Forget Tesla, check out these alternatives

It is sensible to look for companies paying a dividend to compensate if share prices fall back.

16th September 2020 09:53

by Rodney Hobson from interactive investor

It is sensible to look for companies paying a dividend to compensate if share prices fall back.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

All eyes in the motoring world have been on Tesla (NASDAQ:TSLA) lately, but there are plenty more options available among carmakers who offer investors a less heart-stopping ride. Since the London Stock Exchange lacks such possibilities, share buyers must look to the US and Europe.

Carmakers have suffered as badly as any sector in the pandemic, with manufacturing facilities closed or running below capacity, showrooms empty of customers in lockdown and motorists reluctant to splash out on what is one of the most expensive purchases they will ever make.

The big fear is that sales will be dented by rising levels of unemployment as employers fail to take back all the workers laid off during the pandemic or, even worse, a second wave will force further lockdowns. There is some evidence of that scenario in the UK and Europe, while Covid-19 still rages in the US, Mexico, Brazil and India.

Even those resuming something like normal life may be reluctant to commit themselves to heavy spending. Likewise, companies with a fleet of cars due for renewal.

- Baillie Gifford American: owning Tesla and more top stocks

- Want to buy and sell international shares? It’s easy to do. Here’s how

On the positive side, there should be some pent-up demand from those drivers who would have bought sooner had lockdowns not intervened.

In the circumstances it is a sensible policy to look for companies that pay a dividend to offer some compensation if share prices fall back.

Bear in mind that dividends could be reduced if economic recovery falters.

The largest vehicle maker in the world is Toyota (NYSE:TM). Founded in 1937, it sold 10.5 million vehicles in its last financial year to the end of March, although that was before the pandemic really started to bite. Apart from the Toyota badge, its brands include Lexus and Daihatsu.

Source: interactive investor. Past performance is not a guide to future performance.

Toyota has just below half the Japanese market, which has been less affected by Covid-19, and about 14% of the US market.

The shares have edged erratically higher since bottoming at $108.50 in mid-March to stand at $134, still below the pre-crisis level. The yield is 3.03%.

In addition to being one of the world’s leading premium carmakers, BMW (XETRA:BMW) also produces motorcycles. Bayerische Moteren Werke, to give the German company its full name, has production facilities in 15 countries with a sales network in 140 nations. Sales in 2019 totalled 2.5 million cars and 175,000 motorcycles.

Source: interactive investor. Past performance is not a guide to future performance.

This is one of the most easily recognised and trusted vehicle makers with brands including Minis and Rolls-Royce.

The shares have made fairly steady progress from a low of €37.66 to reach €64.32 but there should be more gains to come, with the target being this year’s starting price at €74.22. The current yield is 3.9%.

- Global fund managers boost exposure to tech giants

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

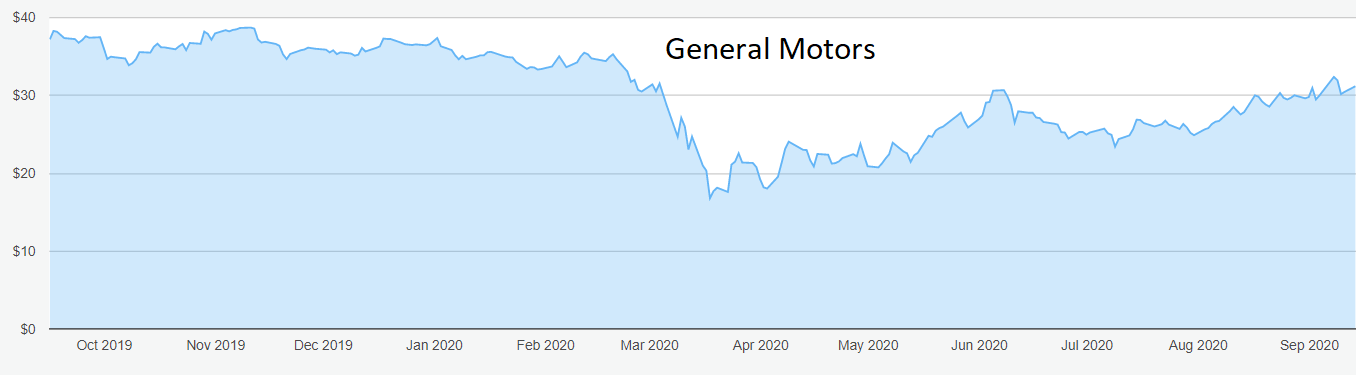

General Motors (NYSE:GM) is now a much more solid company than the version that went bankrupt in 2009. It is the biggest player in the US market with 17% market share.

The shares hit the bottom at $16.80, but despite hitting an attack of the jitters in July they have recovered to $31.60, where the yield is 3.66%.

Source: interactive investor. Past performance is not a guide to future performance.

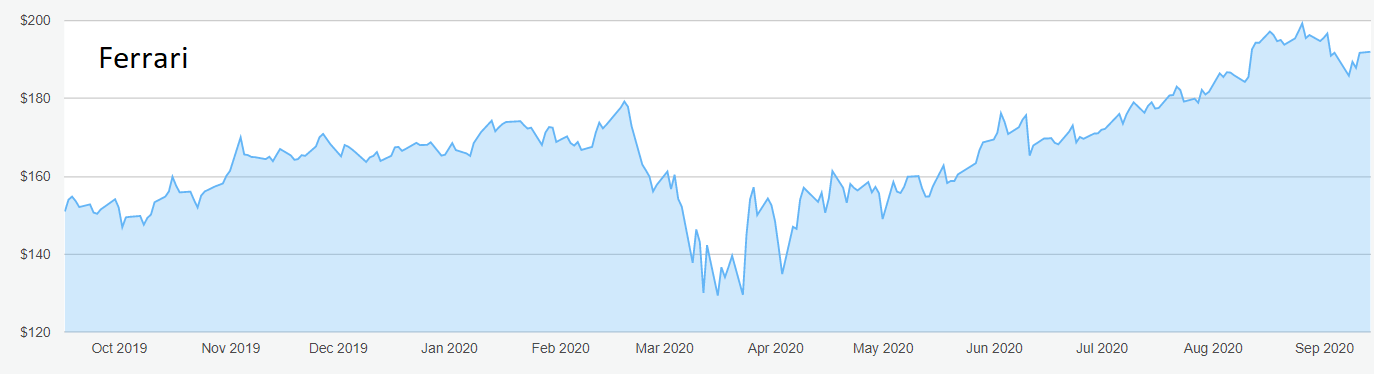

Ferrari (NYSE:RACE) is arguably the world’s most valuable luxury brand, selling fewer cars than other carmakers but at much higher prices to wealthy individuals who have deep enough pockets to ride out the pandemic.

However, at $191.60 the shares are well clear of February’s level and the yield is less than 1% so they are probably fully valued for now.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Consider Toyota up to the recent peak of $136.50. Unlike Toyota, BMW has not eased back recently but its yield still makes it potentially attractive. Buy up to €66.60, the level at which the shares stood before the stock market collapse. Likewise, don’t pay more than $35 for GM, at which point the shares have fully recovered. If you fancy Ferrari, it may be worth seeing if the stock slips back before committing, although that may well not happen. The all-time peak, set in August, was $199.29 and that could be broken before the year is out.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.