European equities: Will they ever bounce back?

Growth in the eurozone has slowed and its firms lag in the global tech race, but there are bright spots.

13th June 2019 10:45

by Tom Bailey from interactive investor

Growth in the eurozone has slowed and its firms lag in the global tech race, but there are bright spots.

European shares are unloved right now. For two months running, fund managers surveyed by Bank of America Merrill Lynch have named "short European equities" as the most crowded trade, while many remain underweight the region.

This current pessimistic view of the continent's companies is largely the result of seemingly deteriorating economic conditions. Since the start of the year there have been persistent concerns that the global economy is slowing down, largely as a result of Chinese attempts to reign in credit.

Europe, being an export-led economy, is particularly vulnerable to such a slowdown. As Stefan Gries, co-manager of BlackRock Greater Europe investment trust, notes:

"Europe, particularly Northern Europe, is an outwardly exposed market, with over 60% of revenues derived outside the region. China is a key market for many European companies."

These fears seemingly peaked at the end of March, when figures showed that Germany, the powerhouse of the eurozone, was suffering its deepest slump in manufacturing in over six years.

Underperformance zone

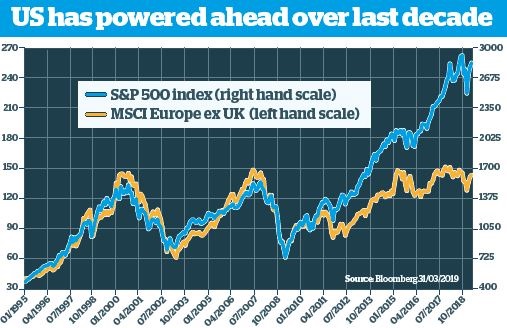

However, beyond the bearish outlook at the start of 2019, the continent's equities have proven a consistent source of disappointment for much of the past decade – especially when contrasted to solid performance elsewhere in the world.

Over the past decade the MSCI USA index has returned 346% in sterling terms. In contrast, the MSCI AC Europe index has returned 143%.

Effectively, Europe has been a brake on global growth: the MSCI World index had a total return of 230% over 10 years, but for the MSCI World ex Europe index that figure was around 260%. That's reflected in relatively sluggish fund performance. Over the past five years the IA Europe ex UK sector has returned 44%, while IA North America has returned 105%.

Weak companies

Europe, it appears, therefore has deeper problems than the fluctuations of the global economy. Despite it being home to many high-quality global businesses, in aggregate, European companies have suffered from poor financial performance over the past 10 years.

Earnings are at the heart of the problem. George Lagarias, chief economist at Mazars, points out:

"The average return on equity for European companies for the last decade is around 8.5%, whereas for the rest of the world it is 9.5%."

Meanwhile, the average ROE for US companies stood at 12-13%. Companies with low ROE struggle to generate the cash needed for investment and growth.

Olly Russ, head of European income at Liontrust (LSE:LIO), highlights the historical divergence of European and US company earnings. "From the mid-1990s right up to 2009/10, both Europe's and S&P 500's earnings moved in a very similar way," he says. "But since 2010 they've moved in different directions." He adds that while US earnings growth has continued to be impressive over the past decade, "if we look at Europe ex UK we are pretty much where we were in earnings terms back in 2007."

Sector disadvantage

Charles Glasse, manager of Waverton European Dividend Growth fund, argues that behind the relatively poor performance of European equities as measured against the US are three sectors: technology, communications services and financials. Europe broadly lacks the sort of dynamic tech and communications companies that have spurred markets on in the US.

Glasse believes around half the relative underperformance of European equities can be explained by Europe's lack of competitive technology firms. There is no European equivalent of the FAANGs. Moreover, some of Europe's best technology companies, such as Sweden's Spotify (NYSE:SPOT), decided to list on US markets rather than in Europe.

This handicap is the result of Europe's own political culture, which prioritises consumer interests over the profitability of businesses and is therefore unlikely to change any time soon, Lagarias argues.

"Europe is more focused on regulating, rather than inspiring the free-wheeling spirit necessary to foster innovation," he says. "Amazon's work practices have been denounced in Europe. Google has been slapped with big fines. New European data directives now directly threaten the bread and butter of big tech companies."

Russ makes a similar point, noting that while Europe once had strong telecoms companies such as Nokia (XETRA:NOA3), the continent has now lost its technological lead, in part due to regulation. While this has been good for the consumer, it has been less positive for investment and innovation.

When it comes to banks, Europe's have been wracked by headwinds, says Glasse. Bank profitability has been dragged down by a number of factors, including the highly fragmented nature of the European market, pro-consumer regulators instituting initiatives such as open banking, and in particular negative interest rates. Russ makes a similar point: "Bank earnings have been severely depressed due to zero interest rates. Meanwhile, US banks now get decent returns."

At the same time, underperformance relative to the US has been exacerbated by Europe's heavier weighting towards financials. The MSCI Europe index has 19% in financial companies; in contrast, the MSCI USA index has around 12%.

The weakness of European banks has also arguably resulted in lower overall economic growth, hurting European companies' profit streams. As Esther Baroudy, portfolio manager at State Street Global Advisors, observes: "Firms in the eurozone are also more reliant on debt financing. However, since 2008 banks have been more reluctant to lend and take on risk, and this has held economic growth back, particularly in countries outside Germany."

This lack of technology stocks, poor bank performance and the knock-on effect on debt-reliant parts of the eurozone’s economy all feed into one thing: lower earnings, reflected in lower share prices and poorer index performance.

Another key point, Russ argues, lies in the structure of the European market compared to the US. Whereas the US has high-growth tech stocks, European indices are dominated by lower-growth and often lower-valued companies. Russ says:

"Europe is quite a 'valuey' index – more so than the United States. If value globally underperforms, so too will Europe."

Chance of a turn around?

So will European equities ever rebound? As the statistics above show, European equities as a whole have not provided negative returns – the problem is that their performance vis-à-vis the US has been disappointing. On a relative performance basis, there is perhaps a case for Europe's recovery.

For example, over the past few years US tech and communication stocks have become very richly valued. Many still struggle with establishing profitable business models. At the same time, many tech companies have increasingly become political villains and now face regulatory threats.

All of this could potentially weigh heavily on the performance of US tech stocks, closing the performance gap between the US and Europe. Similarly, after a decade of growth stocks (well-represented in US markets) outperforming, there is the prospect of a reversion to the mean and a return to 'value'.

Why investors should not fixate on falling passive fund fees

At the same time, certain factors that favoured growth stocks appear to be receding. For example, the past decade of ultra-loose monetary policy has favoured large, highly valued growth stocks, often in the tech sector. Should value stocks once again pick up, so too will Europe's "valuey index".

However, whether European banks – a big part of the index – can become more profitable is less clear. If negative rates are to blame, the outlook for financials does not look strong. Growth in Europe is still broadly weak, meaning low to negative interest rates look likely to be on the cards for the foreseeable future.

As John Redwood MP, chief global strategist at Charles Stanley, notes:

"The euro area is also struggling to deal with huge imbalances between Germany and the south and west of the zone."

Unlike most single countries, the EU eurozone area has no formal fiscal system to help shift money from rich to poor.

The bright spots

None of this, of course is to say Europe has no bright spots or potential investment prospects. "There are some good companies and brands in the euro area, and the countries remain relatively rich and successful," says Redwood. Similarly, argues Russ: "Many individual companies are pretty robust. If they were listed in the US they would be much more expensive."

In particular, argues Glasse, Europe has some exceptional companies when it comes to consumer staples. He gives the example of Nestle (XETRA:NESR). He says that the company has a strong global footprint, while its peers in the US were late with pursuing international expansion.

This means that a large part of its revenues come from outside of Europe, cushioning it against any further economic turmoil the continent may face. Europe is home to numerous such companies.

Glasse adds that he is big on European industrials. "This is another place where European companies have got a global advantage," he says. He points out that a lot of technological development in Europe happens within industrial companies themselves, as part of their own products. "In our view, winning areas in Europe will continue to be in industrials. Some of the best are Scandinavian."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.