Don’t bank on big brands to pay best savings rates

22nd June 2021 12:10

by Marc Shoffman from interactive investor

Loyal savers are seeing the value of their money seriously eroded by inflation, and the biggest banking groups pay some of the lowest rates.

There are no rewards for loyalty when it comes to saving is a mantra confirmed in new research published today.

Comparison website Moneyfacts has found that while savers may be influenced by familiarity, trust, and loyalty when choosing where to leave their cash, many of the best-known brands fail to pay a decent return when it comes to savings products.

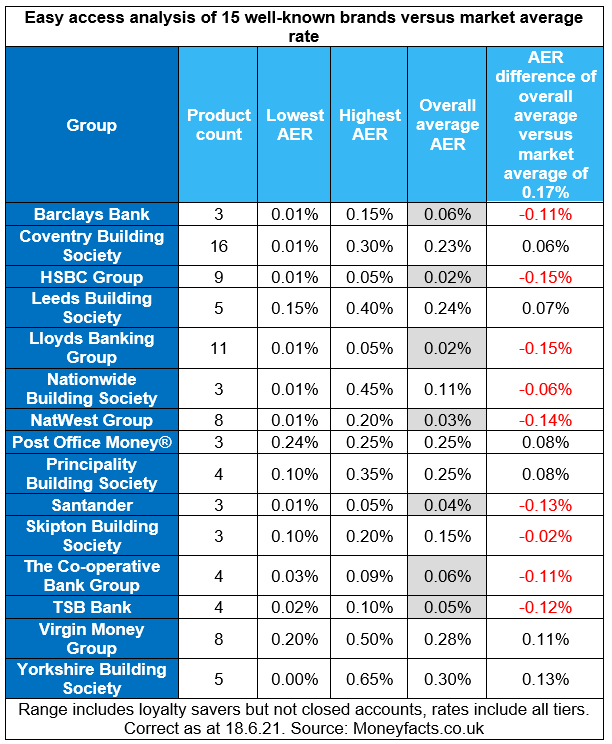

Out of 15 well-known banking and building society brands, including Barclays, Lloyds and Santander, seven fail to pay more than the Bank of England base rate of 0.1%.

- Inflation watch: nowhere to hide for savers following cost of living shocker

- Here’s how much money you need to retire in 40 UK cities

The biggest banking groups pay some of the lowest rates, with savers getting 0.02% on average from HSBC and Lloyds, 0.03% from NatWest, 0.04% from Santander, 0.05% from TSB and 0.06% from Barclays and The Co-op.

Only six out of the 15 well-known brands beat the market average easy access rate of 0.17%, showing how important it is for savers to switch.

Out of the 15 brands, Yorkshire Building Society and Virgin Money Group come out on top paying an average of 0.30% and 0.28% respectively. Post Office Money and Principality Building Society come next both paying 0.25%, Leeds Building Society offers 0.24% and Coventry Building Society savers can get 0.23% on average.

Rachel Springall, finance expert at Moneyfacts, says it is worth looking beyond the main banking brands for better savings deals.

She adds: “Consumers would be wise to re-think their decision making and relinquish any sentiment towards well-known brands when it comes to their savings.

“Even in a low-interest-rate environment, it is clear to see how savers can be better off by switching their easy access account.”

Savers seeking a better return might consider investing their money instead such as through a stocks and shares ISA.

Historically, cash has always lagged behind stock market performance over time, as you often get higher returns with investing in return for taking more risks. You can do this by backing listed companies either through funds or buying shares in companies directly.

It is also harder to beat inflation with a cash savings product as rates are so low, meaning you could effectively be losing money as its value fails to keep up with the cost of living.

Rebecca O’Connor, head of pensions and savings for interactive investor, says: “Loyalty is another word for inertia in financial services and inertia is almost always punished by banks with low savings rates.

“It is really important to review your rates periodically, and be prepared to move your money when they start to become insulting.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.