Five pollution stocks: should you buy any of these household names?

3rd November 2021 10:15

by Rodney Hobson from interactive investor

We analyse some of the biggest names in Corporate America that also rank as significant polluters, and whether the fundamentals scream value.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

As world leaders prepared to make their way to Glasgow to save the planet, companies at the sharp end of carbon pollution – oil producers and vehicle and aircraft makers – were producing results for the latest quarter and, where possible, improving their environmental images. Investors should consider whether fair words will translate into genuine action at a time when ethical and sustainable investing is moving increasingly to the fore.

Few companies have been through the mill to the same extent as aircraft maker Boeing (NYSE:BA), which saw its 737 MAX aircraft grounded after two crashes just before the Covid-19 pandemic stopped air travel in its tracks. Boeing suffered the cancellation of orders for 650 planes as the 737’s flight handling system was blamed for the deaths of 346 people.

The timing, however, did not work too badly against Boeing. Aircraft deliveries would have slowed heavily in the pandemic anyway, and the Federal Aviation Authority in the US has cleared the 737 MAX to fly again just as airlines start to return to the skies.

More than 200 of the grounded aircraft have returned to service and Boeing has delivered nearly as many new versions to fulfil orders over the past 12 months. In the third-quarter Boeing reported revenue up 8.1% to $15.3 billion.

- Fund managers call for more action and fewer words on climate change

- COP26: five top share picks that are climate leaders

- Don't be shy, ask ii...will I make more money investing ethically?

- NS&I green bond disappoints: here are some much better alternatives

- Read all of Rodney's articles by clicking here

There is still a long way to go, though. The quarterly net loss of $132 million is admittedly better than the $466 million loss last time but a long way from the $1.17 billion profit in the same period of 2019. Debt costs are rising alarmingly, a trend that is likely to continue as interest rates rise.

Source: interactive investor. Past performance is no guide to future performance

Back on the ground, Ford Motor (NYSE:F) and General Motors (NYSE:GM) continue to play catch-up in the production of electric vehicles and hybrids while coping with the continuing and erratic shortage of computer chips that is likely to continue into 2022.

Ford saw revenue slip 4.8% to $35.7 billion compared with the previous third quarter and pre-tax profits were a worrying 32% down at $1.9 billion. There were several pieces of good news. The figures were way better than those achieved in the second quarter, allowing Ford to raise its guidance for the full year and to reinstate the dividend at 10 cents for the quarter.

The group is investing over $40 billion in the five years to 2025, most of it going on battery-powered vehicles. That is a pretty onerous, though necessary, burden.

Source: interactive investor. Past performance is no guide to future performance

General Motors beat expectations and suggested that the full year would be at the top end of its earlier guidance, which would take the profits total above $13 billion. That could not disguise a 40% drop in third-quarter profits to $2.42 billion, and a 25% fall in revenue as GM produced fewer cars because of the semiconductor shortage.

The lack of chips actually allowed GM to raise prices of its vehicles, as demand outstripped reduced production, but it is still hard to see how GM is going to bounce back strongly in the final three month. That full-year target could prove difficult to attain, especially as the latest figures were artificially boosted by a $1.2 billion payment from LG Electronics to settle a dispute over batteries recalled due to fire risk.

Source: interactive investor. Past performance is no guide to future performance

Last year you couldn’t give oil away. Now it is back up to $80 a barrel and possibly heading for $100, as the global economy recovers faster than expected and oil producing nations resist the temptation to ramp up supplies. The financial benefit pretty much flows through to the bottom line for producers.

The cash will come in useful as the sector bows to pressure to promote carbon capture schemes. Like it or not, though, oil and gas will continue to be in demand for at least the next decade as it remains an important fuel for power stations whatever climate activists argue.

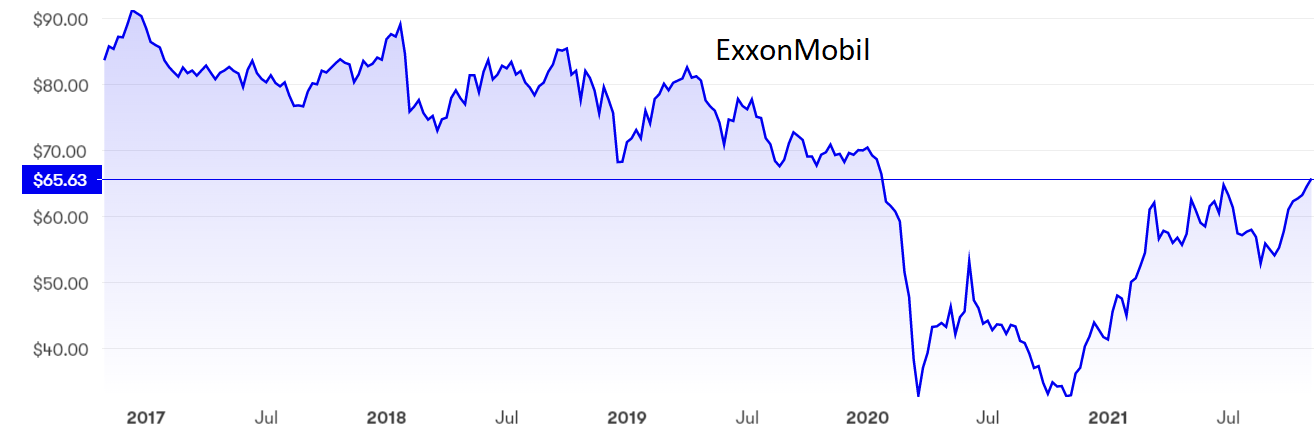

Exxon Mobil (NYSE:XOM) produced a profit of $6.8 billion in the third quarter compared with a loss of $680 million a year earlier, while revenue rose 60% to $73.8 billion. Free cash flow not only covered the dividend, it also knocked $4 billion off debt, which will come in handy as interest rates start to rise. The dividend is increased for the 39th year in succession, putting the yield at 5.3%.

Source: interactive investor. Past performance is no guide to future performance

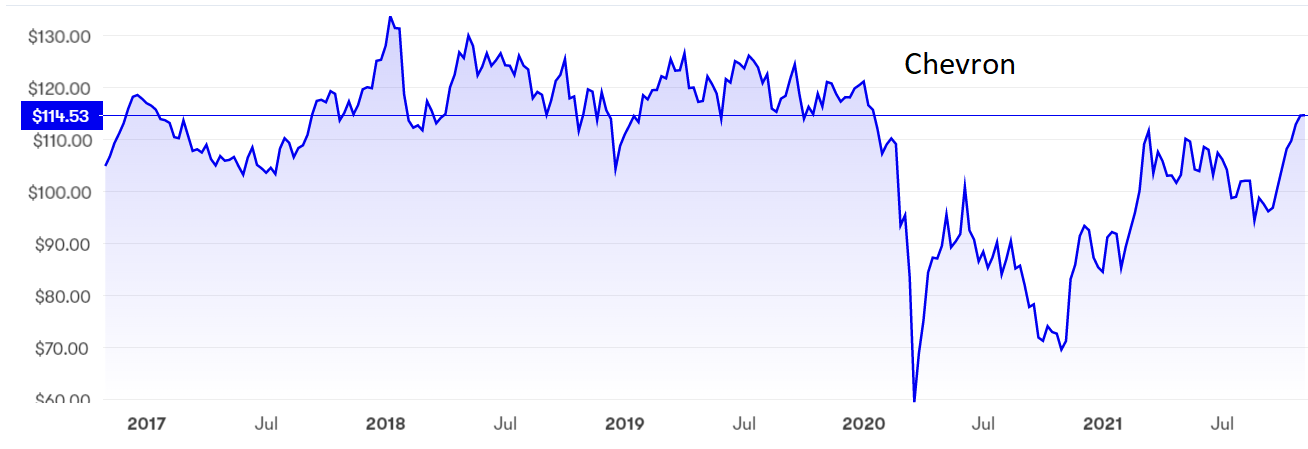

Chevron (NYSE:CVX) also swung from a loss last time to profit, namely $6.1 billion, the best since early 2013 and better than expected. Revenue jumped 83% to $44.71 billion. The yield is 4.6%.

Source: interactive investor. Past performance is no guide to future performance

- The indicators that help us decide when to sell

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Don't be shy, ask ii...how do I tidy up my investment portfolio?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Hobson’s choice: Boeing shares have been falling since March and are still a sell. I did warn in August that at $225 the shares looked quite high enough and they are now down to $214. Ford shares have hit a new peak at $18. Time to take profits. GM has slipped lately and could continue to fall, so it also counts as a sell. The yields for the two oil companies are tempting but the clouds over the sector’s future mean they cannot rate more than a hold.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.