Five fund experts reveal where they are investing now

Amid fears of global recession in 2020, a handful of fund professionals discuss investment strategies.

5th November 2019 12:37

by Jim Levi from interactive investor

Amid fears of global recession in 2020, a handful of fund professionals discuss investment strategies with Jim Levi.

There is intense debate among our asset allocation panellists and the teams who support them, about the dangers of a global recession next year. Schroders' Keith Wade has likened the world economy to a wobbly bike where growth momentum has become so weak that any bump in the road could topple it – if not next year, then in 2021.

Forecasting global growth of only 2.4% for 2020, Wade ominously points out that this number is "similar to growth levels actually achieved in 2008 – just before the great recession of 2009". He and his colleagues have lately questioned whether they should now go underweight in equities generally. Wade is not yet quite ready to do so, however, remaining overweight in the US and neutral in emerging markets but underweight Japan, Europe and the UK.

Stockpiling

Rob Burdett at the multi-manager investment group BMO Global AM says recent central bank rate action in regard to liquidity and interest rates has been driven by fear.

"The fear is that what we have seen lately in terms of growth has been largely a reflection of big increases in inventories (stockpiling) by companies to avoid disruptions ahead of trade wars, Brexit and other issues. And of course cheap money keeps the cost of inventories low."

But this cannot last unless underlying demand is growing; eventually companies have to run down their stocks. "All this is before we consider the increased political uncertainty in a number of areas," Burdett says.

"The situation in Iran has heated up, US politics is heating up, Hong Kong has heated up and in Europe we have Brexit and a German walk-out at the European Central Bank."

Monique Wong at Coutts sums up the situation:

"The global economy is at an inflection point. That makes it very challenging for investors. Either there is a soft landing or there's a recession. We feel the probability of recession has increased, but the timing has been postponed by the action of the central banks."

On the face of it this may seem a very unhelpful background for investors. Certainly several panel members remain cautious, but the contrarians, in Burdett's words, think the negative sentiment is "providing pockets of opportunity for long-term investors". It prompts him to be overweight in European equities. He also stays bullish on Japan – the best-performing equity market in sterling terms during the summer. However, he finds the most opportunities in Asian emerging markets and in Hong Kong, particularly in the heat of the current crisis. He boosts his emerging market score from 7 to 8.

"Recession is what bond markets are signalling at the moment," says Chris Wyllie of Connor Broadley. "But the sharp drop in interest rate expectations over the summer has made valuations on equities more attractive, because earnings yields relative to bond yields have changed significantly." But he warns that his analysis simply does not work if we fall into recession.

"As yet there is no evidence of recession globally, but equally we are not seeing any signs of growth accelerating," he says.

"Overall the signals are more bullish than they were three months ago."

But not bullish enough, it seems, to make him alter his cautious stance on equities. He is now neutral in all equity sectors except in the US, where he scores a 4. "You do need signs of growth accelerating to get markets to break out on the upside," he says.

Central bank taps

With about 60% of the world's central banks already turning on the monetary taps and the Bank of Japan expected to join them shortly, Richard Dunbar of Aberdeen Standard says: "Central bankers are doing their best to generate some inflation into the system, and they are very keen to hand over the baton to governments to be rather more proactive on fiscal policy and spending, as is already being seen in the UK and Germany."

A feature of this quarter's survey has been a dearth of dramatic changes in scores. Average scores are little altered, while Dunbar has made no changes at all and Wong has only tweaked her UK bonds score one notch lower to 3.

"I can see fair valuations across most sections of the market, but nothing is very cheap," Dunbar says. "Given the difficulties we have faced – an unprecedented monetary experiment on top of unprecedented political turmoil – I would not have expected the market performance we have seen in the past couple of years to have been this good. Overall they have coped pretty well."

Past performance, he believes, has shown that it has been right to hold government bonds – but he remains underweight, because they look expensive. As for equities, he believes the wall of worry which equity bull markets have to climb is still very much in place.

"Cash levels among institutions are high, as issues such as the trade war overhang the market," he says. "But any better news on trade, a weakening of the dollar or more action on monetary and fiscal policy by governments could be very helpful next year for markets. These are all things president Trump in an election year would wish for."

Wong thinks the US economy "will probably slow a bit towards the end of the year, but parts of the rest of the world are showing signs of stabilisation." She sees signs of green shoots particularly in the emerging markets and expects the markets to rally soon. "We are sticking to the view that recession, when it comes, is unlikely to be in 2020," she says.

The charms of the UK equity market for the panel have faded through the long hot summer of Brexit stalemate. Back in May, three panel members decided the UK looked cheap and joined Wong in overweight positions. Only Dunbar was neutral. Now, apart from her, they are all back to neutral.

Brexit discount

There is no doubt UK equities have been underperforming during this bull market. As Wong points out: "Since the referendum, UK equities in sterling terms are up 30% while US equities are up 50% in dollar terms. There clearly is a Brexit discount." She sticks with her high score, though at the time of writing the Brexit impasse seems as far away from resolution as ever.

In contrast, some interest in European equities is reviving. Burdett has gone overweight for the first time in more than a year. Wyllie, who remains neutral here, says Europe is "priced for recession". Burdett does not disagree, but points out:

"The overarching fact is that both central banks and governments want to support the economy. That is positive, and though the markets might become volatile, there are clear value opportunities there."

Japan has emerged as the best-performing equity sector during the summer – but none of the panel scores have changed and only Burdett and Dunbar remain overweight. UK investors in Japan get the advantage of a strong yen against sterling, with the yen still regarded as a safe-haven currency like the dollar. Wong is now debating whether to take a more positive view of Japanese equities. "I think Japan looks a bit cheap, but not everyone in the Coutts investment team agrees with me," she says. "It is under-owned by the investment community and profitability is holding up."

Wyllie argues that there are three ways to play a global recovery.

"You buy equities in either Japan, Europe or emerging markets. At the moment Japan looks better value."

This time around there have been no changes in scores for US equities, with a clear division, with the Burdett/Wyllie camp believing other equity sectors now offer better value, while even Wade – arguably the least enthusiastic for equities – still feels a sense of security in holding dollar-denominated growth stocks.

One intriguing statistical side-effect of Burdett's decision to go overweight in European equities has been to push the average score for all five equity sectors up to neutral or a little above neutral. The panel almost seems to believe that governments around the world can do enough to revive the wilting global economy.

Bond strength

Meanwhile, reflecting the strong performance of government bonds in this era of prolonged low interest rates, the panel nudged up its exposure to both gilts and global bonds earlier this year. As Dunbar says: "It has clearly been right to have this balance between bonds and equities, though the emphasis must be on equities." But this trend has come to a halt – for the time being at least. No alterations for the scores of global bonds have been made this time, and Wong has made the only change in UK bonds, lowering her score from 4 to 3.

There are plenty of problems in the property sector – particularly in retail – but Wyllie remains an enthusiast against the background of falling interest rates. He has raised his score to 7 on prospects of solid yields, which he hopes will be at least partially inflation-proofed.

"I have to believe property funds are better value than bonds," he says.

Profit-taking is in evidence in gold within the commodities sector, after bullion's recent strong run. Wade has lowered his score from 6 to 5, but admits he would score a 7 for gold alone for its attractive hedging qualities.

Trump's wishlist

US stock markets have performed very well under the reign of Donald Trump. And he needs them to perform well in his election year in 2020. Can he make it happen?

At the moment the auguries do not look good. Although Wall Street prefers it when the Republican Party is in power – and some of its denizens even like Trump – they are not at all sure this is what they are going to get come the election. "This political uncertainty is one reason why I am underweight in the US," explains Rob Burdett.

"Does Trump have a plan?" asks Chris Wyllie. "Before the election he really needs to find a way to get the dollar down, to revive the rate of global growth through further easing of money and fiscal stimulus. He needs to resolve the trade war with China." It would be nice too if he made peace with Iran or North Korea, or both. He would probably also welcome it if the threat of impeachment was somehow made to go away.

Trump's is quite a long wish list, though for investors in global equities, it would be quite a boost if any one of these little problems in his in-tray was resolved. Investors rather hope he is working on them.

How big are the implications of the various clouds hanging over the administration? Monique Wong notes that the lessons of past impeachment threats against Bill Clinton and Richard Nixon did not impact on Wall Street that much. "Investors in those instances took more notice of the state of the economy than the impeachment threat," she says.

But Keith Wade does not believe Trump is going to resolve the trade war with China quickly. "In our view this is the biggest influence on financial markets at the moment, but we fear there is a long cold war in prospect," Wade says. "The Chinese play a long game and we are going to have to get used to it.

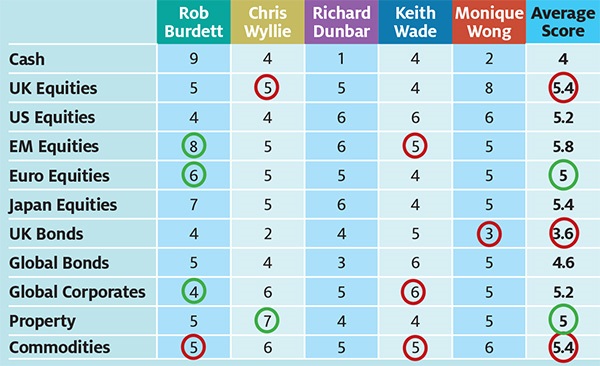

Scorecard: recession fears to the fore

Note: The scorecard is a snapshot of views for the fourth quarter of 2019. How the panellists' views have changed since the third quarter of 2019: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is co-head of multi-manager at BMO Global Asset Management and a research team leader. BMO has £187 billion in assets under management.

Chris Wyllie is chief investment officer at Connor Broadley, a financial planning and investment management firm with £400 million under management.

Richard Dunbar is deputy head of global strategy at Aberdeen Standard Investments, which has some £610 billion in client assets under management.

Keith Wade is the chief economist and strategist at Schroders. The asset management company has around £400 billion in assets under management.

Monique Wong is a multi-asset investment manager at Coutts, the private arm subsidiary of RBS bank, which has some £17 billion of assets under management.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.