Five top trusts spot big opportunity in Europe

29th November 2018 16:24

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

The endless grinding negativity of Brexit has driven investors away from Europe in scores, but some managers see rich pickings for those willing to take the risk...

Every Cloud...

William Sobczak, analyst at Kepler Trust Intelligence.

It was only last year that Europe was considered one of the hottest sectors, and we produced research ('En Garde!') highlighting the sheer pace at which the discounts were narrowing, and how the sector was witnessing its highest inflows since 2015. Over a one-year period, to the end of July 2017, the average trust in the sector had delivered NAV total returns of 26% which – supported by that closing discount – translated to share price total returns of 39%. To put that in context, the average fund in the sector outperformed the average fund in any and all of the Investment Association's OEIC sectors over the same period.

However, this has all but completely been forgotten and, rightly or wrongly, Europe is now one of the most out of favour geographical sectors in the world. We believe it is likely to be 'wrongly', and having met with multiple European fund managers, we feel there may be a discrepancy between the opportunities in Europe, and the sentiment of investors. We look at a range of investment trusts and examine the case for Europe.

Where is the love?

Last month we held our Kepler Trust Intelligence conference, where a number of leading fund managers of Investment Trusts presented to an audience of discretionary fund managers (DFMs). After the conference, we asked the DFMs where they were considering increasing their allocations over the next six months. One area that stood out as particularly out of favour was Europe. Of the 45 respondents, only six identified Europe as an area where they were considering increasing their allocation.

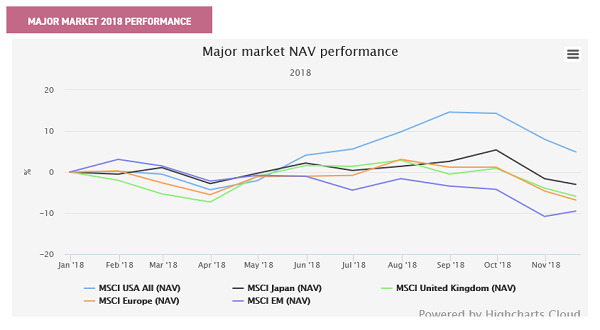

Most in favour were the Emerging Markets where, of the 45 respondents, a quarter were considering increasing their allocation. This was closely followed by the UK, where 20% of DFM's were considering of upping their position. It is striking that Europe attracted less interest even than the UK, with only 13% of respondents considering upping their allocation, despite the disproportionate threat that Brexit is to the UK economy. In fact, of the major markets, EM, Europe and the UK are the three worst performers this year.

Source: Morningstar

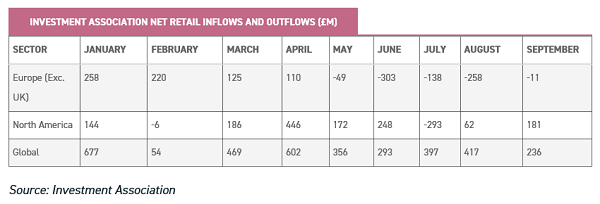

As can be seen in the table below, the lack of interest in Europe by our respondents is in line with what net retail sales figures are telling us: the region has seen consistent outflows since May.

Source: Investment Association

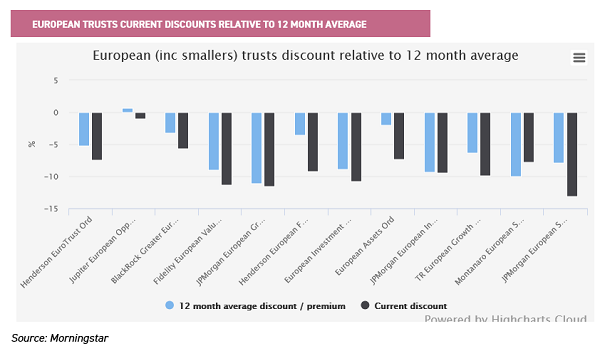

In the investment trust sphere, over the first three quarters of the year we have seen discounts widen to unusual levels. As can be seen below, almost every trust is trading on a discount wider than its 12-month average.

Source: Morningstar

Pessimism isn't due to fundamentals…

Currently, it appears the key driving force behind the widening discounts and the considerable outflows in European markets is macroeconomic sentiment.

If one looks at the Stoxx 600 index, the underlying fundamentals of companies remain stable if not strong and corporate profitability has been improving. During the third quarter, the estimated earnings growth rate for European stocks was 14.2% with six of the 10 sectors in the index poised to see an improvement in earnings, relative to one year earlier.

On the revenue side, of the 140 companies on the Stoxx 600 which have reported revenues, 51.4% beat analyst expectations compared to 54% for a typical quarter. As of the start of November, of the 125 companies on the Stoxx 600 index that had reported their Q3 earnings, 48% outperformed market expectations (Refinitiv data).

In comparison, during an average quarter, one would expect 50% of companies to beat estimates, so this is certainly not a poor picture even if it is marginally below average.

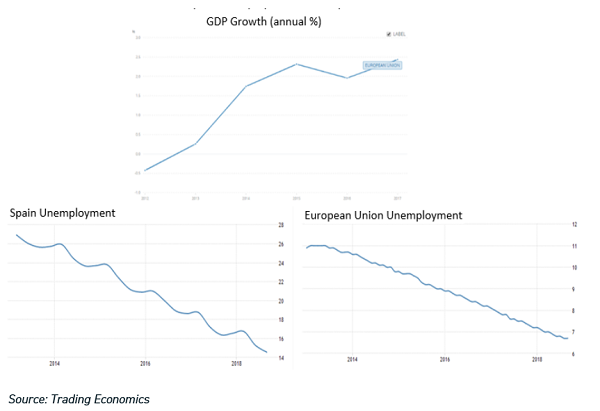

Alongside strong underlying corporate results, GDP continues to rise, and we have continued to see strong unemployment and wage growth data. At the start of November, the EU's statistical office estimated that the unemployment rate had decreased to the lowest level (6.7%) since monthly records began almost 20 years ago.

Even some of the weaker countries within Europe have dramatically turned their prospects around, as shown below by the unemployment rate of Spain.

Source: Trading Economics

Other notable indicators include rising inflation, persistent low interest rates and all-time high productivity levels, which all point towards Europe being in an expansionary phase, rather than a period of contraction.

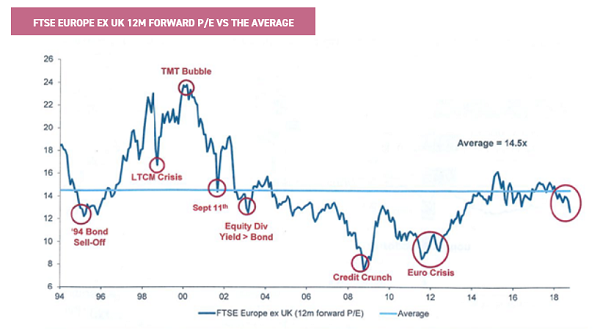

Despite this backdrop, the valuations of European companies have been getting increasingly more attractive. As can be seen in the graph below, the 12m forward P/E has dropped off in 2018, and approaching 12x is below its long-term average. In comparison, the US has an average P/E of 19.3.

One can also look at the Cyclically-Adjusted Price to Earnings (CAPE) ratio (also known as the Shiller P/E) to compare the valuations in Europe and the other areas. The CAPE ratio looks at real earnings per share over a 10-year period to smooth out fluctuations in corporate profits that occur over different periods of a business cycle. On this metric Europe looks attractive relative to the US, although it is more highly-rated than the UK and emerging markets. Of particular note is how cheap Emerging Europe is relative to other geographies.

Source: Starcapital

As shown by the high valuations above, and by the IA inflows data, the US has long been favoured over Europe in recent years. Since the financial crisis, the Eurozone has dramatically underperformed the US market. However, analysis by Gavekal Research identifies three factors which have greatly favoured the US market since the financial crisis, but which may now be either reversing or becoming less significant:

- Although we have seen a wide gap between economic growth in the US and the Eurozone, US growth is likely to slow as the effect of President Trump's fiscal stimulus dwindles. All the while, the resilient domestic cycle should see Eurozone growth remain at current levels.

- US companies are unlikely to be able to sustain their current pace of share buybacks, which have boosted stock market returns, given the prospect of higher borrowing costs and already stretched corporate balance sheets.

- The "unfavourable" Eurozone index composition is becoming less noticeable, as we have seen a reduction in the weight of the ‘administered’ or state-influenced sectors. Within those sectors comprised of 'old national champions', profitability may continue to be an issue, but cyclical headwinds are fading and reform has been extensive. Alongside this, the tech boom that has driven much of the strong performance in the US is likely to face increased political scrutiny in the near future.

Managers are optimistic

It seems anomalous that Europe remains so out of favour despite the decent fundamentals. Brexit is more of a threat to the UK than the continent, while the US is expensive and running on the last dregs of Trump's stimulus. Meanwhile, the emerging markets are more dependent on US monetary policy and the strength of the dollar.

In the main, we find the managers of European trusts have been repositioning their portfolios defensively, but remain more optimistic about their region, than the rock-bottom sentiment witnessed in retail investors.

Sam Morse, the manager of Fidelity European Values, tells us he sees plenty of opportunities in the region, but says the political noise surrounding many of the countries is clouding investors' judgement. Examples of this "noise" include (in his view) the impact of the resignation of Angela Merkel as CDU leader, the budget troubles of Italy, and most obviously Brexit.

He says that high quality, international companies that merely happen to be domiciled in Europe are being pigeon-holed as risky, despite their evident robustness. Once the politics surrounding some of these countries is resolved, he believes that positive sentiment should return, which would clearly also have a positive influence on discounts.

That said, the team do see a recession in the coming years, but not until the end of 2019 at the earliest.

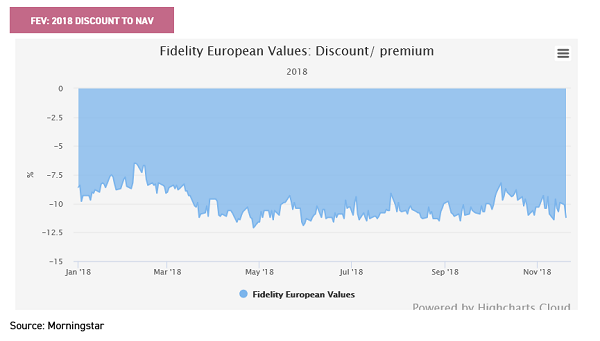

They are already beginning to anticipate and reposition the portfolio, so that it represents the types of companies that will continue to outperform their peers regardless of the economic situation. Fidelity European Values has seen its discount flirt with double digits throughout 2018, despite a strong long-term track record. Sam has been at the helm of the portfolio for the past eight years.

During this period, he has delivered an NAV total return of 107.4%, against a return of 68.6% from the benchmark FTSE World Europe ex UK index. The trust is managed with a conservative stockpicking approach, which aims to identify companies with strong balance sheets, proven business models and disciplined use of capital, which can grow their dividend regardless of the economic environment.

Typically, the portfolio is comprised of between 40-50 holdings, and at the time of writing the top ten holdings make up c.40% of total assets, making its concentration rather punchy. The portfolio is dominated by large caps, and businesses with a market cap over €10bn make up 76.8% of the holdings.

Source: Morningstar

The managers of JPMorgan European Smaller Companies, Francesco Conte and Edward Greaves, are also excited by the opportunities within Europe, largely because of the types of company domiciled there, many of which they see as having oligopolistic, or even monopolistic, qualities. The optimism is not unwarranted when looking at the historical performance, and as can be seen below, European small caps have produced long-term equity returns amongst the best in the world.

Source: JPMorgan

JESC aims to provide capital growth from a diversified portfolio of smaller companies in developed Europe, excluding the UK. It is managed through a high-conviction stockpicking approach, which has delivered impressive results over the 23 years that the fund manager, Francesco Conte, has been at the helm.

The trust is comfortably the largest in the AIC European Smaller Companies sector, with a market cap of close to £600 million, giving its shares good liquidity. The manager has delivered greater levels of alpha than any of the peers in the AIC European Smaller Companies sectors over one, three and five years.

Although the managers see the current sentiment as over exaggerated, they do still recognise that central bank monetary policy has gone from a long period of being a tailwind to now being a headwind.

As such, they too have restructured their portfolio to a more defensive position during the summer. This has proved to be inspired timing, as the trust has outperformed peers on the way up, and so far on the way down too. Set against this strong performance, the trust has seen its discount widen sharply this year. As can be seen below, the discount has relentlessly widened throughout 2018, despite the trust’s long term track record and move to a defensive tilt paying off during the highly volatile month of October 2018.

Source: Morningstar

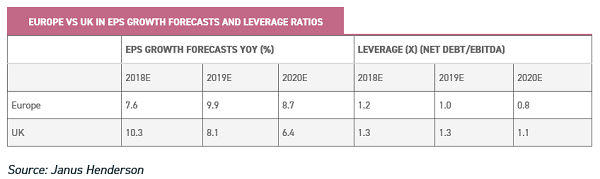

In common with many other managers we have spoken to, the newly appointed manager of Henderson EuroTrust, James Ross, believes that much of the pessimism around Europe may be overplayed. In his view, this is backed up by a comparison of European EPS growth forecasts and leverage ratios to the UK market. Consensus earnings growth for the continent is expected to be stronger in 2019 and 2020, with significantly lower leverage.

Source: Janus Henderson

The aim of the trust is to deliver superior total returns from a portfolio of high quality European (ex UK) investments. Tim Stevenson has been running the portfolio for the past 24 years, however in the past few months he has announced his retirement and it has been announced that James Ross will be taking over as lead manager in early 2019.

James believes that the types of businesses that can be found in Europe are a significant differentiating positive factor.

Describing many of the companies as 'privately owned public companies', he believes that within Europe there is a wide diversity of high returning, mid-cap companies.

These companies have been controlled by private families over generations, with a long-term view always in mind. This contrasts to other markets like the UK, which is made up of very large, mature companies that are covered by hundreds of analysts. James believes that such markets are far more efficient, whereas Europe continues to offer greater opportunities to generate high levels of alpha - something that we have observed in the past in this article.

Henderson EuroTrust's discount has fluctuated greatly over the past three years, and as of the start of November the trust is trading on a discount close to 8%, slightly wider than the one-year average of -6.2%.

Source: Morningstar

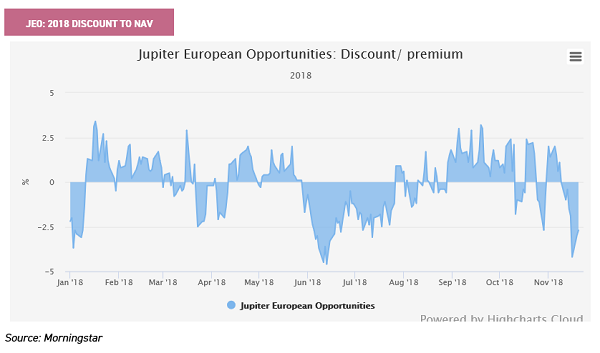

Jupiter European Opportunities is the only trust in the sector to regularly trade on a premium to NAV, but even JEO has seen its premium disappear for periods of 2018. Currently trading on a discount of -4%, the trust is run by Alexander Darwall, one of the most consistent high conviction and high alpha managers out there.

Performance has been outstanding in absolute terms, and Alexander likes to invest in what he sees as exceptional companies, expected to grow irrespective of the wider economic environment or stock market cycles.

He sets great store by company meetings with management, trying to identify the twin pillars of "the right company" and "the right management" which underpin his disciplined approach to stock selection. Having identified these companies, he looks to identify long-term structural trends which will help the company grow.

Alexander has a high degree of flexibility to manage the portfolio as he sees fit. For example, the portfolio concentration is much greater than one would normally find with the top ten holdings representing 75% of NAV.

Additionally, he has full latitude to invest outside of continental European listed companies, the requirement only being that most companies held will undertake a substantial proportion of their business activities within Europe.

Currently c. 25% of assets are invested in UK listed companies. In the manager's view, his investee companies are increasingly global, but are unified by their common roots as being driven by European expertise.

Source: Morningstar

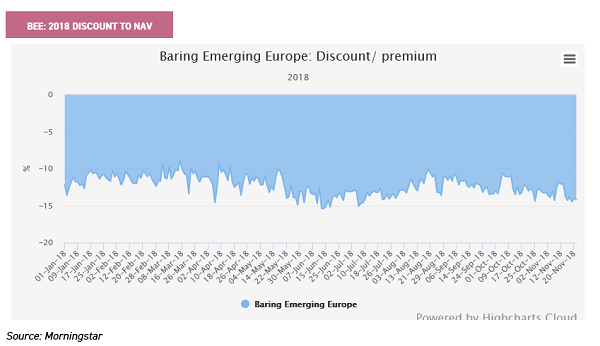

An allocation to Eastern Europe might be appealing given the rock-bottom valuations illustrated above. The MSCI EM Europe Index is trading on a P/E of just 8.2, compared to 13.3 for the broad index.

Baring Emerging Europe is the only closed-ended fund investing in the region following the vote to wind up BlackRock Emerging Europe. The trust takes a bottom-up stock-picking approach rather than trying to make major macro calls and has an outstanding track record of adding alpha to its benchmark.

Manager Matthias Siller believes that the emerging economies in his universe have highly inefficient stockmarkets, which makes sustainable outperformance through stock selection possible.

Indeed, he believes that the opportunity for active managers is only growing thanks to the dramatic reduction in the number of sell-side analysts researching the region as a result of MIFID II reforms and the low number of IPOs in the region in recent years.

Overall, Matthias thinks the greatest opportunities over the long term are in the consumer sectors thanks to the under-penetration of consumer services in the region. The trust is overweight both the consumer sectors although they make up very small parts of the index. Russia dominates the index and the trust, although it is an underweight for the portfolio. Matthias says that political issues have dominated economic fundamentals in recent years in the eyes of international investors, which means that the country is trading on highly attractive valuations.

The trust is currently yielding 4.6% following a period of underperformance for the region, which is trading on some of the lowest valuations in the world. The board is also committed to defending a discount of 12% over the medium term, which offers some comfort on the downside.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.