Five takeaways for fund investors from first quarter of 2022

7th April 2022 11:15

by Kyle Caldwell from interactive investor

Kyle Caldwell examines the key trends that have played out for fund and trust investors so far this year.

There’s been no shortage of headwinds for investors to contend with in the first three months of 2022: Russian’s invasion of Ukraine, inflation at its highest level in decades, and interest rates moving higher. Each has influenced the performance of stock markets, which has fed through to the performance of collective investments.

Below, is a run-through of five trends that played out for fund and trust investors.

Market rotation

Value shares outperformed growth shares in the first quarter. Data from FE Analytics shows a notable performance gap between the two investment styles: the MSCI World Value Index returned 2.9% versus a loss of 6.6% for the MSCI World Growth Index.

Value shares, which tend to be cyclical, are being seen as a better bet than growth shares to profit from the post-pandemic economic recovery and higher interest rates. Such companies offer ‘jam today’ as their valuations are not based on producing high profits in the future.

- Bargain Hunter: 10 growth-focused trusts on notable discounts

- Are Scottish Mortgage’s private holdings overvalued?

- Why investors are retreating to passive funds as markets fall

Meanwhile, technology and other growth shares are seen as ‘jam tomorrow’ stocks, as their more expensive valuations are hinged on their future earnings potential. Such companies are negatively impacted by high inflation and increases in interest rates because both devalue their expected future earnings.

As a result, the performance of value funds has been turbocharged, while for growth strategies it has been a headwind, including for funds and trusts managed by Baillie Gifford such as Scottish Mortgage (LSE:SMT).

Most fund and trust sectors lost money

Only four of the 58 fund sectors produced positive returns in the first quarter. Two adventurous fund sectors led the way – Latin America and Commodity/Natural Resources – with average returns of 27.6% and 16.5%. The other sectors that made money, Infrastructure and UK Direct Property, are more defensive. The respective average returns were 5.3% and 3.3%.

For investment trusts, more sectors made gains – 15 out of 49 – although most had returned less than 2%. The stars of the show were Latin America (average trust up 22.8%); Commodities & Natural Resources (20%); Insurance & Reinsurance Strategies (11.5%); UK Commercial Property (5.9%); and Renewable Energy Infrastructure (3.2%).

Bear in mind that with specialist fund and trust sectors such as Latin America, the rewards and risks for getting it right or wrong tend to be great. With such funds, to simply ‘buy and hold’ may not pay off. Instead, consider being prepared to quit a losing position. If you buy at a bad time and the fund performance plummets, it can be an uphill struggle to return to even.

If you time your entry well, keep a close eye on those paper gains and consider banking profits when sentiment swings the other way.

In any case, for investors who are willing to stomach the risk, such funds should form only a small part of a diversified portfolio.

Smaller companies have underperformed

Smaller company shares were out of favour in the first quarter of 2022, with investors instead focusing on the old-economy sectors that dominate the FTSE 100, namely banks and miners.

For funds, this was reflected in the fact that three of the five worst-performing sectors were smaller company-focused: European Smaller Companies, UK Smaller Companies and Japanese Smaller Companies, with respective losses of 13%, 12.2% and 9%. The other two sectors in the bottom five are China/Greater China, and Technology, down 11.8% and 10.6%.

The same trend played out for trusts. Global Smaller Companies, European Smaller Companies and Japanese Smaller Companies were in the bottom five sectors, down 18.7%, 17.1% and 16%. Growth Capital, which contains trusts that invest in unlisted companies, was the worst-performing sector, down 22.2%. China/Greater China was also in the bottom five, down 18.6%.

- Fundamentals: how to invest £10,000

- Expert investment tips: £50 to £50,000

- Funds and investment trusts with the punchiest portfolios

For more seasoned investors, periods of subdued or poor performance from smaller company funds and trusts is par for the course. Smaller companies are riskier than larger companies, and are much more vulnerable to investor sentiment quickly turning sour. A long-term investment horizon, therefore, is crucial.

The long-term outperformance of smaller companies over larger companies is a powerful investment trend. The numbers speak for themselves: research by the London Business School found that £1 invested in 1955 in UK smaller companies would have grown to £7,933 by the end of 2020. In contrast, £1 invested in UK large companies over that 65-year period would have grown to £1,054.

Funds have beaten trusts

Overall, funds held up better than trusts. The average UK All Companies fund lost 5.9% versus a 12.9% decline for the equivalent investment trust sector. There was a similar gap for global strategies, with the average global fund declining by 5.2% versus a loss of 11.4% for the average global trust.

The key reason why trusts have underperformed is due to their ability to use gearing (borrowing to invest). Gearing magnifies losses as well as gains, causing a geared trust to drop more than similarly managed open-ended funds when markets fall, but rise more when markets go up.

- Trust investors punished as markets fall but are still smiling long term

- Fundamentals: five reasons why investment trusts are different from funds

A recent interactive investor analysis of 12 pairs of similarly managed investment trusts and funds showed that over one month and three months funds were better performers.

Since February, six out of 12 funds beat their sister trusts and one returned the same amount. Since December 2021, 10 out of 12 funds beat their trust peer. All data was to 17 March 2022.

Passive specialist funds outperform active

Energy-focused strategies and Latin America topped the performance charts in the first quarter of 2022.

Commodities have been on a tear for the past two years, with some predicting the early stages of a new ‘supercycle’ for the asset class, driven by the global green revolution, as major economies strive to decarbonise. Russia’s invasion of Ukraine had the effect of pushing prices up further. This provided a boost to Latin America shares, given that a high amount of exports are linked to commodities; includinglithium, oil, iron ore, copper, wheat and soybeans.

The highest returns, though, for both energy and Latin America have come from exchange-traded funds (ETFs) rather than active funds. For renewable energy, the top three performers in the first quarter were: the SSGA SPDR S&P US Energy Select Sector ETF, the iShares S&P 500 Energy Sector ETF and the Xtrackers MSCI USA Energy ETF, with respective returns of 44.9%, 44.8% and 44.4%. In contrast, the actively managed Schroder Global Energy fund returned 33.5%.

For Latin America, the best returns came from focusing purely on Brazil and the iShares MSCI Brazil ETF was up 43%.

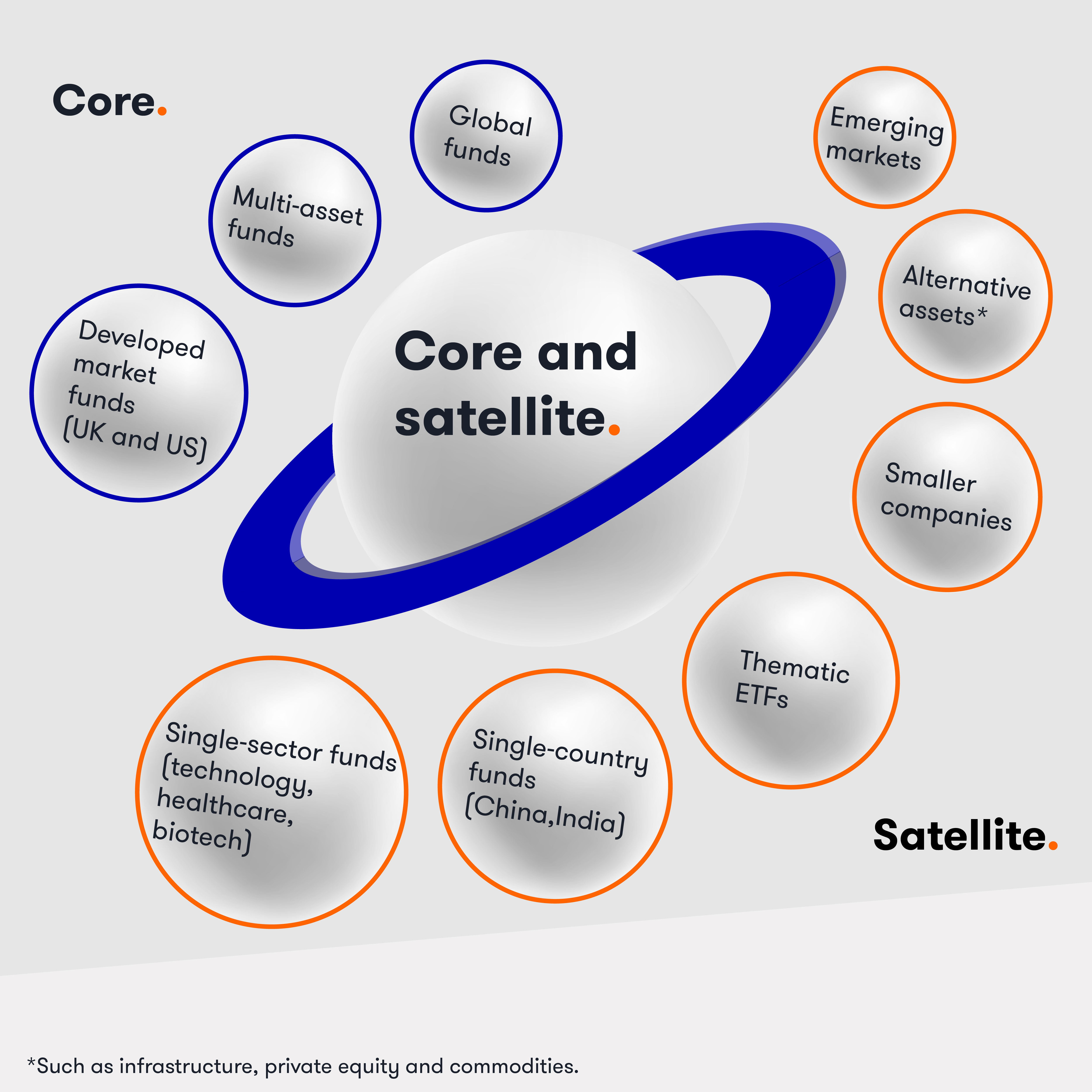

Specialist funds are potentially a good fit for a core and satellite strategy, where most of a portfolio (70% to 80% typically) is invested in developed market equity funds. The remainder, the satellite part, is where investors can add some spice in high-risk, but potentially high-reward, funds in the hope of generating higher growth.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.