The European fund Saltydog just bought

A falling pound helps overseas investments, so Saltydog analyst just bought into European small-caps.

22nd June 2020 13:16

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

A falling pound helps overseas investments, so Saltydog analyst just bought into European small-caps.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

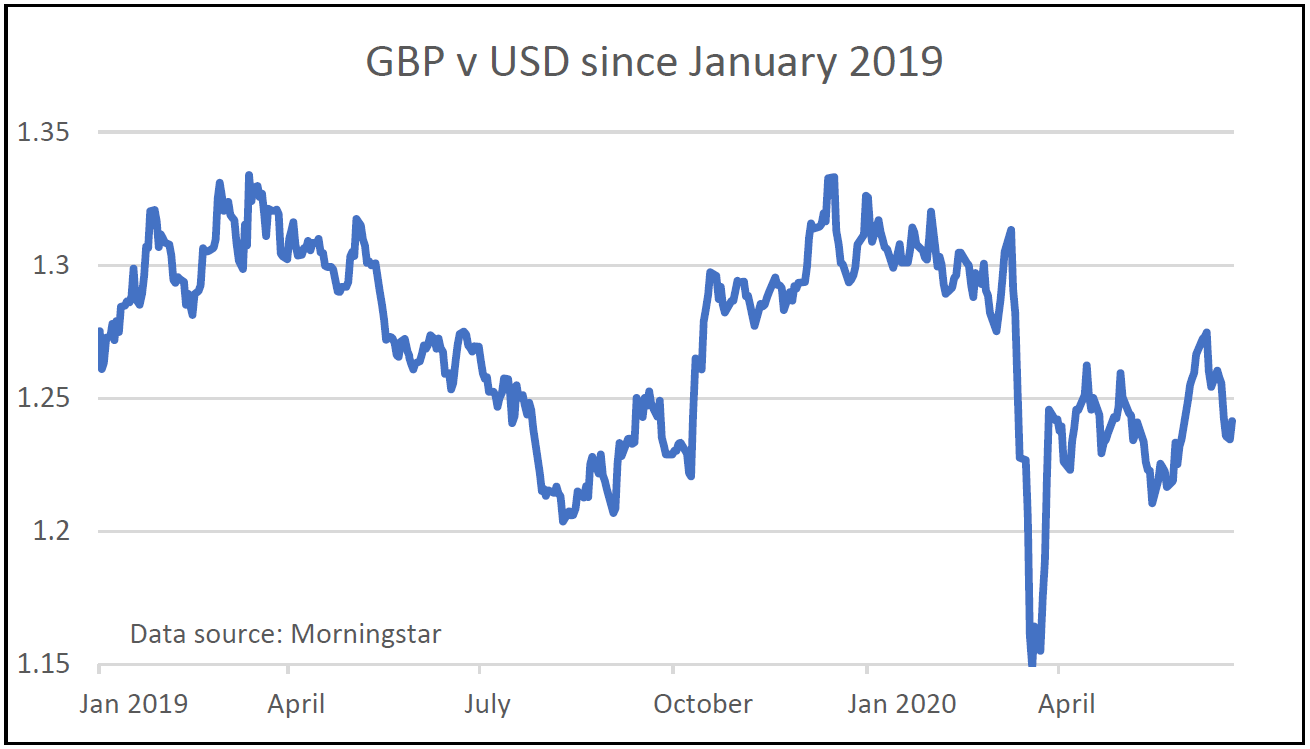

For much of last year we focused on the strength of sterling. When Boris Johnson was first elected as Prime Minister, at the end of July, sterling was on a downward trend and at levels that we hadn’t seen since just after the EU referendum. After that we saw a strong recovery.

The pound went from a low of around $1.20 in August to a high of $1.33 in December, a rise of over 10%.

This would have had a negative effect on any investments with assets or income denominated in dollars, as its value would have fallen when converted back into sterling.

Since then the pound has weakened against the dollar. It started to go down gradually, then had a dramatic fall in March. Although it then recovered, it is still down 6% so far this year and has been falling over the last few weeks.

Past performance is not a guide to future performance.

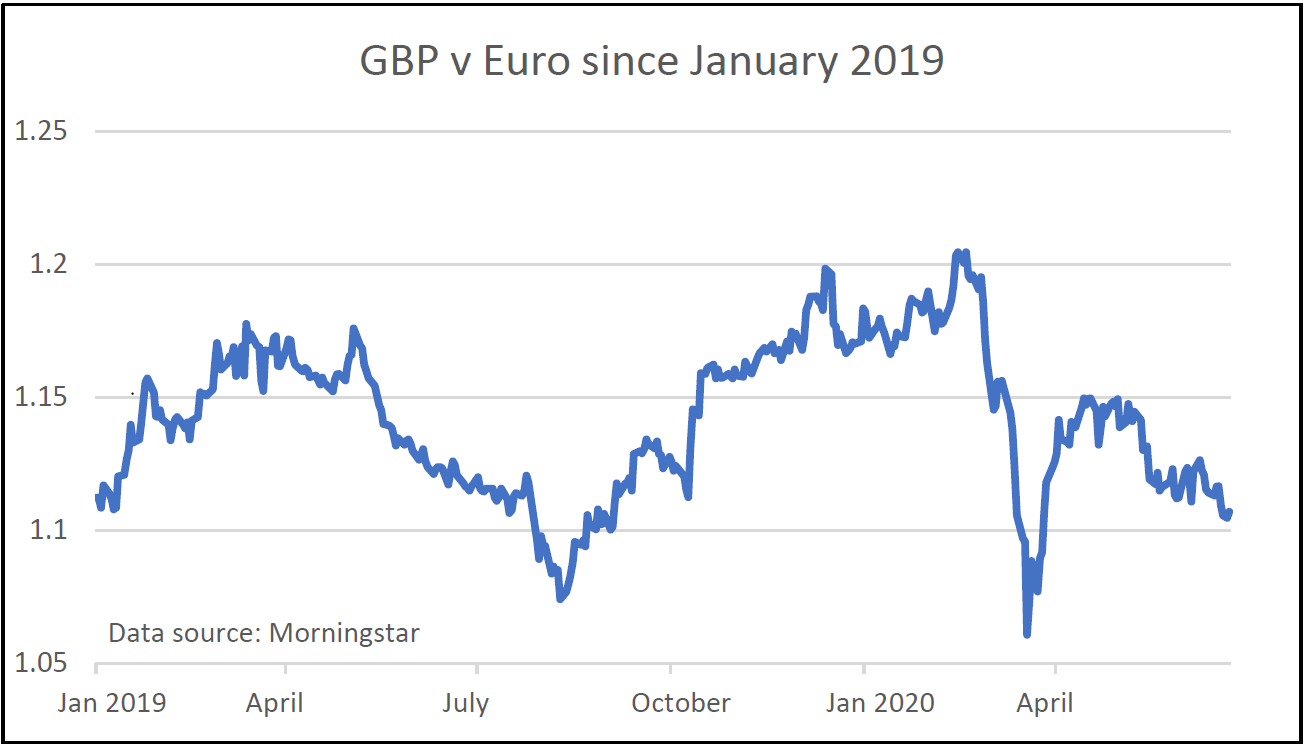

When you look at the value of sterling against the euro the trend last year was similar.

Between March and August, the value of the pound fell from a high of almost €1.18 to a low of €1.07, but it then recovered and in February of this year it briefly went above €1.20.

It had the same sudden drop and rebound in March that we saw against the dollar, but has had a more sustained fall since then.

It’s now over 8% lower than the February high.

Past performance is not a guide to future performance.

A weakening pound will have helped any investments valued in euros, and we’ve seen this coming through in our numbers. The European sectors have started to perform well and, in last week’s Saltydog analysis, were ahead of the Global, American, and Japanese sectors.

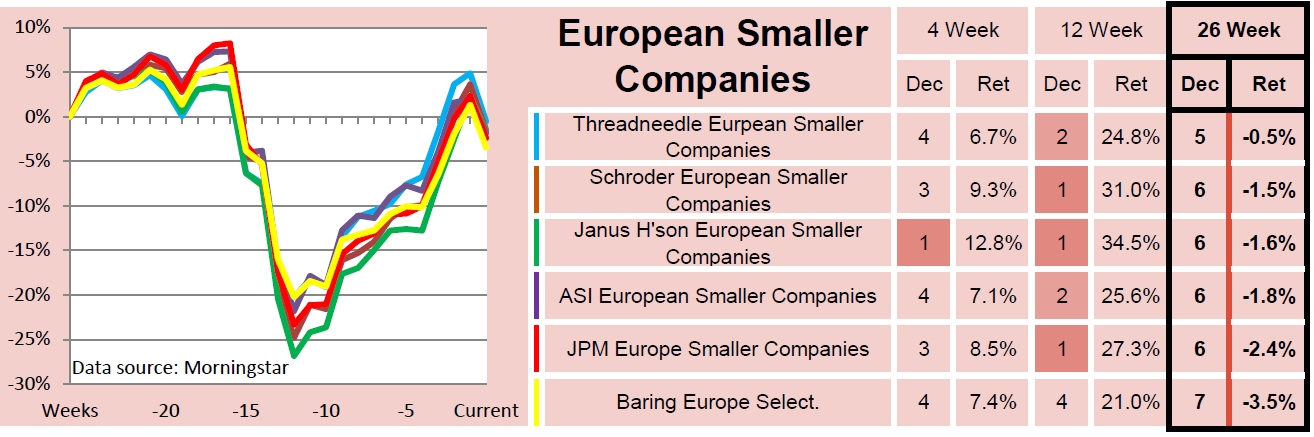

We recently invested into a fund from the European Smaller Companies Sector – Janus Henderson European Smaller Companies.

Past performance is not a guide to future performance.

Although when we looked last week it had dropped a little, it has subsequently recovered. We’ve been holding the fund for less than two weeks and it is currently up 2.8%.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.