition just before the year end, it finished the year with little debt and declared a “robust ability to take advantage of opportunities as they arise.”

The first, and last, we’ve heard from Judges Scientific on the pandemic is the company’s outlook statement in the annual report, signed off over a month ago. The order book, it said, was still robust, while explaining that the epidemic will impact sales through cancelled scientific conventions and travel restrictions, and might impact manufacturing. It concluded:

“...the only guidance your board can provide on trading performance is that the effect will be limited if the outbreak lasts only a further two months and will have a progressively growing and more significant impact thereafter.”

Somewhat surprisingly, considering many companies still trading have deferred or cut dividends as a matter of prudence, Judges Scientific proposed a 25% increase in the dividend.

Buying the same company over and over

By “opportunities”, the company means acquisitions. It buys small scientific instrument manufacturers, a strategy I’ve described before as buying the same company over and over.

In fact, target companies vary widely in the type of scientific instrument they manufacture, but they are otherwise similar. They are small.

Their founders want to sell their businesses, but they also want to leave them in good hands. The acquisitions are well established in profitable niches, and they are capable of sustaining that profitability.

UK-based scientists are prodigious inventors of equipment, and good products and limited competition are the principal advantages of the companies Judges Scientific buys.

Moorfield Nanotechnology, Judges Scientific’s latest acquisition makes laboratory equipment for academic and industrial research. Source: moorfield.co.uk.

The company uses debt to finance the acquisitions, and uses the cash flows of the group to repay the debt before repeating the routine. It’s a strategy that has stood the test of time (nearly 20 years and about that many acquisitions). A good reputation for following through on deals and for repaying debt, as well as a nurturing culture, are the principal advantages of the mothership.

The strategy requires Judges Scientific not to pay too high a multiple of earnings, or it will be a long time before it can afford more acquisitions. In recent years, finding the right companies at the right price has proved more difficult, so Judges Scientific has stopped buying. Moorfield Nanotechnology, acquired in December, was its first acquisition for over two years. Even so, the company has averaged 13% revenue growth and 34% profit growth per annum over the last three years, which has shown investors these businesses are more than just cash cows funding further acquisitions.

Judges Scientific made a commitment to improving the businesses it owns when it hired Mark Lavelle, its new chief operating officer, from Halma in 2018, a bigger agglomeration of businesses with a similar strategy: to “buy and build” manufacturers of safety technology. Judges Scientific supports its subsidiaries by funding research and development (to the tune of 5 to 6 % of group revenue) and encouraging them to help each other.

The company says “the energy deployed” since Lavelle’s recruitment contributed significantly to Judges Scientific’s performance in 2019, which was barnstorming:

Since the company sells equipment all around the World, mostly to universities and industry, its strong performance recently has also been a function of the weak pound after the Brexit vote.

Improved performances at two of its larger businesses, which had experienced lulls in demand, also helped.

Though public spending on higher education can be variable, and so too spending on industrial research, it seems likely that both markets will continue to require increasing levels of precision made possible by scientific instruments.

I like the simplicity of the strategy, and discipline with which it is executed.

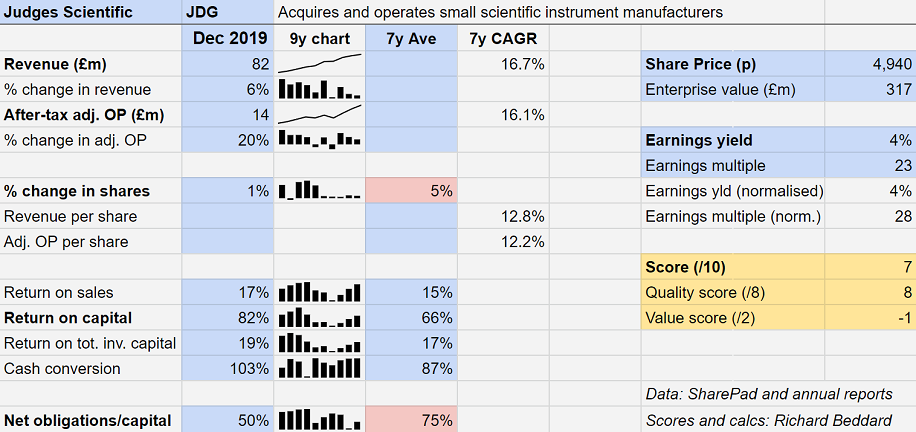

Scoring Judges Scientific

Note: I have replaced the bullets in the scoring with +/- /? to reinforce whether my opinion on each point is positive, negative, or quizzical.

Does the business make good money? [2]

+ At 19%, return on total invested capital is very healthy. Total invested capital includes the total cost of each acquisition. An average return on operating capital of 66% shows just how profitable these companies’ operations are!

+ Average cash conversion of 87% is also high.

What could stop it growing profitably? [2]

? At 50% of operating capital, Judges total financial obligations (including borrowings, capitalised operating leases and a small defined benefit pension scheme) are tolerable, but borrowing is lower than average because of the dearth of recent acquisitions.

? As Judges Scientific grows it may need bigger acquisitions to sustain the rate of growth, but there is less competition for smaller acquisitions.

? As the world has globalised, higher education has expanded enormously. I don’t know if this will continue.

? David Cicurel, founder and principal dealmaker is over 70 years old.

How does its strategy address the risks? [2]

+ Judges Scientific has a prudent deal-making record, so it is unlikely to splurge on big acquisitions unless they are good value

+ Organic growth, and Judges invigorated policy of nurturing it, shows the group is a good operation irrespective of new acquisitions

Will we all benefit? [2]

+ Directors hold nearly 15% of the shares, so they are committed shareholders. They’re not extravagantly paid+ Last time I visited, the head office was in a back street and the table in the boardroom was from IKEA!+ Employees participate in group share schemes+ Managers of subsidiaries have "responsibility for their own destinies" (within financial controls)

Are the shares cheap? [-1]

- Sadly not. A share price of £49.40 values the enterprise at about £317 million, about 23 times adjusted profit. The earnings yield is 4%.

Looking past the pandemic to the sunny uplands of near normality, I think Judges Scientific is reasonably priced considering what a good gaggle of businesses it is. Currently it is ranked 19th by my Decision Engine and I think it will probably make a good long-term investment.

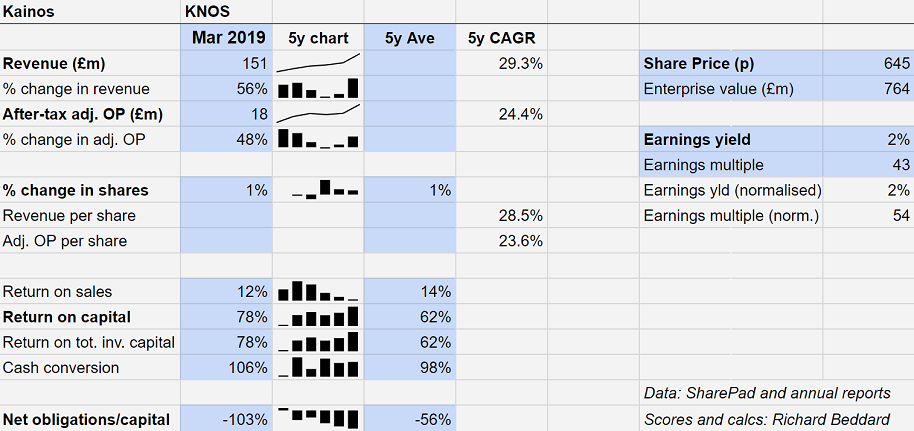

Something new: Kainos

Kainos (LSE:KNOS) is one of those companies I intend to research, but never quite get around to it on account of the blood curdling valuation (about 43 times adjusted profit in 2019). The company’s trading update on 16 April, and in particular this bit of altruistic opportunism at the peak of the coronavirus pandemic caught my attention though:

“In the current environment, digital access to essential services has become extremely important. We have therefore taken steps to offer, pro bono, the expertise of some of our most experienced colleagues to help key government departments, care providers and organisations provide digital services to those that need them most.”

The company develops software for government and commercial clients using agile techniques, basically involving more collaboration and quicker results at the expense of cut and dried initial project parameters. Kainos doesn’t know how bad things could get as a result of the pandemic so it is cutting costs, but the past is an ocean of blue (which is better than pink!):

There is absolutely nothing objectionable about these statistics except the valuation.

Richard owns shares in Judges Scientific.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.