Do investors have to choose between green and greed?

A principled stance is increasingly being linked with business excellence.

17th September 2019 16:21

by Hannah Smith from interactive investor

A principled stance is increasingly being linked with business excellence.

This year has been one of weather extremes. By April, the UK had already experienced almost 100 wildfires, making 2019 the worst year for such fires on record. Flooding in Lincolnshire in June drove hundreds of people from their homes. Then a late-July heatwave engulfed Europe, sending temperatures in France above 45 degrees for the first time on record. With such terrifying evidence of climate change before us, combating it has never been more urgent.

Five years ago, the World Economic Forum warned that extreme weather and a lack of action on climate change will be among the top 10 global risks facing firms, and this year it says these are the top threats over the next decade. In July this year, a joint statement from four bodies, including the Bank of England and the Financial Conduct Authority, said climate change poses "far-reaching financial risks" to regulated firms. Businesses can no longer afford to bury their heads in the sand, and many are now trying to address the problem, on paper at least.

In the glare of public concern about climate change, asset managers are jumping on the bandwagon by offering 'low carbon' products and funds with an ESG (environment, social and governance) focus. (For simplicity, in this article I focus on the 'E' in ESG, but I also lump together ESG, ethical, green and sustainable investing. They are not the same thing, but these definitions are complex and to some extent subjective and would merit a whole separate article to explain them.)

Caring credentials

Wealth managers too are getting in on the act. Seven Investment Management celebrated reaching £100 million of assets under management in its Sustainable Balance fund in an announcement it pegged to Climate Action Week, while Equilibrium Asset Management has moved underweight in fossil fuel firms in client portfolios, as it doesn't consider these "the winners of the future" and is backing renewable energy instead.

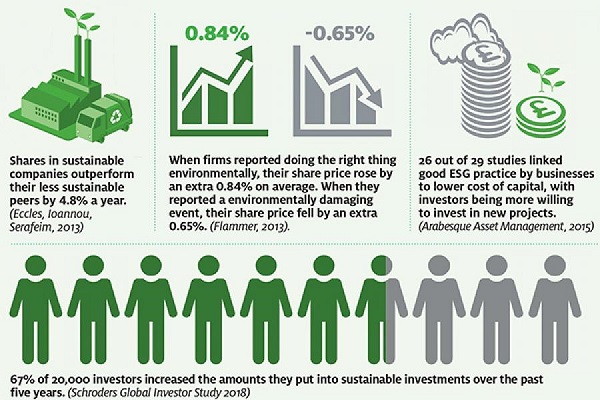

Appetite for this type of investment product is growing, and now the weight of assets is starting to follow people's stated intentions to invest more sustainably. Last year's Schroders Global Investor Study found that 67% of investors increased the amounts they put into sustainable investments over the previous five years.

It's a good start, but why isn't everyone investing this way? Surely by now 'sustainable investing' should just be 'investing'? Although green and sustainable investing is now much more mainstream, the idea still persists that you have to sacrifice profits for principles – meaning you must accept lower returns if you want to invest for environmental or social good. But the evidence suggests this is a myth.

There is a vast body of academic research on the topic and, helpfully, one report has examined it all to draw some conclusions. Arabesque Asset Management analysed 200 academic studies to look at the correlation (note that correlation is not the same as causation) between sustainability and economic performance. It found that 88% of studies show that companies with solid ESG practices perform better operationally and have stronger cash flows than those that don't, while 80% show that such firms' share prices perform better. One 2013 paper found that the stocks of sustainable companies tend to outperform those of less sustainable ones by 4.8% a year.

Looking specifically at environmental sustainability, the Arabesque report found "a direct relationship between the environmental performance of firms and stock price performance". It said positive environmental news triggers share price rises, while the opposite is true when firms behave environmentally irresponsibly.

Share prices punished

BP (LSE:BP.), for example, saw its share price halve between April and June 2010 after the Deepwater Horizon oil spill in the Gulf of Mexico, and a peer group of major oil companies lost 18.5% in the aftermath. Environmental disasters in the chemicals industry have also hit stocks. One study found that, after environmentally positive events, stocks showed average alpha of 0.84%, while they underperformed by -0.65% after negative events.

The research also found that, leaving aside one-off environmental disasters such as the BP spill, firms that are generally more polluting have lower stock market valuations. "Corporate eco-efficiency and environmentally responsible behaviour are viewed as the most important factors leading to superior stock market performance," the report stated.

Companies with more sustainable policies also benefit from a lower cost of capital – both debt and equity. Arabesque found that 90% of studies showed a relationship between better sustainability practices and a lower cost of capital. That's important as it often results in higher valuations.

Meanwhile, a 2019 study from MSCI found data to support the idea that high ESG-rated companies "were more profitable and paid higher dividends".

However, the problem with academic studies is that they are, well, academic. They might not reflect what happens in the real world and in actual portfolios.

Victoria Hasler, head of research at Square Mile Investment Consulting & Research, says: "I think for your average person on the street, there is still a perception that you have to either give up some returns or maybe take on extra risk if you want to invest with an ethical or sustainable mindset. It's really hard to say conclusively whether you do or don’t have to give up returns. But even if you do, you probably don't have to give up much. It may be that you just have to invest with a slightly longer time horizon, and we should probably be doing that anyway."

Bumpy ride

Financial advisers say they caution clients planning a green investment, not that returns will necessarily be lower, but that they might have to take more risk.

Gareth Chalk, a financial adviser at Blackstone Partners, has around a third of his clients in socially responsible portfolios. He notes that volatility can be higher when certain sectors of the market are excluded. He says: "It used to be a slightly tongue-in-cheek comment years ago that clients had a choice: would they like to invest ethically or would they like decent investment returns, because they couldn't they have both?

"Things have moved on, and socially responsible portfolios are pretty mainstream – there is plenty of choice and some excellent performance. However, as there is a more limited range of investment options, this can lead to a greater concentration of risk and higher volatility as a result. This means returns can be exaggerated compared with traditional investment portfolios – both going up and going down. People need to understand this and be prepared to hold on through any bumpy rides."

Gemma Woodward, director of responsible investment at Quilter Cheviot, says the type of exclusions your portfolio makes could affect your returns in some market environments.

"If you're investing ethically, we would say you're taking a negative screen, and whether that’s going to cost you in performance depends on a number of factors."

Risk and reward

She points out that excluding controversial sectors such as tobacco, alcohol, cosmetics (which are tested on animals) and so on means you avoid a lot of consumer stocks that tend to do well in market downturns, "so that can really change your risk profile". Green investors often want to exclude fossil fuel producers too, but this won’t necessarily hit long-term performance, she suggests. "For a very long time I've looked after money that doesn't invest in oil and gas, and sometimes that hurts you and sometimes it doesn’t. It tends to come out in the wash," she adds.

Fossil fuel producers have been slow to adapt their business models in the face of mounting pressure over climate change and fierce competition from renewable energy sources that are becoming cheaper.

Ed Gillespie is a futurist and green campaigner who points to the looming threat of a sub-prime carbon bubble of $22 trillion (£18 trillion) worth of fuel that is "unburnable if we are to avoid a climate catastrophe". He wonders what impact this will have on the profits of the world's incumbent energy giants. He says investors must choose to back the industries of the future, not the past, and they can still make money while investing in an environmentally sustainable way.

"People say to me: 'can we fix the environment and the economy at the same time?' I say of course we can. We can make a transition where doing well financially is not at the expense of the planet. We are perfectly capable of that, in fact many funds already do that. As Al Gore said, investors are waking up to the biggest investment opportunity in history – sustainability."

Green returns

But even if we did have to sacrifice some returns to invest in this way, is that such a bad thing? Gillespie says investors want returns, but not at any cost.

"We perhaps have to just suck up a slightly more modest return in order to create a better world. It's not about cancelling that return, it's about shaving off the greed element and making sure businesses can make reasonable returns in a way that benefits the collective."

Hasler agrees that benefits other than financial returns are increasingly important to investors. Not just to millennials, as is often thought, but to many other investors: retired baby boomers, for example, who have time on their hands and are interested in green investing.

"Investing with a sustainable or ESG focus delivers returns that aren't necessarily monetary," she says. "For many people, these other returns – social or environmental benefits, for example – are as important as monetary returns.

I think that as an industry, we need to start recognising that, because we are all focused on percentage returns, and there are benefits to investing that are much more difficult to measure."

'Greenwash' and how to spot it: funds paying lip service to an ethical ethos

When choosing a fund, Damien Lardoux, head of impact investing at EQ Investors, says investors should use "the sniff test": look at the top 10 holdings and decide whether those companies are what they want to see in a green or sustainable product.

He notes that in 2017 HSBC (LSE:HSBA) launched a 'low carbon' fund that included exposure to oil giants. He says:

"If I'm an investor in low-carbon funds, would I expect energy companies such as oil majors? Probably not. The 'low carbon' claim suggests the fund is fighting climate change, but it's merely trying to achieve a lower carbon footprint than the index ."

Quilter Cheviot's Gemma Woodward says investors should look for a clear policy on how managers engage with companies. She says: "It is difficult for the average person who just wants their pension to be somewhere good. There are funds out there, but is a given fund doing what you want it to do? How committed is its manager to using their influence to be a positive force?"

Questions to ask:

- How long have the managers been investing this way?

- How strong is their performance track record?

- What is their methodology?

- Do they engage with companies to urge change?

- What's actually in the fund?

Shareholders view firms with good governance as less risky

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.