Five bargain hunters reveal strategies for Q1 2019

Our five-strong expert panel run through the investment areas they favour and those they are avoiding.

8th February 2019 15:54

by Jim Levi from interactive investor

Our five-strong expert panel run through the investment areas they favour and those they are avoiding.

A year ago in this column, Keith Wade, chief economist at Schroders, issued a stark warning to investors. He said:

"Very few people think the markets will be as good in 2018 as they were 2017."

That proved quite an understatement. The FTSE All World index, which covers shares in 50 markets, ended 2017 up 22% – its biggest rise since the financial crash. However, a year later it had lost almost all of those gains, mostly in the final febrile months of 2018.

Markets spent 2017 catching up with the cheerful reality of the global economy finally reaching a brief 'Goldilocks' phase where the temperature was 'just right' for synchronised global growth and low inflation. They spent 2018 coming to terms with a different reality: fading growth, particularly in China and Europe.

US fit for another year

A stronger dollar, a spike in oil prices, rising US interest rates and US president Donald 'trade spat with China all contributed to a change in the global economic climate. The final straw was the increasing body of evidence that earnings growth among US companies was peaking. The star-performing FAANGs (Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX) and Alphabet's Google (NASDAQ:GOOGL) shed much of their frothy valuations.

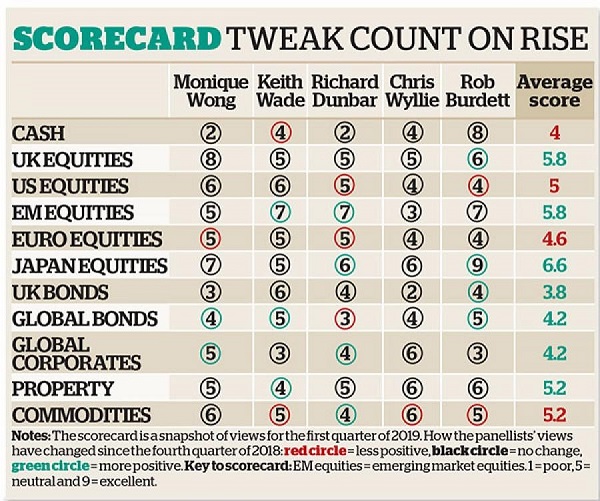

As a result, as 2019 gets under way, our five fund manager experts have had to adjust their asset allocations to cope with bearish and much more volatile conditions. They have tweaked their exposures to government bonds, corporate bonds and property as defensive ploys. However, they are by no means entirely gloomy about equities.

Richard Dunbar at Aberdeen Standard Investments says his central argument at the moment is that the world economy remains in a very long expansionary cycle that has followed the financial crisis.

He says: "There have already been two periods of economic deceleration since the expansion began. We are now into a third deceleration. The indicators we look at do not point to a recession. Valuations in equities as a whole are about 20% cheaper than they were in September."

Fund managers like volatility because good companies get dragged down with the not-so-good ones, creating opportunities to buy for the longer term. And there are other reasons to be cheerful. Straws in the wind suggest the US Federal Reserve might stop raising interest rates. Two quarter-point rises were expected this year, but now there may be none. That could weaken the dollar and, in tandem with a sharp drop in oil prices, perhaps reverse the slowdown in global growth.

Moreover, there are signs that both China and Europe may try implementing tax cuts to revive activity, just as Trump has in the US. Finally, hope is rising that the US and China might reach a deal on trade.

Weighting for gain

On average, the panel remains overweight in three equity regions: the UK, emerging markets and Japan. They are neutral about US shares.

European equities takes the wooden spoon. The average score for European equities is down from 5.8 a year ago to an underweight of 4.6 now. Monique Wong at Coutts has lowered her score here for the second successive quarter, from 6 to 5, and Richard Dunbar has followed suit.

Wong catalogues a list of problems in the eurozone. She says: "The European Central Bank has plans to end easy money, but it may have missed its chance to raise interest rates. Meanwhile, there is Brexit to deal with, worry about the euro, a budget problem in Italy and fear that the banking sector – a large element in European equity indices – is particularly vulnerable."

Rob Burdett at BMO and Chris Wyllie at Connor Broadley both stay underweight. "It is still a bit early to buy Europe," says Wyllie, "but it has more cyclicality in its index, as it is more exposed to international trade than, say, the US, so we may soon be tempted back in."

Keith Wade is "fairly lukewarm", with a score of 5. "It is possible that Europe will turn to tax cuts when the monetary stimulus provided by the central bank tapers off this year," he says.

But he questions whether the eurozone has the mechanisms to achieve this. He adds: "Italy very quickly ran into trouble with the European Commission over its budget. Whether the Commission would ask the French to re-do their budget is perhaps a different matter."

Some of our panellists take comfort from the recent relapse on Wall Street. US shares are now around 20% cheaper than they were in September. However, both Wyllie and Burdett remain underweight. Wyllie allocated underweight positions for all equities except Japan back in November, and his timing was spot on. He has not changed his scores for equities at all this time.

He says: "We are now keeping an eye out for buying opportunities, as it seems farfetched to think the US will go into recession in the next 12 months. We may well have reached a low point, but I need more evidence to prove that, as there are still valuation risks on Wall Street."

Wade remains positive on US equities. He adds: "The US economy has enough momentum to get it through this year. We have cut our growth forecast for 2019 from 3.1% to 2.9%, but our forecast for the US has not changed and there remains a blue-chip quality about many US shares." His score is an unchanged 6.

Wong also scores 6 for the US. She says:

"The US is cheaper than it has been, but also better value because earnings have risen. It may be more expensive than other developed markets, but that is because it remains a higher-quality market."

In contrast, Burdett has lowered his US score from 5 to 4. He says: "Our 12-month view is that this is still one of the best major markets, but in the shorter term, we could still see further selling." He retains his high cash score of 8 as he awaits the appropriate moment to rebuild on Wall Street.

Buying emerging markets

The panel started 2018 with emerging markets their most favoured equities sector, but that call proved wrong. Emerging markets had a tough year as the dollar strengthened and growth slowed in China. By May three panel members were cutting back their exposure, although Burdett pushed his score up to 8 at that point. By the end of the year, Wyllie had cut back his score from 7 to 3.

While Wyllie remains on the sideline, Wade and Dunbar are buying again: both have pushed up their scores from 6 to 7 for this quarter. "Valuations are now attractive and we foresee a weakening dollar helping the sector," Wade says. "But if emerging markets are to outperform this year, the impetus has to come from a recovery in Chinese shares." That in turn requires a recovery in China's growth rate and a good outcome to China's trade dispute with the US.

"Given the falls we have seen in equities, we see more opportunities to buy now in emerging markets than elsewhere," says Richard Dunbar. "So we are raising our scores in emerging markets and in Japan, at the expense of the US and Europe."

Our panel's love-in with Japanese equities remains intact. It has been its favourite sector since August. This is in spite of a 20% drop in the Tokyo market since September.

Burdett admits he made a wrong call in November, when he raised his score from 7 to 8 as the market continued to tumble. Nevertheless, he is raising it again to 9. "It has been one of the worst-performing markets lately, but there is good value there as earnings are rising," he says.

"Moreover the yen is an attractive currency to hold as a safe haven in troubled times."

Wade is more cautious. "There is a good valuation case for Japan, but it would be hurt by any slowdown in global trade," he says. "A recovery in China would help Japan, but a weaker dollar translates into a stronger yen and that is not good for Japanese equity valuations. Overall, it makes sense to be neutral."

Neutral on Brexit

Brexit dominates UK equity market thinking. Even a miraculously smooth departure from the EU might have a short-term downside effect, because it would almost certainly send the pound sharply higher. That would weigh heavily on the overseas earnings of many constituents of the FTSE 100 index.

"We are still neutral in the UK because of the Brexit risks," says Wade, "but were it not for the greater attractions of other markets, we would be increasing exposure in the UK. Valuations do now look attractive."

None of the panel is underweight in the UK. Indeed, Wong (with a score of 8) remains a big fan. She says: "We are contrarians here, and we have sat through the ups and downs (mostly the downs) of the market. But the forward yield on UK shares is now more than 5%. Although Brexit casts its shadow, the FTSE 100 index seems to trade in line with global markets." She believes the main effect of a Brexit is likely to be felt on sterling.

Surprise package

Dunbar points out that property was the best-performing asset allocation sector on our list during 2018. "When you think of all the problems over Brexit and the City of London in the wake of the 2016 referendum result, many people would not have believed we could have achieved two years of 10% a year total returns here," he says.

Only Keith Wade remains underweight in the property sector, and even he has now grudgingly raised his score from 3 to 4.

The commodities sector remains intriguing. Three panellists have lowered their scores, mainly in response to a weaker global growth outlook and falling oil prices. However, Wong keeps her score at 6 on the grounds that the oil price may well have bottomed out. "A price range of $45-$55 looks fair value to us," she says.

Dunbar disagrees, however. He believes the oil price has been overshooting on the downside and he has raised his score from 3 to 4. He says:

"The tremendous slide in oil has gone beyond what the fundamentals suggest on the downside. Although there are a lot of negative noises, we are not going to hell in a handcart."

Fixed interest (gilts, global bonds and corporate bonds)

Fixed-interest markets – including both government bonds and corporate bonds – have comfortably outperformed equities in recent months. Three panel members have raised their scores for global bonds, which in most cases means US Treasury bonds. But Richard Dunbar bought when yields rose above 3% in early autumn and has now lowered his score from 4 to 3. Over the year since February 2018, however, average scores for global bonds have edged up from 2.6 to 4.2.

UK bonds get mixed reviews from the panel. Keith Wade sticks to his score of 6 based on the risk of the UK's exit from the EU leading to a recession.

He says: "We have lowered our cash score and we are also neutral in global bonds, because we now see bonds as a better hedge against the risks of weak equities and recession and we see much less risk of a resurgence of in¬flation. We now think the risks are skewed towards de¬flationary outcomes."

Rob Burdett has also raised his government bond exposure to re¬flect the greater risk that the ‘bear’ will continue to dominate the equities sector, at least in the short term.

However, both Monique Wong and Chris Wyllie have little time for UK bonds. Wong says they are "untradeable", while Wyllie declares them "deeply unattractive and uninvestable". In both cases, their stance is mainly the result of the outcome of the Brexit process being highly uncertain. "I would rather hold US Treasuries at this point," Wong says.

Corporate bonds are creeping back into favour in some quarters, although Wade much prefers the government bond alternative. Wyllie disagrees and in November pushed up his corporate bonds score to 6.

He says:

"They are an alternative to US Treasuries without the exposure to the risk of a falling dollar. You have to pick your corporate bonds carefully, and avoid US investment-grade issues."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.